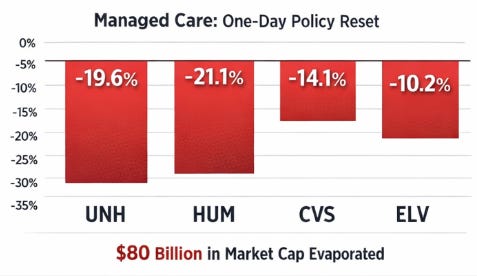

$80 Billion in Smoke

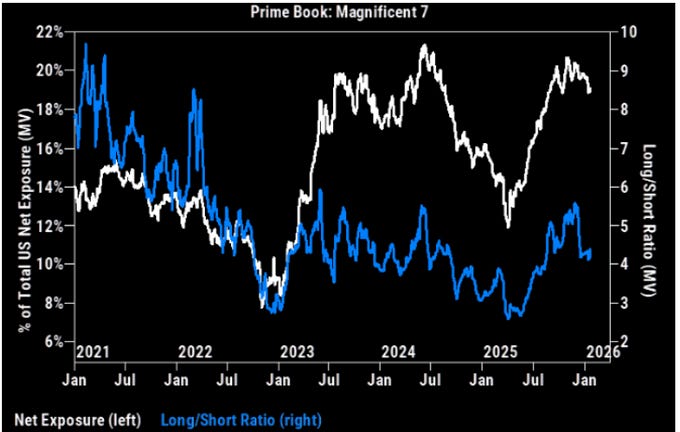

Magnificent Mania, Q4 Earnings Arrive

Quick Thank You -

Before we dive in, I have to take a moment.

Last week, Unusual Flows officially hit bestseller status. That doesn’t happen without you. Every share, every referral, every conversation you’ve had telling a friend or colleague about what we’re building here. This community has grown into something real, and I don’t take that lightly.

We’re just getting started. More tools, more data, more alpha coming your way. Thank you for believing in what we’re doing.

Now let’s get to work.

The Tape

What a session. Let’s take a peak at the charts first.

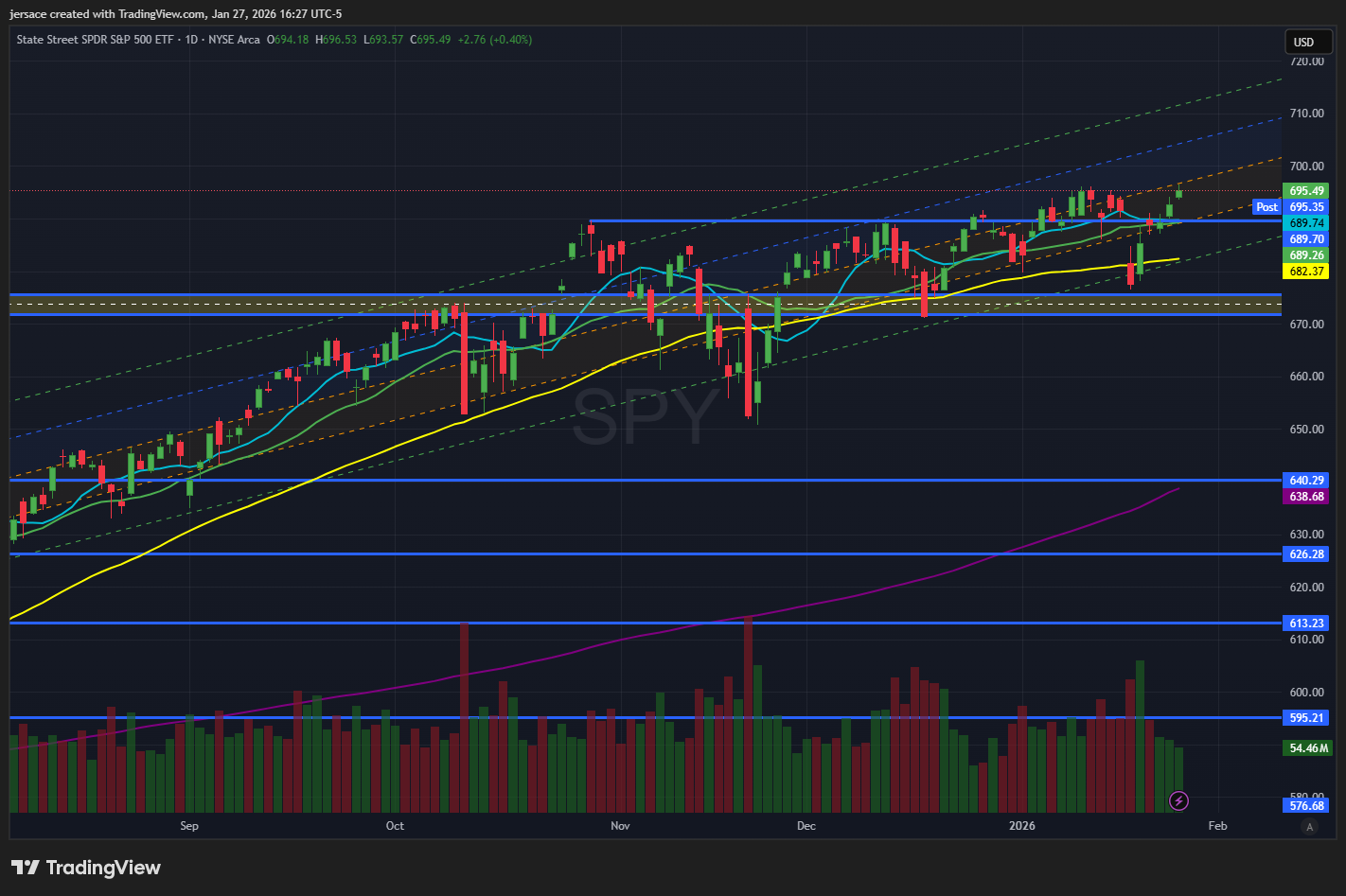

- SPY Daily

- QQQ Daily

- IWM Daily

- DXY Weekly

Price says calm. Rotation says chaos.

S&P 500 pushed to fresh all time highs, settling at 6,978.59, up 0.41%. We’re 22 points from the psychological 7,000 level. Nasdaq finished at 25,939.75, up 0.88%, as mega cap tech continued positioning into this week’s reports. Microsoft gained 2.19%, Apple added 1.12%.

But if you’re only watching the indices, you’re missing the real story.

The Dow got absolutely torched. Down 0.83% to 49,003.41, dragged into the red by a healthcare sector that can only be described as a bloodbath.

$80 billion in market cap evaporated from managed care in a single session.

UnitedHealth cratered 19.61% to $282.70 after dropping 2026 guidance and confirming what everyone feared: the first annual revenue decline in three decades. They’re calling it “right sizing across the enterprise.” The market called it something else.

But UNH wasn’t alone. CMS dropped a bomb, proposing a 0.09% increase to Medicare Advantage payments for 2027. Wall Street was expecting 4 to 6%. Dr. Oz and the Trump administration clearly have different plans for managed care.

Humana fell 21.13% to $207.93. CVS shed 14.15% to $72. Elevance dropped 10.2% to $338.51. That’s not a selloff. That’s a policy induced reset.

On the other side of the tape, CoreWeave ripped 10.73% to $108.86 after Nvidia announced a fresh $2 billion investment to build out five gigawatts of AI data center capacity by 2030. Jensen went on camera to reaffirm the partnership. The flow reflected the enthusiasm.

Silver saw one of the wildest sessions in recent memory. SLV closed at $101.59, up 3.3% after experiencing massive intraday volatility. Over 100 million shares traded on the session. First time an ETF other than SPY has topped that list since we started tracking in 2012. Wild.

VIX at 16.32. Remarkable complacency given the headline risk this week.

The Headlines

CMS Medicare Advantage Bomb

This is the story. CMS proposed 0.09% payment increases for 2027 when the Street expected 4 to 6%. That delta is enormous for companies where margins are already thin. UNH, HUM, CVS, ELV all got taken to the woodshed. The April final notice will be the next catalyst. Either they soften the blow or managed care has a serious problem.

Nvidia Doubles Down on CoreWeave

$2 billion fresh investment. Five gigawatts of AI data center capacity by 2030. Jensen Huang went on camera personally. When Nvidia writes checks like this, pay attention. CRWV ripped 10%+ and the flow was aggressive all session.

Fed Wednesday

FOMC decision at 2pm ET. No change expected. Powell presser at 2:30. Given the ongoing political drama, the tone will matter more than the decision itself.

Earnings Avalanche

Wednesday after close: Microsoft, Meta, Tesla. Thursday after close: Apple. This is the week that determines whether mega cap tech leads or lags in Q1.

In case you missed it, we recently opened up a discord server for the paid subscribers to make it easily accessible to find any missed information, trade ideas, charts, and filter through discussions with ease given their advanced search feature vs the classic “ctrl + F” function on substack chat. While this is reserved for paid only members, I realize discord is not for everyone, and I will continue to post trades on substack as we always have. This is just an added feature for those who enjoy it.

We are also still working on developing a new website client for your use that will be granted upon a new tiered subscription in the future once finalized. I have dropped a few teasers here and there within chats. Features include:

Historical options database

Portfolio / basket tracking

Market AI Chatbot

Market News updated throughout the day & filtered ticker search

Stock allocation & performance tracking

Among many other features to come.

What’s Buzzing

CoreWeave (CRWV)

The AI infrastructure name of the moment. Nvidia’s $2 billion investment validates the thesis. $56 billion backlog is real. Debt load is real too. But in this tape, growth gets funded. Stock closed at $108.86, up 10.73% on massive volume. The flow was relentless all day.

Managed Care Wreckage

UNH down 20%, HUM down 21%, CVS down 14% in a single session. This is what policy risk looks like. The question now is whether April’s final CMS notice softens the blow or confirms the damage. Some contrarian flow showed up in HUM calls late in the session. Someone’s betting on a bounce.

Silver (SLV)

Most traded security of the day. Over 100 million shares. Massive intraday swings. Safe haven flows, inflation hedging, short squeezes, take your pick. The metals trade is alive and well.