A Sweet Delight

Outlook for Jan 20-23

What’s up everyone,

Happy Monday. Markets are closed for MLK Day, so we get a quick breather before jumping back into what’s shaping up to be a pivotal week. Let’s break it all down.

The S&P 500 closed Friday at 6,940 - essentially flat on the day but down slightly for the week. The Dow settled at 49,359 and Nasdaq at 23,515. But here’s the thing: if you’re only watching the big indices, you’re missing the real story.

The Great Rotation Is Here (well, it’s been occurring)

The Russell 2000 is absolutely ripping. We’re talking +8% YTD while the S&P sits at just +1.5%. Small caps have now outperformed the S&P 500 for 11 consecutive sessions - the longest streak since 2008. This isn’t noise. This is the rotation we’ve been waiting for.

Why? A few things converging:

The valuation gap between small and large caps hit a 25-year extreme at year-end

Russell 2000 trades at ~18x P/E vs. S&P at ~26x

Lower rates are finally flowing through to small-cap balance sheets

GDP is running hot, Atlanta Fed’s GDPNow pegs Q4 at 5.3%

If you’ve been sitting in mega-cap tech waiting for breadth to improve - congratulations, it’s happening.

Current Levels

Index Close (Jan 16) YTD: S&P 500 6,940 +1.5% Nasdaq 23,515 +2.0% Dow 49,359 +1.2% Russell 2000 2,678 +8.0% VIX 19.23

Gold: $4,600+ (record high)

Silver: $90+ (record high, +26% YTD)

10Y Treasury: 4.20% (breaking out of multi-month base)

- SPY Weekly

- QQQ Weekly

- IWM Weekly

- DJI Weekly

Overall, things are pretty constructive in the grand scheme of things with a longer time frame horizon outlook. While we do sit at/near overbought levels, the channel remains pretty mid-line controlled if you will. When looking at futures at the time of writing, we are still trading above the 10wk SMA on Spooz yet people are running around like chickens with their heads cut off on X. We’ve seen this exact song and dance before just under a year ago. The famously coined TACO trade is back? Per chance, per maybe. Certainly will see a good bit of blood in the week ahead especially with the higher beta names & growth stories likely taking a big hit. This provides necessary downside to consolidation & entry for traders who were ‘locked out’ of the trade.

The Headlines

Powell vs. DOJ

Fed Chair Jerome Powell dropped a bombshell last Sunday: the DOJ served the Fed with grand jury subpoenas threatening criminal indictment over his testimony about the Fed’s building renovation project.

But Powell isn’t backing down. In a rare video statement, he straight up said this is about one thing: “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Trump denied involvement but continues hammering Powell on rates, posting “Jerome ‘Too Late’ Powell should cut interest rates, MEANINGFULLY!!!”

The market implication? JPMorgan now expects the Fed to hold rates steady all of 2026. That’s a big shift from the 1-2 cuts everyone was pricing in. Fed independence concerns are real, and the bond market is paying attention.

Personally still believe we remain on track for 1-2 cuts this year.

Credit Card Cap Drama

Trump floated a 10% cap on credit card interest rates for one year. Bank stocks got hammered - Citi down 7% for the week, Bank of America off 6%, Wells Fargo down 7%. Even JPMorgan sold off despite beating on earnings. Goldman Sachs remained resilient in the grand scheme of things and continues to surge at highs.

Geopolitics Getting Spicy

Iran, Greenland, Venezuela - choose your fighter (lol). Trump announced tariffs on any country doing business with Iran, “effective immediately.” The Greenland situation is escalating. Meanwhile, safe haven flows are going straight into gold and silver.

Macro Setup

The macro picture is honestly pretty constructive despite all the noise:

The Good:

GDP running hot

Initial jobless claims came in at 198k, second lowest in two years

Consumer spending holding steady

Taiwan Semi’s guidance was strong (more on this below)

Earnings season starting solid (Goldman/Morgan Stanley crushed it)

The Concerns:

Fed independence under direct attack

Valuations stretched (CAPE ratio at 40, only hit this during dot-com bubble)

Inflation could re-accelerate if rates stay higher for longer

Geopolitical uncertainty at multi-year highs

This Week’s Earnings

Earnings season heats up. Here’s what matters:

Tuesday (Jan 20)

Netflix (NFLX): All eyes here. The WBD acquisition bid is the wildcard. Stock down -6% YTD after four straight monthly losses. Look for subscriber numbers and any updates on that $83B deal.

3M, US Bancorp, United Airlines, D.R. Horton, Interactive Brokers

Wednesday (Jan 21)

Johnson & Johnson (JNJ): Watch immunology segment and any talc litigation updates

Kinder Morgan, Halliburton (watch this one), Charles Schwab, Truist

Thursday (Jan 22)

Intel (INTC): The turnaround story of 2026. Stock is up 129% over the past year and 30%+ just this month. Panther Lake (18A process) now in high-volume production. This is the key AI infrastructure name everyone’s been sleeping on. We classified this name as a Trump Trade back in late ‘24 and we see it coming to full fruition now.

GE Aerospace (GE): Should be a blowout given the plane backlog

Procter & Gamble (PG), Freeport-McMoRan (FCX), Capital One, Intuitive Surgical

FCX is going to be interesting given the recent run-up from mid December & the widely discussed “Copper Supercycle” from our year-ahead.

Friday (Jan 23)

SLB (Schlumberger)

Also: Fed meeting is Jan 27-28, expect no change, but the Powell situation will dominate the presser.

What’s Buzzing

Intel (INTC)

I can’t emphasize this enough. The stock ripped 30% in the first two weeks of January alone. Taiwan Semi’s strong capex guidance ($52-56B for 2026) validates the AI infrastructure buildout. Intel is sold out on server CPUs and reportedly considering 10-15% price hikes. Jefferies has a $45 target (current levels). Earnings Thursday after close.

Gold Miners

Newmont (NEM) hitting all-time highs. Gold at $4,670+, silver above $90. If you believe the Fed independence narrative plays out, precious metals have room to run. Target prices of $5,000 gold / $100 silver are being thrown around by serious analysts.

Small Caps / IWM

The breakout is legit. MarketBeat has targets of 3,250-3,650 on the Russell. That’s 20-35% upside from here. Focus on quality. Industrials, financials, domestic cyclicals benefiting from “America First” policies.

Under the Radar

Freeport-McMoRan (FCX)

Copper and gold exposure. Stock up 40% since the start of December. Metals are on fire. Earnings Thursday before market open.

Dave & Buster’s (PLAY)

Just got upgraded to Buy with a $30 target (55% upside). First positive same-store sales in 13 quarters could be coming. Worth watching.

Dollar Tree (DLTR)

Up 96% in the past year. Evercore just added a tactical outperform rating with $165 target (+17%). Multi-price point strategy is working.

Defense names

Budget increases being proposed. Lockheed (LMT) near all-time highs. Smaller contractors like Kratos Defense (KTOS) benefiting from “America First” industrial policy.

Netflix (NFLX)

Earnings Tuesday, but the Warner Bros acquisition drama overshadows everything. “The earnings will be overshadowed,” as one analyst put it. Options pricing in an 8%+ move. Netflix has now recorded SEVEN straight weeks of downside. Not a huge proponent of ‘knife-catching’ but this one is hard to ignore given the sheer dominance & upside potential here.

Options Flow Breakdown

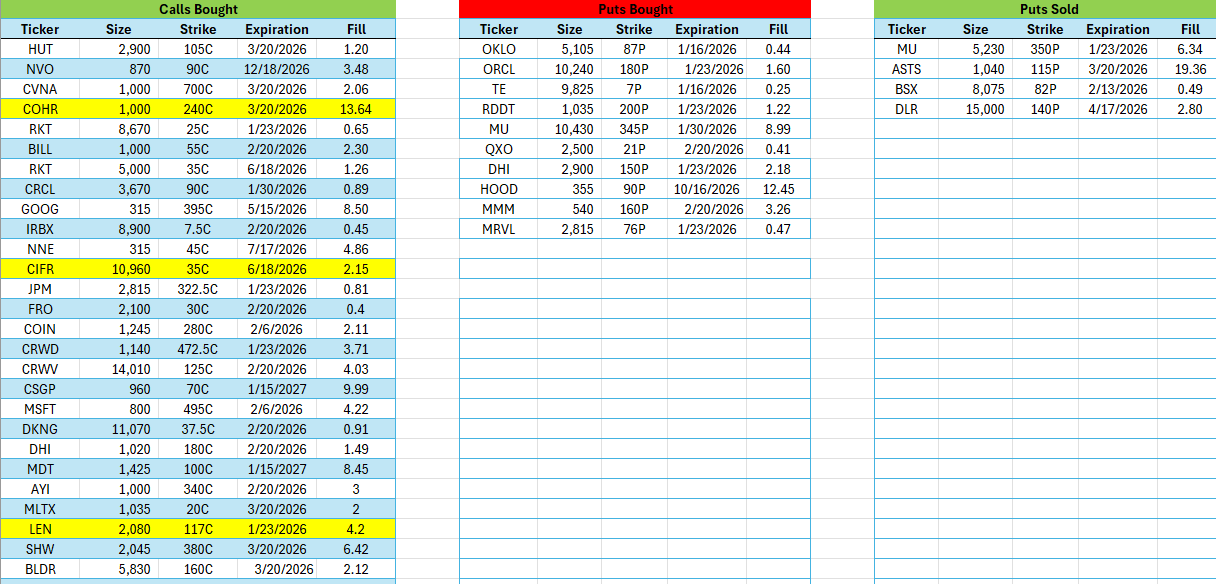

Let’s take a look at Friday’s flow grab for the time being while we discuss the current market as many of these highlighted trades will open in the red.

I’ve highlighted only a few trades that really piqued my interest on Friday as we weren’t entirely focused on adding new positions during the session. However, Tuesday should provide us some intriguing opportunities depending on a potential continued unwind vs an intraday reversal.

A standout theme with flow as of late, and one in which we did relatively good with, has been homebuilders. We first positioned into Lennar back in December after their earnings report with the assumption there would be a news trade here with parabolic upside. We were nuts on. Absolutely crushed the thesis as it came to fruition the exact week of expiration for our contracts. Although, there is so much more behind this trade & feels like a potential year-long theme.

Ideas from Friday:

RKT 25C / 35C 13,670x total size across both strikes for 01/23 & 06/18

Weekly idea a bit aggressive but will monitor the chain action upon open to see if they are taking the loss or adding at a lower cost for the aforementioned reversal possibility.

LEN 117C 2,100x 01/23

Again, another weekly to watch for with earnings on Tuesday.

DHI 180C 1,000x 02/20

Earnings also Tuesday. Bit more time behind the idea.

BLDR 160C 5,800x 03/20

Supplier play on housing, more under the radar.

Given futures downside over the weekend, the idea is that these contracts are going to open in the red, some even deep in the red. Money had obviously been flowing into these names especially RKT with some serious size / conviction. Few direct earnings bets including LEN weeklies and DHI quarterlies. Assuming that the whales remain in the trades come Tuesday close, the opportunity for discounted flow trades are present into the report.

COHR 240C 1,000x 13.64 avg

This is the AI optical networking play. Premium paid is substantial (~$1.36M notional). Someone's betting on continued data center buildout. With TSM's strong capex guidance last week, this makes sense thematically. Chart looks great as well, see below.

CIFR 10,960 contracts at 35C for June

Bitcoin miner. Highlighted for a reason. That's a BIG bet. If BTC holds and miners catch a bid, this has room. Not to mention the surplus of news headlines that consistently surround these names / sector boosting them higher. Incredibly volatile name and this will certainly provide discounted entry.

CRWV 14,010 contracts at 125C for FebruaryLargest single position (OI wise) in the flow. Worth digging into what’s driving this.

DKNG 11,070 contracts at 37.5C for Feb

NFL playoffs in full swing. Sports betting volumes are elevated. Solid seasonal catalyst. This is a bet we notice yearly. Typically has worked although the growing presence of Kalshi, Polymarket, and other prediction markets presents new competition & uncertainty.

Obviously some of those bearish ideas will pay nicely given the weekend we’ve seen. ORCL weeklies are interesting given the cloud competition heating up + Gemini deals going to Google. Reddit weeklies as well coming in at the 20D from below & resistance level of 237 and change. MU had a bit of a split, with puts bought & puts sold. Clearly the puts sold is a bullish position with the whale willing to be assigned shares at $350. The memory trade is far from over IMO, but intermediate weakness on a name that has gone relatively parabolic is always necessary.

Actionable Setups for a Down Open

If futures stay red, here’s how I’d play it:

RKT on the dip. The call flow is too big to ignore. Near-term catalyst could be rate expectations or housing data. Watch for support levels to hold. Would lean towards the June chain vs the weeklies for obvious reasons given the short week and Geopolitical uncertainty.

LEN / DHI into earnings Tuesday. Both have call flow. The LEN 117C expiring Friday is a lotto but the flow is there. I expect more homebuilder flow in the coming days with more time behind them.

COHR for AI infrastructure. If it pulls back with broader tech weakness, the 240C March calls suggest someone sees a move. This is a beneficiary of the same theme driving TSM.

Fade ORCL. 10k+ puts expiring this week. If/when it gaps down, could have momentum. Watch 180 as the level to hold as it has previously (bullish gap back from June ‘25).

BLDR as a builder play (neat). Less volatile than the homebuilders themselves, benefits from the same tailwind. March expiration gives time.

Bottom line: The homebuilder/housing theme is screaming from this flow. RKT, LEN, DHI, BLDR all have significant call buying. With rates potentially staying higher for longer (per the Powell/Fed situation), this might be a “bad news is priced in” bet.

If we get a gap down Tuesday, those are the names I’d be stalking for entries. The COHR and CIFR calls are more thematic AI/crypto bets with longer timeframes.

The Playbook

Look, the market wants to go higher. We just capped off three consecutive years of double-digit gains. GDP is strong, earnings are coming in solid, and now we’re getting the breadth expansion everyone’s been waiting for.

But there are real risks here. The CAPE ratio at 40 is screaming caution. The Fed situation is unprecedented. Geopolitics are a wildcard. Overbought territory + Greed.

My take for the week:

Let earnings dictate the action, especially Netflix Tuesday and Intel Thursday

Small caps remain the play if you believe in the rotation

Individual names amid broader market chop

Precious metals as a hedge against the chaos

Stay nimble, we have Fed next week and PCE data Thursday

The best opportunities often come when things feel uncomfortable. Right now, it’s uncomfortable, and that’s when you stay sharp.

See you tomorrow & cheers,

Jersace

Unusual Flow is for informational purposes only and should not be considered investment advice. Always do your own research.

Key Dates This Week

Date Event Mon 1/19 Markets Closed (MLK Day) Tue 1/20 Netflix earnings (AMC) Wed 1/21 J&J, Schwab, Halliburton earnings Thu 1/22 Intel, P&G, GE Aerospace, FCX earnings / PCE Data Fri 1/23 Michigan Sentiment (final), S&P Global PMI Jan 27-28 FOMC Meeting

Sources:

CNBC, Bloomberg, Yahoo Finance, MarketBeat, Seeking Alpha, FRED (St. Louis Fed), Reuters, Wall Street Journal