AI Agents & Robotics: Megatrend(?)

The SaaSpocalypse, Dow 50K, and Why Fear is Creating the Setup

What a week.

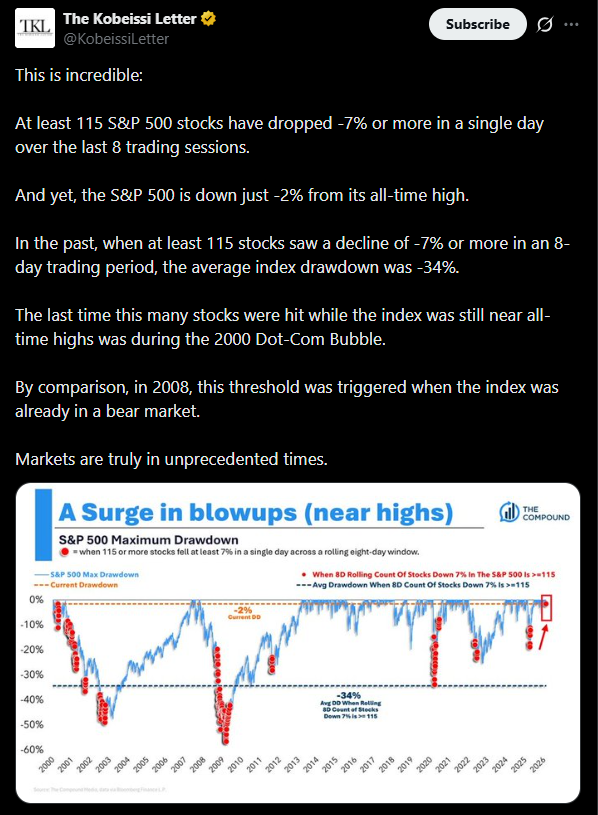

If you felt like the market was pulling you in two directions at once, that’s because it literally was. The Dow ripped through 50,000 for the first time ever last Friday. Up 1,207 points in a single session. A 2.5% move on the week fueled by a hard rotation into cyclicals and value. Caterpillar, GE Aerospace, Boeing, the airlines, all caught serious bids. Then this week, that momentum hit a wall. Thursday brought a 669-point reversal in the Dow as AI disruption fears spread beyond software into networking (Cisco down 12% [Thursday] on weak guidance), wealth management, and legal services. This week, the S&P closed at 6,836, down 1.4%. Nasdaq got hit hard as well, losing 1.27%. Dow Jones also negative on the week losing 1.23%.

- SPY Daily

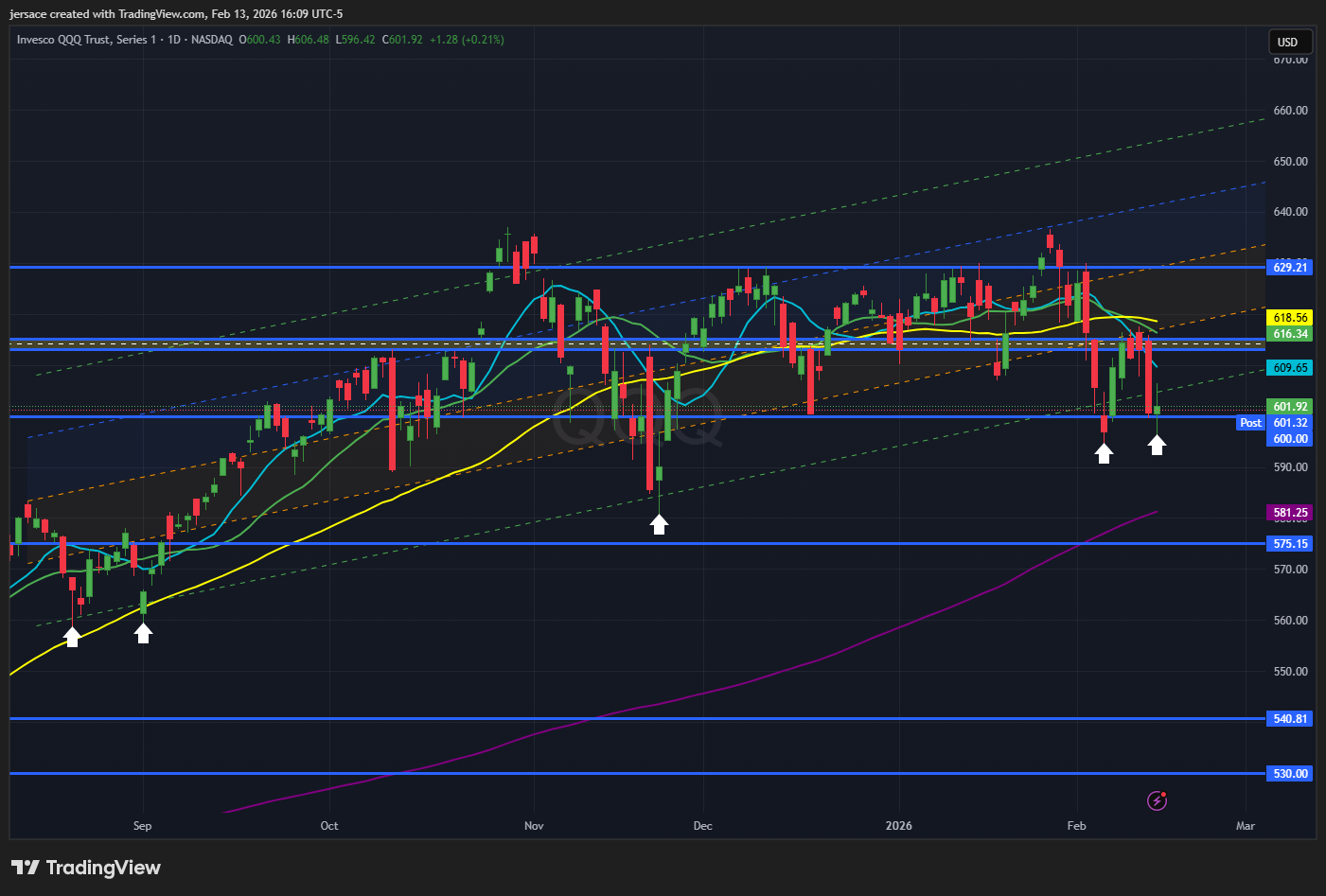

I see a lot of folks mentioning hedges and flipping short etc. but what remains curious to me is why they would position in such a way today, versus three days ago at range highs? Why short support, range lows, and below the channel? I understand the reasoning of it closing below moving average’s and such but when you frame it the way I have above, it feels more panicky than tactical. I have highlighted the last 3 instances in which we closed/wicked below this channel and in each instance we have snapped back into the range within the following two sessions. While there is no guarantee of the similar reaction, it is likely. Just something to note and always check multiple time frames before making rash decisions. If you check the weekly, we remain above the 20wk which has been acting as our floor lately. Times have been whippy as we will touch into more in depth below.

- QQQ Daily/Weekly

More of the same here yet slightly uglier.

Going to display the weekly for this one as well as you can see that we are still compressed in the middle of this channel although below the weekly averages. Of course we have the longer weekend where being in positions carries more risk especially with ongoing Middle East conflicts - though nothing has materialized the past few instances. Personally still in the camp of “nothing ever happens” & that we ultimately resolve higher once the continued unwind of AI complex fears / capex / collateral collapse settle. I do not have a crystal ball and cannot firmly say with the utmost confidence of when that would happen, although I will remain course and buy dips where I see value.

- IWM Daily

Still the YTD leader and showing similar signs as of late in regards to market chop, but holding up well. Not too much else to comment on here other than the looming rotation back into quality (Mag-7 / undervalued key assets).

- DJI Daily

The story of the week, really the story of 2026 so far, is what traders at Jefferies are calling the “SaaSpocalypse.” Bloomberg reported that Anthropic’s product releases triggered a nearly $1 trillion selloff in enterprise software stocks. The iShares Tech-Software ETF (IGV) is now 30% below its recent high. Officially deep in bear market territory. Atlassian cratered 35% in a single week back in early February. Salesforce is down 40%+ over the past 12 months. Workday, same story. Even Palantir, one of 2025’s biggest winners, has given back 27% year-to-date.

The fear is straightforward. If an AI agent can do the work of 10 humans, why would a company pay for 10 software seats? The per-seat SaaS model that minted millionaires for two decades is getting repriced in real time.

But here’s where it gets interesting for us.

The market is painting with a broad brush right now. Selling everything that touches software, buying anything that touches AI infrastructure. The VanEck Semiconductor ETF is up 10% year-to-date while the software ETF is down 18%. That divergence is the widest it’s been in years, and divergences like this don’t last forever. Some of these software names are getting unfairly lumped in with commodity SaaS that honestly deserves to get disrupted. The companies actually building the orchestration layer for AI agents, the platforms that make agentic AI work in production with real governance and security, those are getting thrown out with the bathwater. And that’s where the opportunity is.

On the macro side, the delayed January jobs report finally dropped Wednesday showing 130K jobs added, well above the 53K consensus. Unemployment ticked down to 4.3% from 4.4%. Consumer sentiment ticked up. CPI dropped this morning at 2.4% year over year, coming in below the 2.5% consensus. Good news on the surface, but core CPI still ticked up to 0.3% month over month so it’s not all clear skies. The Fed is still on hold and markets are pricing roughly a coin-flip on a June cut. The government shutdown that ended February 3rd delayed a lot of this economic data so we’re just now getting caught up on the full picture.

The rotation is real though. Value and cyclicals are leading. Small caps (Russell 2000 up 7% YTD) are outperforming large-cap tech for the first time in a while. The Dow hitting 50K while the Nasdaq struggles tells you exactly where institutional money is flowing.

So how do we play this?

The SaaSpocalypse isn’t the end of software. It’s the market sorting winners from losers in real time. And when the market sorts this aggressively, it creates dislocations. Dislocations are where alpha lives.

That’s exactly what this week’s deep dive is about. The same AI agent technology that’s destroying commodity SaaS stocks is creating an entirely new investable theme. One that spans agentic orchestration platforms, humanoid robotics, edge AI components, and the infrastructure that powers all of it. The companies building the tools that make AI agents actually work in the real world, not just demo well on X, those are setting up to be the next cycle’s biggest winners.

We’re breaking down the full AI Agents & Robotics theme. The layers of the stack, the key players, the timelines, and a tiered watchlist from high-conviction infrastructure plays down to speculative robotics bets. This is the kind of theme that starts with institutional flow, builds into retail narrative, and eventually becomes consensus. We want to be positioned before that happens.

Let’s get into it.

The Big Picture

If 2025 was the year AI proved it could think, 2026 is the year AI starts doing. The narrative is shifting hard from model capabilities to agentic execution, autonomous systems that can plan, act, and complete multi-step workflows with minimal human oversight. Simultaneously, humanoid robotics is crossing the chasm from science-fair demos to factory-floor deployments. These two themes are converging into what could be the defining investment cycle of the next decade.

This is not theoretical anymore. Goldman Sachs expects hyperscalers to pour over $500 billion in capex this year. KPMG found that 67% of business leaders say they will maintain AI spending even in a recession. And at CES 2026, Boston Dynamics put its Atlas robot to work sorting car parts in a Hyundai factory, not doing backflips for cameras. The money is real, the deployments are starting, and the investable surface area is expanding fast.

Part 1: The Agentic AI Revolution

What Changed

The shift from chatbots and copilots to autonomous agents represents a fundamental change in how enterprises consume AI. Instead of answering questions, AI agents are now executing tasks: processing invoices, resolving IT tickets, orchestrating supply chains, and managing complex workflows across departments. Gartner predicts 40% of enterprise applications will integrate task-specific AI agents by 2026, up from less than 5% in 2025.

The agentic AI market is projected to expand from roughly $7.3 billion in 2025 to $88 billion by 2032, a 42.8% CAGR. But the more telling stat comes from Bessemer Venture Partners: the real competitive advantage in 2026 will not be in building the best model, but in data governance, agent orchestration, and observability platforms, the middleware that makes agents work reliably in production.

Why It Matters for Markets

Wall Street is repricing the entire software stack. Again, the iShares Expanded Tech-Software Sector ETF is down 19% year-to-date while the VanEck Semiconductor ETF is up 12%. The fear is that frontier AI models can now replicate what traditional SaaS companies charge subscription fees for. But this creates a massive dislocation, and dislocations create opportunities.

The companies that survive and thrive are those embedding AI agents into mission-critical workflows where switching costs are high and governance matters. The companies getting killed are commodity SaaS plays with thin moats. This is a stock-picker’s market, not a rising-tide market.