AI, Pharma Breakthroughs, Tech Surges & Fiber Optic Revolution: This Week's Game-Changing Trends!

Week of 9/9

Friday at close, the S&P500 included $PLTR, and $DELL. Congratulations to those who celebrate. What an exciting week for the flow! We had a hit rate of nearly 100% with only one red trade. What a beauty. Let’s take a look at the weekend pull.

Notable Flow:

PLTR 0.00%↑ 35C 02/21/2025 Exp.

ARCH 0.00%↑ 120C STO 02/21/2025 Exp.

APLS 0.00%↑ 45C 09/20 Exp.

SMCI 0.00%↑ 200P 10/18 Exp.

FYBR 0.00%↑ 37.5C 10/18 Exp.

PLTR 0.00%↑ 35C 02/21/2025 Exp.

Vol: 7,704 OI: 2,756 Avg: $3.13 Prem: $2,413,573

On this chain, 4k contracts were traded at the Ask. The rest had filled at the Mid and Bid sides. With an OI of 2.7k, we expect the new OI on Monday, 09/09, to be at or above 7k. This Whale was likely speculating that the stock would be added to the S&P 500 on Friday. The rumors were true, and the stock is up 7.86% after the announcement. Now, we must see if the initial reaction will follow on Monday.

We have previously spoken about PLTR 0.00%↑ and will likely continue to do so as it will be getting hit more frequently post-S&P inclusion. It will likely become a mess as, historically, names tend to find a local top shortly after the inclusion date. It's an odd coincidence, but the chart looks mint with a large rounded base into a bull flag surfing the Moving Average up and now up over 7.5% into Monday’s open, just below major levels of 33 and 35, respectively.

ARCH 0.00%↑ 120C STO 02/21/2025 Exp.

Vol: 4,032 OI: 2 Avg: $12.61 Prem: $5,085,101

This Whale is bearish on the stock by selling calls on credit. About 4k contracts were traded at the Bid on 09/06 at 11 am ET. As soon as the trade was placed, the call Net premium went from $0 to -$3.5 million, which allows us to assume that these calls were being sold. Since OI was only 2, we discarded that they were being closed and concluded that they were being opened. This was the highest options volume that the stock had in the past 14 days.

Resting upon the 200-week moving average, this stock is on the verge of continuing its downside toward previous support/resistance levels dating back to early 2022. These levels are all shown in the chart below. A break of the 200-week moving average is quite considerable as it is a slower moving average that rarely sees much action, yet here we are. It is definitely worth keeping an eye on in a tricky market that has been slipping all over the place.

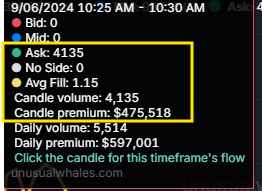

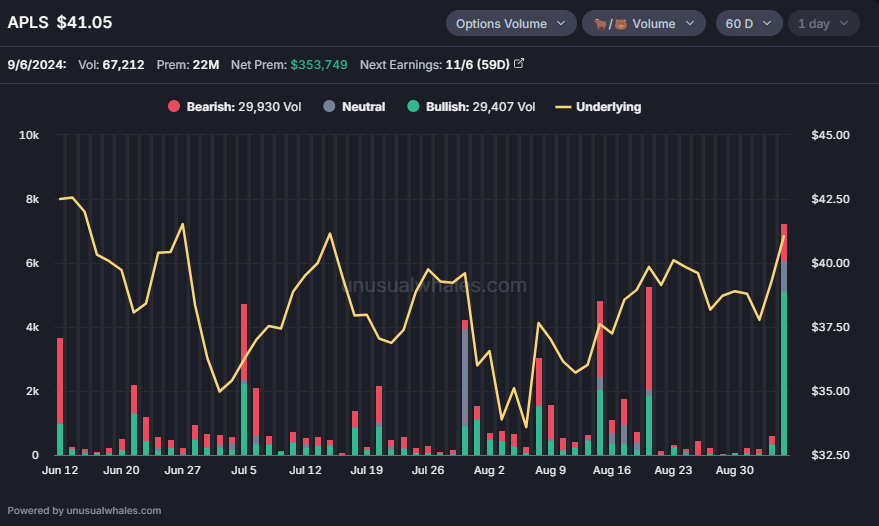

APLS 0.00%↑ 45C 09/20 Exp.

Vol: 6,128 OI: 541 Avg: $1.12 Prem: $686,750

This Whale traded 4,135 contracts at the Ask, accounting for almost all of the daily volume on this chain. Our Whale friend seems confident in opening short-dated calls in a single-leg trade. The company will participate in the Baird 2024 Global Healthcare Conference on September 11, and we will watch this event to see if there is a catalyst that will affect the stock price.

The options volume chart below shows the highest volume in the past 60 days.

Finding support in the low 30s, it has found some upward momentum into the upcoming week, reclaiming all relative moving averages outside of the 200-day. Also displayed is a small bull flag, which we broke over on Friday. It will be notable for the week ahead to see if this breakout can continue through the chosen strike of 45. The pharmaceutical sector consistently sees large moves in either direction, so it can be tricky to trade at times.

SMCI 0.00%↑ 200P 10/18 Exp.

Vol: 2,963 OI: 483 Avg: $2.03 Prem: $601,033

This Whale is speculating for more downside on this stock, which has had a rough summer not only because of the big tech selloff but also because of news and rumors. On August 27th, Heidenburg Research published an article that accused the company of accounting manipulation, sibling self-dealing, and sanctions evasion. One day later, the company announced that it would delay its 10-K filling for Fiscal Year 2024. Lastly, on September 6th, JP Morgan cut the stock to neutral from overweight and set a new price target of $500/Share from $950/Share.

I’m not even sure where to begin on this story. It’s been a wild year for Super Micro, being one of the top gainers on everyone’s lists, yet now, it is becoming one of the top losers on everyone’s lists. Oh, how the tables turn. We have come nearly full circle as SMCI once again trades in the 300’s. The chart on all time frames looks pretty disgusting with support a good bit of way’s down as the move’s up we’re very aggressive, there wasn’t much action to build out support bases along the way.

Amid the allegations of accounting fraud, Super Micro is now nearly 70% from all-time highs. This is astonishing.

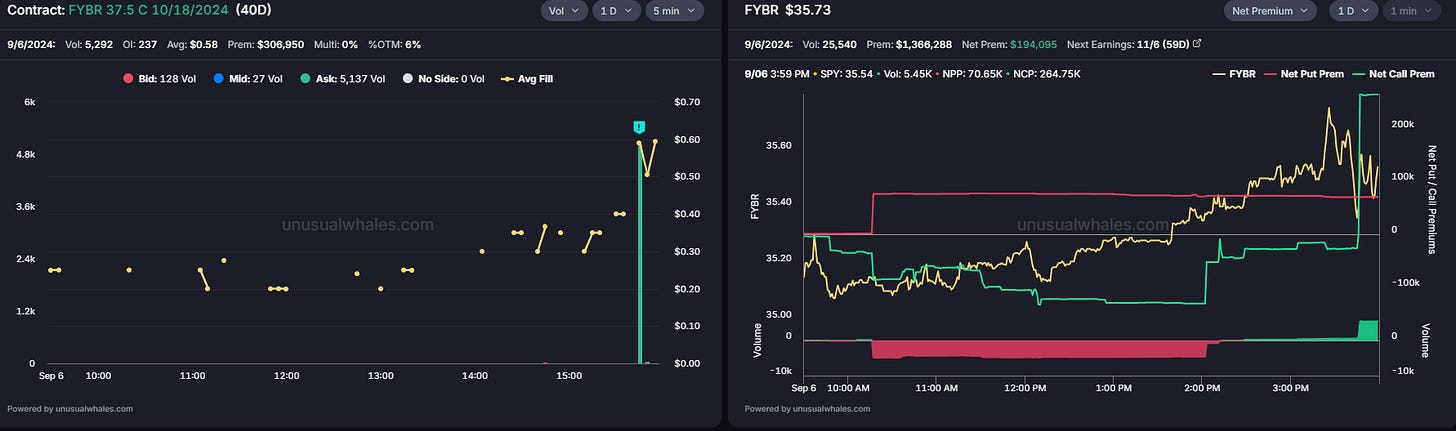

FYBR 0.00%↑ 37.5C 10/18 Exp.

Vol: 5,292 OI: 237 Avg: $0.58 Prem: $306,950

This Whale added calls at 3:50 PM ET, just in time before the market closed, probably betting that the Verizon acquisition will follow through in the following days. The 40C for the same expiration also saw some interesting volume, with almost 4k contracts traded at the Ask earlier that day.

Frontier Communications is a telecommunications company primarily focusing on fiber-optic and broadband services. The stock has been volatile recently due to significant news. Most notably, Verizon is set to acquire Frontier in a $20 billion deal aimed at expanding Verizon's fiber network, which could enhance its coverage to 25 million locations across 31 states. This volatility is shown clearly as the stock surged nearly 40% earlier in the week in one session. These are uncharted waters as the stock hit a mark it has yet to see in this session and remains trading overhead previous action into the week open. Could be a fun one to watch.

Let’s get after it this week, folks. Is the bull run over? Are we just getting started? People are talking! Let’s just hope the flow navigates the water better than Jack Sparrow’s “broken” compass. If that’s the case, we should be in good hands!

Thanks for tuning in. We hope you enjoyed it as well as last week’s gains. As always, if you liked the read, likes are greatly appreciated, and the chat is open to subscribers for comments, questions, and suggestions.

Happy NFL Sunday Folks,

Kian, Jersace, & Jon

Are there any upcoming catalysts or data events to get the smci puts itm? That would be wild