Banks and Oil: Capitalists' Favorites

Notable Flow 9/25

Hello all - another day of choppy action for spooz yet we see the Russell 2000 leaking -1.5% on the day. Many traders attempting to factor in and digest all the macro relevant data as of late but there are plenty of opportunities outside of these indices. Let’s take a look at what we found today.

Notable Flow:

FITB 0.00%↑ Bullish Risk Reversal: 45C BTO and 37P STO 01/17/2025 Exp.

C 0.00%↑ 55P STO 10/25 Exp.

WFC 0.00%↑ 49P STO 11/01 Exp.

XOM 0.00%↑ 105P STO 11/15 Exp.

FITB 0.00%↑ Bullish Risk Reversal: 45C BTO and 37P STO 01/17/2025 Exp.

This bullish trader speculates that the stock's price and volatility will increase or remain flat. The trader wrote approximately 10.5k contracts of the 37P and received a credit of $791k. Additionally, it opened 10.5k contracts of the 45C, paying an underlying of $1.6 million. This trader’s PnL will be positive if the stock price exceeds $45 by expiration.

Although some banks and financial assets have seen challenges and struggled as of late, Fifth Third Bancorp has remained resilient in trending above the 10-week moving average all summer long. In search of further upside we see this whale pressing the gas. Nice reversal idea here heading into the final stretch of the year. No notable patterns but as I mentioned previously, just strong PA with supportive moving average’s nearby.

C 0.00%↑ 55P STO 10/25 Exp.

Vol: 10,038 OI: 115 Avg: $0.40 Prem: $401,601

This trader is placing a bullish bet and expects the stock price to go up or at least not go below $55 by the expiration date. The Whale traded 10k contracts at the Bid for $400k in credit.

More bullish bank bets here… I sense a theme today. After a recent failed breakout for Citigroup, the daily candle rests upon the 10 & 20 DMA acting as support during today’s session while also rejecting the trendline from local highs. Ideally we hold this spot of 60 and get a bounce above the trendline ultimately rallying towards 63 as the whale collects his short-term premiums from the OTM puts sold.

WFC 0.00%↑ 49P STO 11/01 Exp.

Vol: 9,047 OI: 11 Avg: $0.46 Prem: $416,168

It is very similar to the trade above, another example of putting writing in banks. There are almost the same number of contracts and the same amount of premium. This Whale traded 9k contracts at the Bid, receiving $415k in credit. Could it be the same trader? We may not know the answer, but it is definitely something that we will watch once the contracts are closed.

Another bullish bank bet. SHOCKER! Similar situation here although Wells Fargo has had a bit more troubles lately than the previous banks mentioned. A lot of headlines are mentioning banks as buys associated with the Fed’s decision to cut rates, but this is still speculation as anything is possible. I displayed Bollinger Bands on this chart just to display the action that occurs above/below the mid-line acting as a pivot level. Currently trading below this pivot and resting on relative support, it could be due for a bounce assuming market conditions improve across the sector.

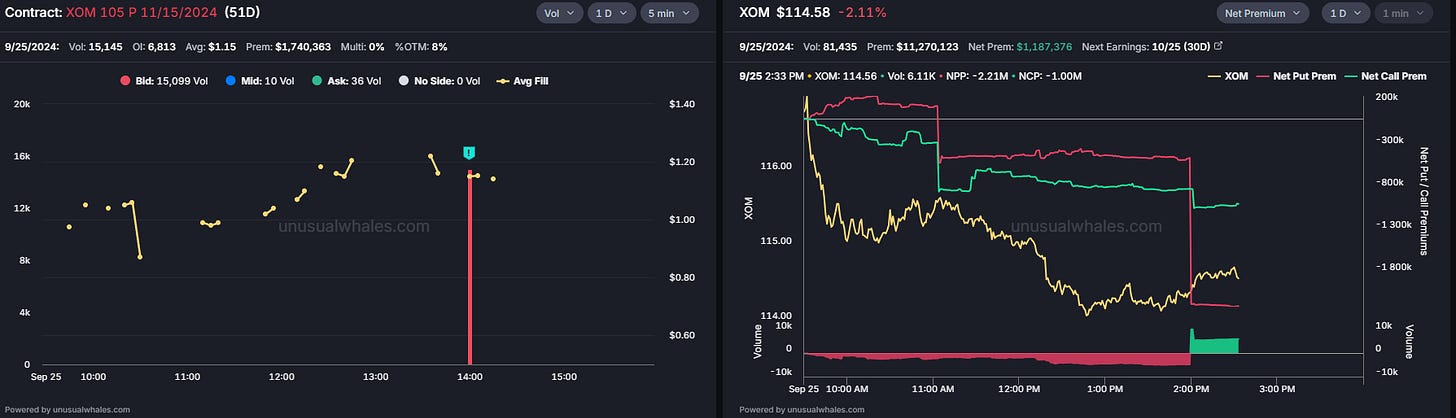

XOM 0.00%↑ 105P STO 11/15 Exp.

Vol: 15,145 OI: 6,813 Avg: $1.15 Prem: $1,740,363

This trade was labeled a “floor trade,” meaning it occurred on an exchange's floor. This floor trader is bullish on the stock, trading 15k contracts at the Bid for a credit of $1.73 million. The trader speculates that the stock price will remain above $105 by expiration.

Seemingly a range bound trade as of late, the broader market for oil is at a major inflection point as OXY trades just above the 200-week moving average which is one of the most supportive levels to bid. Better days for oil ahead seem likely. To pair with the range, the 10DMA has crossed over the 20DMA in today’s session which bodes well for short term bulls.

That covers today’s flow pull. Banks and Oil. The world depends on them daily and we investigate people’s oversized wagers. Pretty neat, eh? Have a great rest of your day folks and stay safe out there if you are in the path of Hurricane Helene. If you enjoyed today’s read, likes are greatly appreciated.

Cheers,

I wonder why $105 for XOM? it seems like the risk reward would be low for selling puts. Oil has only been this cheap relative to gold two other times in the last 30 years.