Bull Trap or Melt Up?

Return of the Data Centers

Good afternoon all - Microsoft and Meta reported great earnings last night after the bell triggering a gap & go across the board in regards to many other related stocks and the indices itself. A few takeaways I had from these reports and guidance calls is that AI & Data Centers continue to have a major role going forward. CapEx is not an issue (for now).

Some headlines:

CFO: AI demand is growing faster than what they can supply.

FY26 CapEx will include a "greater mix of short-lived assets"

So even with the capacity that we're bringing online in 2025, we are having a hard time meeting the demand that teams have for compute resources across the company.

$META ON CAPEX: Mgmt says the 2025 CapEx hike is an acceleration, not a one-off. Too early to set a 2026 baseline, but current spend could become the new normal depending on infra needs. “We’re flexing build strategy to bring capacity online faster in ’25 and ’26.”

Microsoft $MSFT Q4 Guidance:

Productivity & Business Processes: $32.05 - $32.35B

Intelligent Cloud: $28.75B - $29.05B

Personal Computing: $12.35B - $12.85B

Revenue Guidance Totals: $73.15B - $74.2B

Q4 Wall St Estimate: $72.26B

SPY Daily

Trending in the right direction. The market extended their ‘winning streak’ today if you will. Major tech companies, including Microsoft and Meta, delivered quarterly results that beat expectations, helping to lift sentiment across the market. Microsoft’s strong cloud performance and Meta’s robust revenue both contributed to today’s rally. The U.S. economy contracted in the first quarter, with GDP down at an annualized 0.3%-the first decline since early 2022. The drop was largely attributed to a surge in imports ahead of new tariffs and softer consumer spending. However, business investment remained strong, and analysts expect some of these negative effects to reverse in the coming quarter. We back-tested the 50DMA early on in the session where buyers stepped in to hold current marks. Traders will be looking for more positive news to drive the next move and continue this rally off April lows.

QQQ Daily

The rally was driven by strong earnings from major technology names and *allegedly* renewed optimism around U.S.-China trade talks. Microsoft reported higher-than-expected CapEx, signaling ongoing investment in AI infrastructure. Meta also raised its capital spending outlook, reinforcing the AI-driven growth narrative that had fueled tech stocks in 2024. Short-term indicators are positive, with QQQ holding above its 50-day average. However, the ETF is technically overbought, and the broader trend remains cautious after a volatile first quarter. We’ve got the 200DMA just overhead which brings cause for concern, yet with a few more major tech companies set to report in the coming days, we can see a push above this mark if they beat expectations.

Short-term momentum is positive and investor flows are robust, the ETF is approaching technical resistance and remains overbought. Caution is warranted as the market awaits further macro data and the next round of earnings from other tech giants.

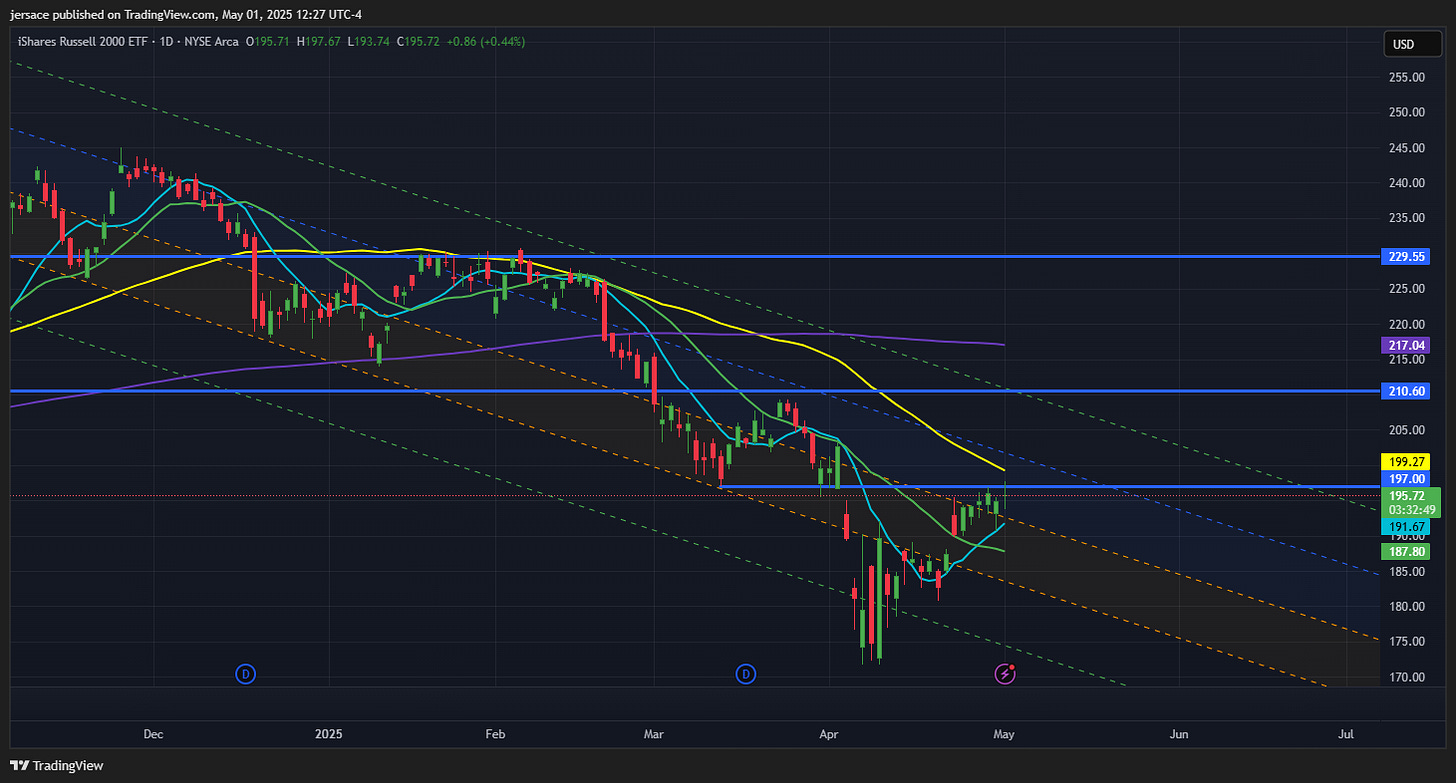

IWM Daily

While large-cap tech stocks have dominated headlines, small caps have quietly stabilized after a volatile first quarter. IWM has managed to hold above recent lows, though it remains below its 50-day and 200-day moving averages, reflecting a cautious longer-term trend. The recent ability to hold above $190 is constructive, but a decisive move above $200 would be needed to confirm a new uptrend and attract more buyers.

While economic data remains mixed, the potential for lower rates and improving market sentiment could set the stage for a breakout if the ETF can reclaim key resistance. For now, small caps are steady but still searching for stronger momentum.

Let’s take an in depth look at some flow from today’s session for our subscribers: