Challenging Week: Performance Dips Amid Market Shifts

Notable Flow Week of 9/30

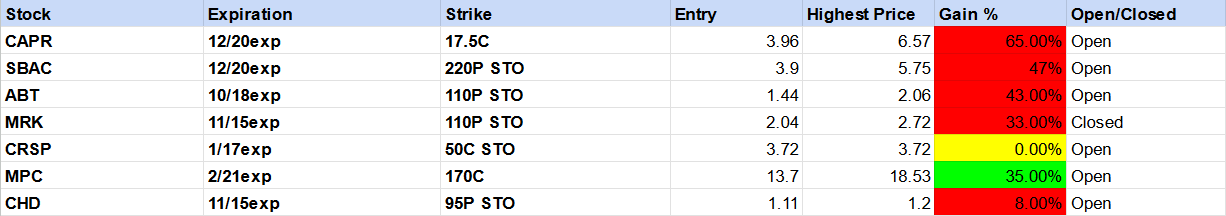

This week's Unusual Options Activity picks faced a challenging market environment, with several selections struggling to deliver the expected gains. Despite identifying key opportunities based on significant flow signals, many positions were impacted by broader market volatility and unforeseen shifts in momentum. The anticipated bullish moves were stalled by macroeconomic factors and unexpected sell-offs, leaving the overall performance below expectations.

While some plays showed early promise, they couldn’t maintain upward pressure due to weakened investor sentiment and external factors. The short-term setbacks highlight the unpredictable nature of options trading, where even strong signals may face headwinds. The focus now shifts to recalibrating strategies and adjusting to market conditions in anticipation of a rebound.

Although this week's Unusual Options Activity picks struggled to gain traction, six out of the seven trades remain open, leaving room for a potential turnaround. While initial gains were elusive, these positions still have time to recover as market conditions evolve. Key factors such as upcoming earnings reports and potential catalysts in broader economic trends could provide the momentum needed to reverse losses and deliver positive results.

With the trades still in play, there’s a solid chance for a rebound, especially as investor sentiment stabilizes and technical signals align. Patience is key in options trading, and with these positions not yet expired, they retain the flexibility to capitalize on any favorable market shifts in the days ahead. The focus now is on monitoring these opportunities closely to maximize their potential before expiration. Thank you all for sticking with us through a challenging week. We appreciate your trust and support as we navigate these market ups and downs together. We’ll be back next week with fresh insights and picks—see you then!

Best,

Kian , Jon, Jersace, Subrocs Capital Arts™