Chips, Clicks, and Chaos: The Wild Ride of Semis and Cyber Sales in the Stock Market

Notable Flow 9/11

Good evening folks. With a heavy heart we will always remember the day of infamy that is September 11th. I’d like to leave the intro at that.

Notable Flow:

AMAT 0.00%↑ 185C 11/15 STO Exp.

GLBE 0.00%↑ 45C 04/17/2025 Exp.

IBM 0.00%↑ 250C 01/17/2025 Exp.

WDC 0.00%↑ 72.5C & 85C Debit Spread 02/21/2025 Exp.

AMAT 0.00%↑ 185C 11/15 STO Exp.

Vol: 655 OI: 188 Avg: $11.10 Prem: $727,292

This Whale is placing a bearish bet by selling calls to open, trading 650 contracts at the Bid. The stock has been beaten and is down about 30% from its July highs. The Net premium chart below shows mostly call selling in the past 30 days, which makes us assume that this trader is looking for the downtrend to continue.

Today, the company announced a $400 million investment to establish a new engineering center in India over four years.

In regards to the chart at hand, pretty straight forward as it trades below all relative moving averages on the daily time frame most notably the 10DMA located at 184.30 at the time of writing. Assuming the whales positioning is in favor of the stock rejecting this moving average as it has the previous 12 sessions. Support is found at 171, 163, and 155 from here.

GLBE 0.00%↑ 45C 04/17/2025 Exp.

Vol: 563 OI: 500 Avg: $2.90 Prem: $163,000

Around 500 contracts were traded at Ask today, adding to the 500 existing OI. With contracts that are 25%, this Whale is buying a good amount of time specualting for a nice upside movement. The call Net premium reached its highest level in the past 14 days.

Over the past year, the stock has experienced some volatility, declining about 19.57%. Analysts estimate a potential price range of $37 to $48, depending on market conditions and the company's performance. The company’s long-term outlook remains positive due to its strong position in the growing global e-commerce market to pair with a very nice looking chart.

The chart displays a weekly falling wedge dating back to July ‘23 as well as trading above all moving average’s with today’s action breaking above the upper trendline. A few notable resistance levels between here and the strike chosen from previous attempts of this break most notably the 40 mark. Over a 20% move in equity is the whale’s anticipated play here.

IBM 0.00%↑ 250C 01/17/2025 Exp.

Between 12:05 PM and 12:10 PM ET, 4.8k contracts were traded at the Ask with an underlying cost of $579k. The stock is trading at all-time highs, but that is not stopping this Whale from buying calls 20% OTM.

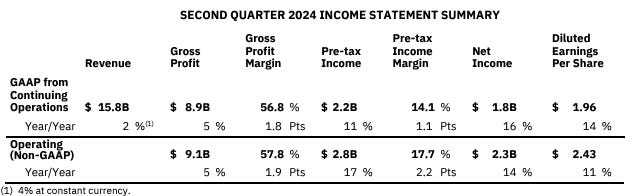

The company reported its 2024 Q2 earnings on 07/24. It showed significant growth in revenues and margins, which investors welcomed as great news.

IBM is currently trading at all time highs so we pulled a trend based fib-extension to help create some probably levels of resistance and profit taking points if one were to be long. Most interestingly the 0.382 & 0.5 marks which are commonly used by fibonacci traders. These marks are shown at 242.79 & 253.23.

I used the monthly chart this go around not only because it has a few months to expiration but just to encapsulate majority of the volume whilst displaying the previous all-time-highs rather than the weekly chart which also looks decent, but a ton of range bound action previously.

WDC 0.00%↑ 72.5C & 85C Debit Spread 02/21/2025 Exp.

This Whale is placing a multi-leg bullish trade by buying 2.5k contracts of the 72.5C at $3.4 x 100 for a total premium of $850k and selling 2.5k contracts of the 85C on credit at $1.2 x 100 for a total premium of $300k. The credit subtracts from the bought calls, making this whale pay $2.2 x 100 per contract for a total premium of $530k in this trade. The Whale profits will cap at 10.3 a contract or $2,575,000.

A few weeks ago Western Digital Corp. tested the 200wk MA which remains a very solid level of support in most instances such as we see here as it held. Since then, it has also reclaimed the 50wk MA and back-tested this spot twice now. Remaining resilient thus far, the asset seems poised for a bounce after dropping ~34% in 4 weeks. A break of the 10/20wk MA’s will provide the gains the aforementioned whale ever so desires.

What a wild day. We saw spooz drop veraciously during the first couple hours of the open before reversing the entire move and then some back above 5500 and towards 5550. Over a 100-point reversal intraday. Pretty neat stuff, innit? To pair with that information, I mentioned yesterday the hammer candle on the daily chart. Well, today’s hammer candle is even more so impressive as we have a 2.36% move from lows to highs during today’s session.

Cheers to all the successful flow we have pulled thus far and we hope to continue providing you all with these interesting ideas that we see come across our desks daily. If you enjoyed today’s read, likes are greatly appreciated.

Onwards & Upwards,