Computer Banking: Spooky Earnings Season Arrives

Weekend Bag

Hello all - quite the eventful week last week as many bulls were rewarded, and select bears also had their cheers. Let’s look into what we came across in our weekend scans.

Notable Flow:

SOFI 0.00%↑ 13C 01/17/2025 Exp

IBM 0.00%↑ 270C 03/21/2025 Exp

ZBH 0.00%↑ 100P 11/15 Exp

TFC 0.00%↑ 45C 11/15 Exp

SOFI 0.00%↑ 13C 01/17/2025

Vol: 13,782 OI: 5,546 Avg: $0.20 Prem: $277,591

At 3:15 PM ET on Friday, 10/11, around 12.2k contracts were trading at the Ask, causing a big spike in the call net premium. This trader is opening contracts that are 34% OTM, expecting a big move in the next 90 days.

Often referred to as a "one-stop shop" for consumers' financial needs, SOFI now looks to be a shop for bulls, as we see this trader take note of a large base breakout occurring here. Seeking more momentum of this weekly trendline break, 10.00 remains his nearest resistance target before entering an FVG. Many banks have a pretty good look to them as of late, and this is a potential theme to end the year.

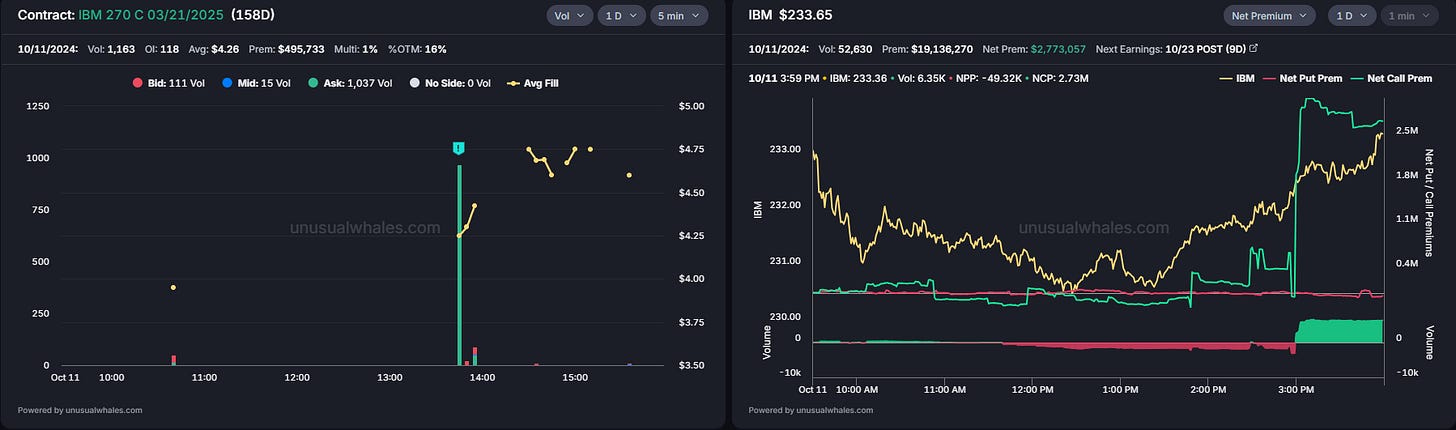

IBM 0.00%↑ 270C 03/21/2025

Vol: 1,163 OI: 118 Avg: $4.26 Prem: $495,733

This whale added around 1k contracts of these calls, which are 16% OTM. With barely any OI on Friday, today, the new OI added the 1k contracts and was updated to 1.15k, as we expected after the order came on Friday.

The chart still looks great, the stock is still at all-time highs, and IBM still makes computers. Could this trend continue? The stock has been up over 43% in the past four months and is in the process of going for a fifth straight. Price action is a bit extended from the moving averages, but this seems to be a hot name to own in the technology sector as of late.

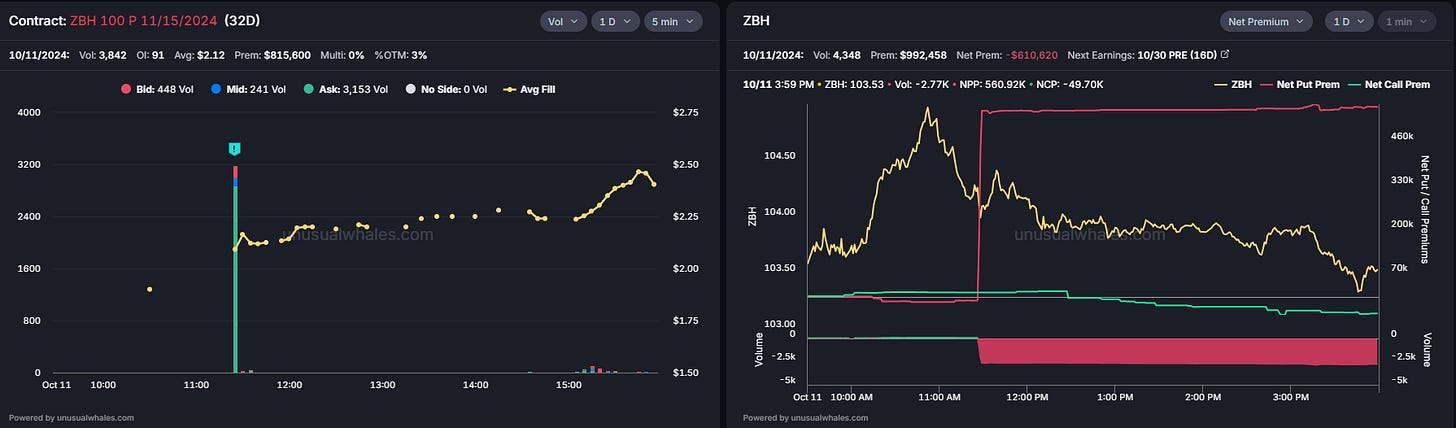

ZBH 0.00%↑ 100P 11/15

Vol: 3,842 OI: 91 Avg: $2.12 Prem: $815,600

Almost 4k contracts were traded on this chain with an Ask volume of 3.15k. This stock had the highest options volume in the last 14 days. OI spiked from 91 on Friday to 3.6k today. This trade covers the company’s earnings, which are on 10/30. Investors expect an EPS of $1.75 and revenues of $1.801B.

Zimmer Biomet Holdings is a prominent global medical device company specializing in musculoskeletal healthcare, particularly joint replacement devices. The stock has faced some challenges recently, including a nearly 9% drop due to operational issues like a new software implementation, which impacted its short-term performance. This trader likely is trying to ride the negative news for the continued downside of negative sentiment as this trade expires in just a month after rejecting a key level in the previous few sessions this past week.

TFC 0.00%↑ 45C 11/15

Vol: 13,838 OI: 4,682 Avg: $0.99 Prem: $1,366,290

This Whale traded 10k contracts at the Ask on Friday, making up for almost all the volume that the chain had that day. This is a name that does not get a lot of options activity; in fact, Friday was the highest options volume in the past 30 days.

Truist Financial, formed through the merger of BB&T and SunTrust, is one of the largest financial institutions in the U.S. Truist recently posted better-than-expected earnings for the second quarter of 2024, with an EPS of $0.91, outperforming analyst estimates of $0.84. Looking ahead, analysts expect modest earnings growth for the upcoming quarters. The next earnings report is on Oct 17th.

The chart also displays a nice bull pennant on the daily time frame, with the moving averages nearby acting as support. Assuming we have a cooperative market across the broader spectrum this week and the report is positive, this could be a nice trade for Mr. Whale.

Thanks for tuning in and good luck to everybody this week as we trade uncharted territory in the broader market as the S&P500 remains at highs with the Nasdaq only a little bit behind (~2%). As always, if you enjoyed the article, likes are greatly appreciated.

Cheers,

Kian, Jersace, & Jon