CPI Leaked?

Notable Flow 10/9

Good afternoon folks - what a day. The indices rallied nearly all day long after a brief period of weakness at open into the coming CPI print tomorrow. Many estimates are coming in at 2.3% for the print but only time will tell. Let’s dive into what we gathered today anyhow.

Notable Flow:

COP 0.00%↑ 100P STO 11/15 Exp

GLW 0.00%↑ 49C 11/15 Exp

CLS 0.00%↑ Call Roll: 57C 10/18 Exp STC & 60C 11/15 Exp BTO

WPM 0.00%↑ 65C 11/15 Exp

COP 0.00%↑ 100P STO 11/15 Exp

Vol: 10,898 OI: 2,722 Avg: $1.25 Prem: $1,364,823

This trade took place on the floor of an exchange. This floor trader opened 10k contracts on credit for a total premium of $1.25 million. This is the lowest net put premium in the past 30 days, which means the highest put-selling. This trade is bullish since the Whale speculates that the stock will remain above $100 by expiration, allowing the trader to collect the premium received.

Pretty solid support located at 100 correlating to the chosen strike to sell puts here. Last weeks downtrend breakout has begun to backtest amid this weeks session and held the 10/20-week moving averages while also rejecting the 50-week. A backtest of this trendline is a nice look for traders who have only recently come across COP and desired an entry. They now have one.

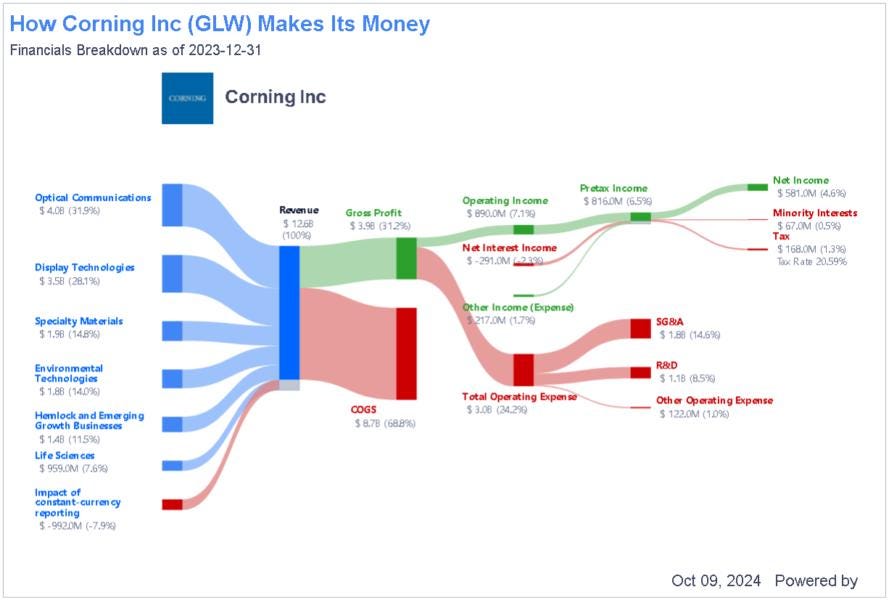

GLW 0.00%↑ 49C 11/15 Exp

Vol: 11,224 OI: 330 Avg: $1.34 Prem: $1,505,745

Another day of bullish flow, the call net premium hit its highest levels in the past 30 days. Yesterday, the 46C 11/15 Exp. had almost 6.5k contracts traded at the Ask and a total premium of $850k. The stock rallied 5% today after Deutsche Bank raised its price target to $49 from $46. The contracts hit almost 100% returns, and the Whales still hold it. Today, the call activity continued, and the Whales are speculating more upside.

GLW stock made a typical cup and handle breakout during today’s session with news of a partnership with KD which aims to deliver high speed connectivity for modern software-equipped vehicles. Below is an image depicting the business operations behind GLW if you’re into that sort of thing…

CLS 0.00%↑ Call Roll: 57C 10/18 Exp STC & 60C 11/15 Exp BTO

This trader originally bought close to 3k contracts on 09/26 for an average of $1.03 today. He closed them for 2.29, more than double their original value. However, instead of closing the trade, this Whale rolled the position with a further strike and expiration by opening around 1.8k contracts of the 60C on 11/15 for an average of 3.73 per contract and paying $670k in premium.

Just about 3% OTM, this trader looks to follow the recent momentum in the semi conductor/chip industry as CLS offers exposure to the likes of NVDA, AMD, AVGO, etc. Nearing all time highs, good data the remainder of the week could surge this price even higher and even put this trader ITM.

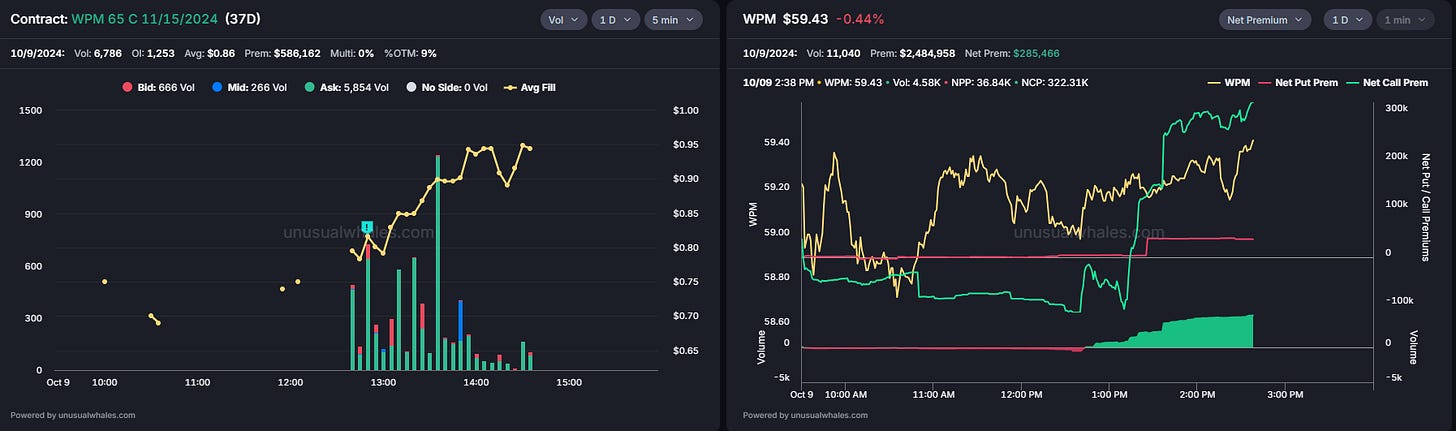

WPM 0.00%↑ 65C 11/15 Exp

Vol: 6,786 OI: 1,253 Avg: $0.86 Prem: $586,162

Over 6.8k contracts were traded on this chain today, with an Ask volume of 5.8k. This chain already had 1.25k in OI and volume. As the volume chart shows above, the chain got crowded with multiple buys rather than just one transaction as the day progressed; when this happens, it is very important to confirm OI the following day.

WPM rests at the bottom of it’s bollinger band indicator meaning a bounce is likely due/possible in the following trading sessions. You can see how it has acted previously on the chart shown below. It also rests upon a supportive trendline from Q1 lows giving traders an opportunity to seek value. The chosen strike is just under 10% OTM with slightly over a month worth of time meaning the idea is for this trade to work sooner rather than later.

That concludes our article for the day. I hope you all enjoyed the read and had an even better day in the market. If you enjoyed the read, likes are greatly appreciated and see you guys tomorrow.

Cheers,

Kian, Jersace, & Jon

Only my CPI estimates :)...

https://open.substack.com/pub/arkominaresearch/p/sep-2024-cpi-estimate?r=1r1n6n&utm_campaign=post&utm_medium=web