Earnings Armageddon

Notable Flow 10/28

Alright, I know the World Series is stealing the spotlight, but let’s switch gears and dive into today’s flow! We’re in the biggest earnings week of the quarter, and while the flow was all over the place, I’ve spotted some absolute gems that could turn into serious profit plays. Let’s break it down!

Notable Flow:

ARCC 0.00%↑ 21C 12/20exp

HPQ 0.00%↑ 41C 1/17/2025exp

HGV 0.00%↑ 35/30 Put Debit Spread 12/20exp

ARCC 0.00%↑ 21C STO 12/20exp

Flow: This whale is betting that ARCC will not go any higher than $21/share. They are selling to open the 21 call for 12/20exp for over $405k in premium. Great volume on this contract, over 4k and over 2,900 open interest. On the right hand side of the chart, you can see that this was the most amount of options volume in the last seven days as well.

Chart: Looking at the daily chart, stock is trading above all major moving averages. Earnings are coming up on October 30th. What this whale is hoping for is if it rejects this resistance at around 21.78. A rejection there would most likely take it to around 21.18.

HPQ 0.00%↑ 41C 1/17/2025exp

Flow: This whale is placing a bullish bet on HPQ, paying over $454k in total premium, over 4k in volume, 2888 open interest, contract costing around 1.02 average. This is an 10% out the money move with 81 days left until expiration. Almost all volume was at the ask today with very few at the bid. This was the highest amount of options volume in the last 7 days.

Chart: Daily chart looking constructive. Riding above all major ema’s. What we are looking for is a break of 36.79 and that should be enough to get to 37.97. October 15th, it had some trouble breaking that resistance and ended up shooting down so second times a charm?

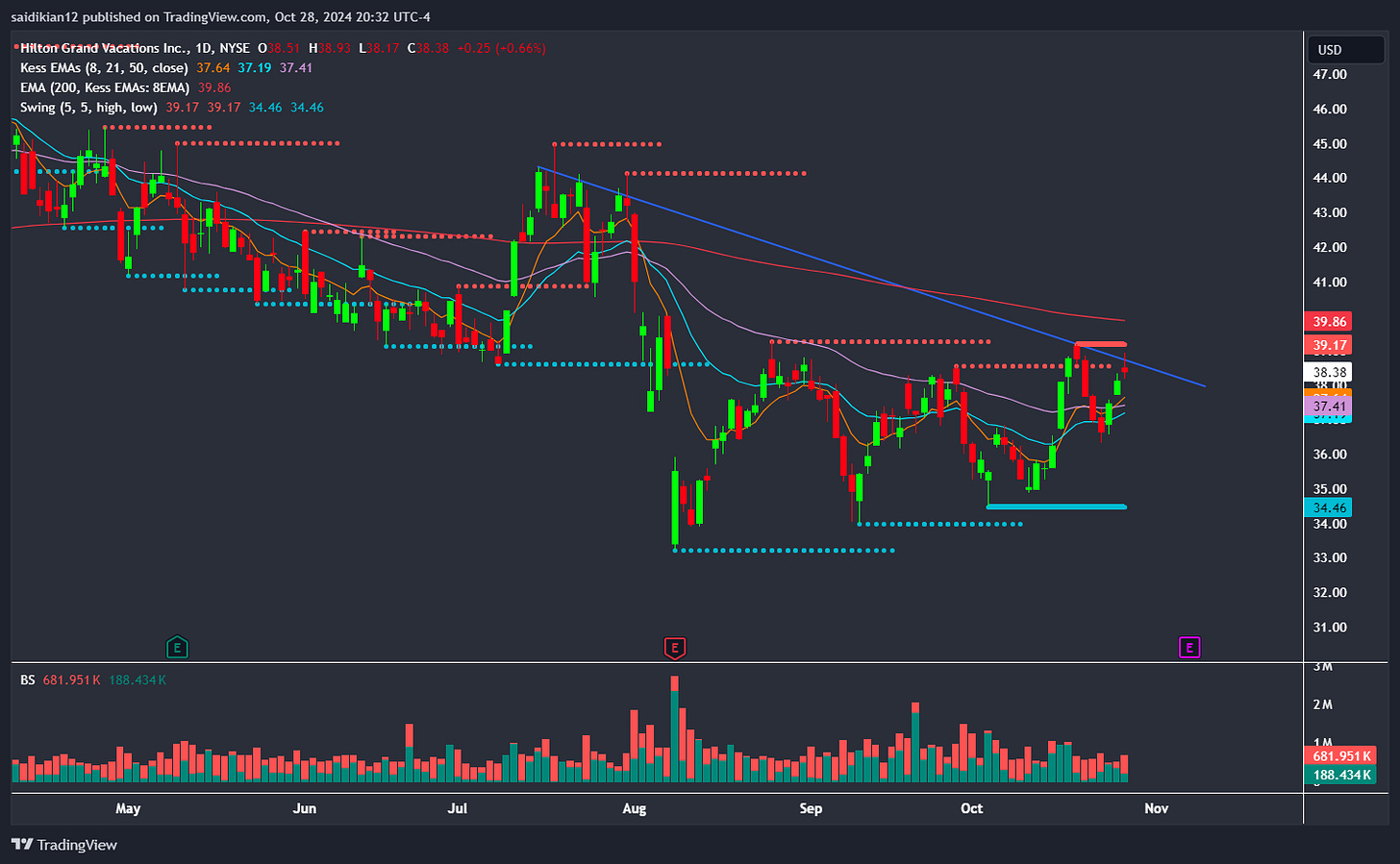

HGV 0.00%↑ 35/30 Put Debit Spread 12/20exp

Flow: This whale is purchasing a bearish put debit spread. The 35 put is being bought to open and the 30 put is being sold to open. Nice size on these contracts, over 3250 in volume, totaling around $235k in premium. The 35 strike is being bought for $1/contract, the 30 put is being sold for .26/contract. Premium paid for this is .74/contract. Max profit would be 4.26/contract.

Chart: First to note, earnings are November 7th. Would like to see a push up to 39.17 for that double tap look. Stock trading below the 200ema (never bullish) and rejecting a long term downward trend line. Average of 880k volume so would not expect too much movement. Earnings will be key.

That’s a wrap, folks! Flow today was drier than expected, with lots of messy earnings bets and no strong directional plays to sink our teeth into. But hang tight—once we power through this earnings frenzy, things should clear up. Appreciate your patience, and stay tuned for the next Substack update where we'll have some real action to dive into. See you there!

Best,

Kian, Jersace, JonETrades, Subrocs Capital Arts™