Feels Good Man

Notable Flow 8/15

Happy Friday Jr. to all who celebrate -

Good news is good news again as the market reacts positively for the third day in a row to morning data sending us back into the 5500’s.

Today we have Prof stepping into the kitchen with his fundamental expertise to add some more value for you all, because we’re just so nice and caring. What kind of factory do you guys think is shown above? Looks pretty menacing but I’ve always had a fancy for cartoon pizza, always looks so good. I’m going way off topic here and going to draw the line in the sand. Let’s dive in.

Notable Flow:

BABA 0.00%↑ 85C 8/30 Exp

ALAB 0.00%↑ 55C 10/18 Exp

CEG 0.00%↑ 160P STO 9/20 Exp

STX 0.00%↑ 120C 3/21/25 Exp

UBER 0.00%↑ 77.5C 11/15/2024 Exp

BABA 0.00%↑ 85C 8/30 Exp

Vol: 13,827 OI: 1,439 Avg: $0.99 Prem: $1,362,390

The company reported earnings on 08/15 pre-market seeing a revenue increase of 4% driven by double-digit public cloud growth and increasing adoption on AI-related products.

Although the post-earnings reaction disappointed both bulls and bears by having the stock below the expected move. Whales are betting for the upside by opening short-dated calls, since this specific chain is crowded with 12k volume we have to be careful by reading the flow and making sure we understand where is that volume heading to. By looking at the Ask-side action, increase in call net premium, and increase in IV (implied volatility). We can conclude that most of these contracts are being opened, but since they are short-dated calls it is always good to check the OI (open interest) change the next day.

The chart is showing us a nice recovery since the 71.9 lows and an important test coming at the 82 - 82.3 resistance area. It is important to note that the stock reclaimed the 50 and 200 EMAs by trading above 77.55 and 78.28 respectively

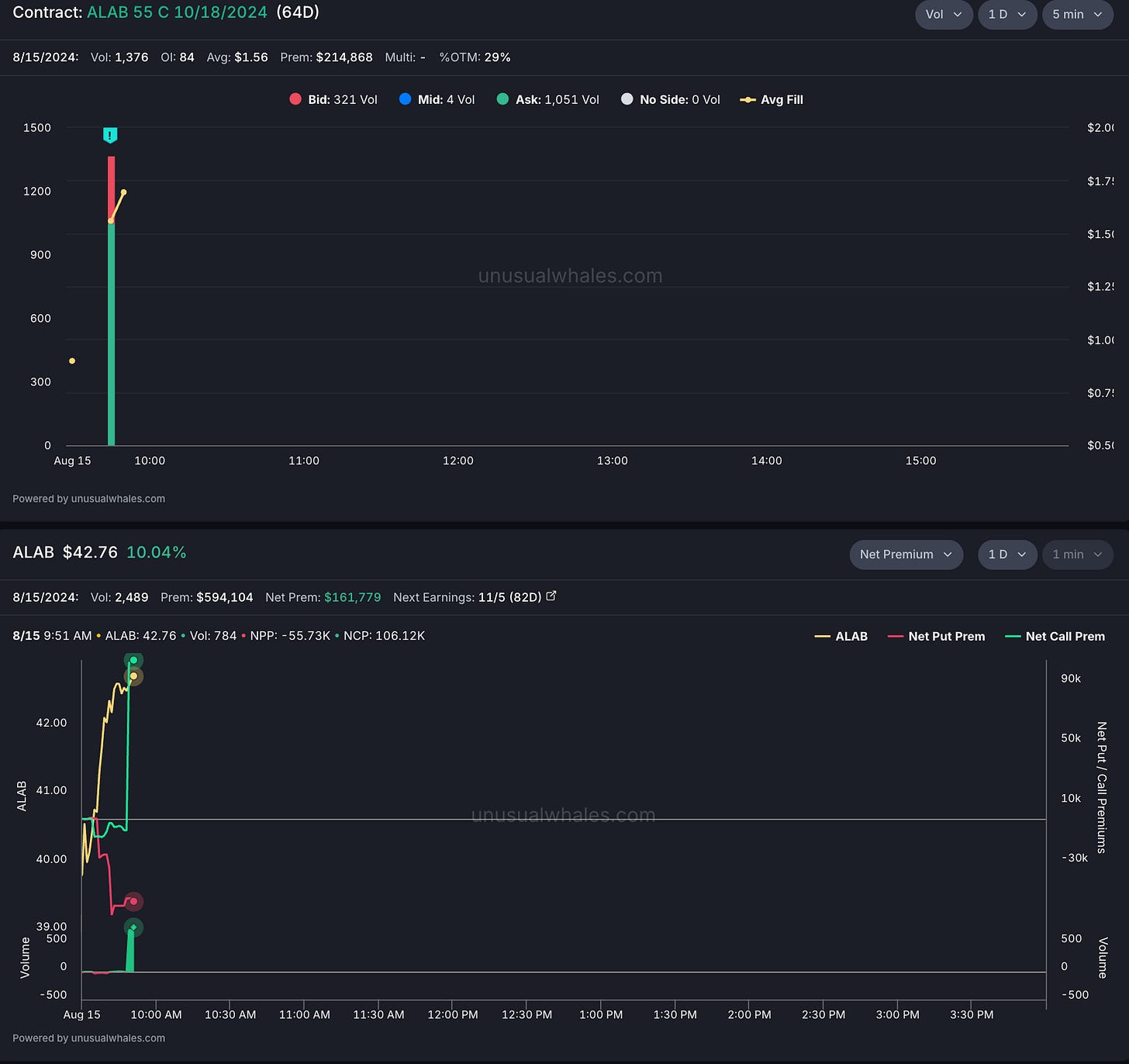

ALAB 0.00%↑ 55C 10/18 Exp

Vol: 1,736 OI: 84 Avg: $1.61 Prem: $279,056

The stock is up 23% since it reported earnings on Aug. 6. The company’s revenue is up 619% YoY and it was maintained at overweight and buy by institutions such as JP Morgan, Deutsche Bank, Barclays, among others.

The call flow is pretty clean and it is showing the whales opening calls 29% OTM. It doesn’t seem like these whales are scared of a pullback even after the big move to the upside they are still wanting more and tagging higher strikes such as the 55C.

The chart is showing a resistance at 43.9 followed by another resistance at 45.6 which was a previous support in July. Additionally, the stock is trading above the 10EMA and testing the 20EMA which could be used as another resistance.

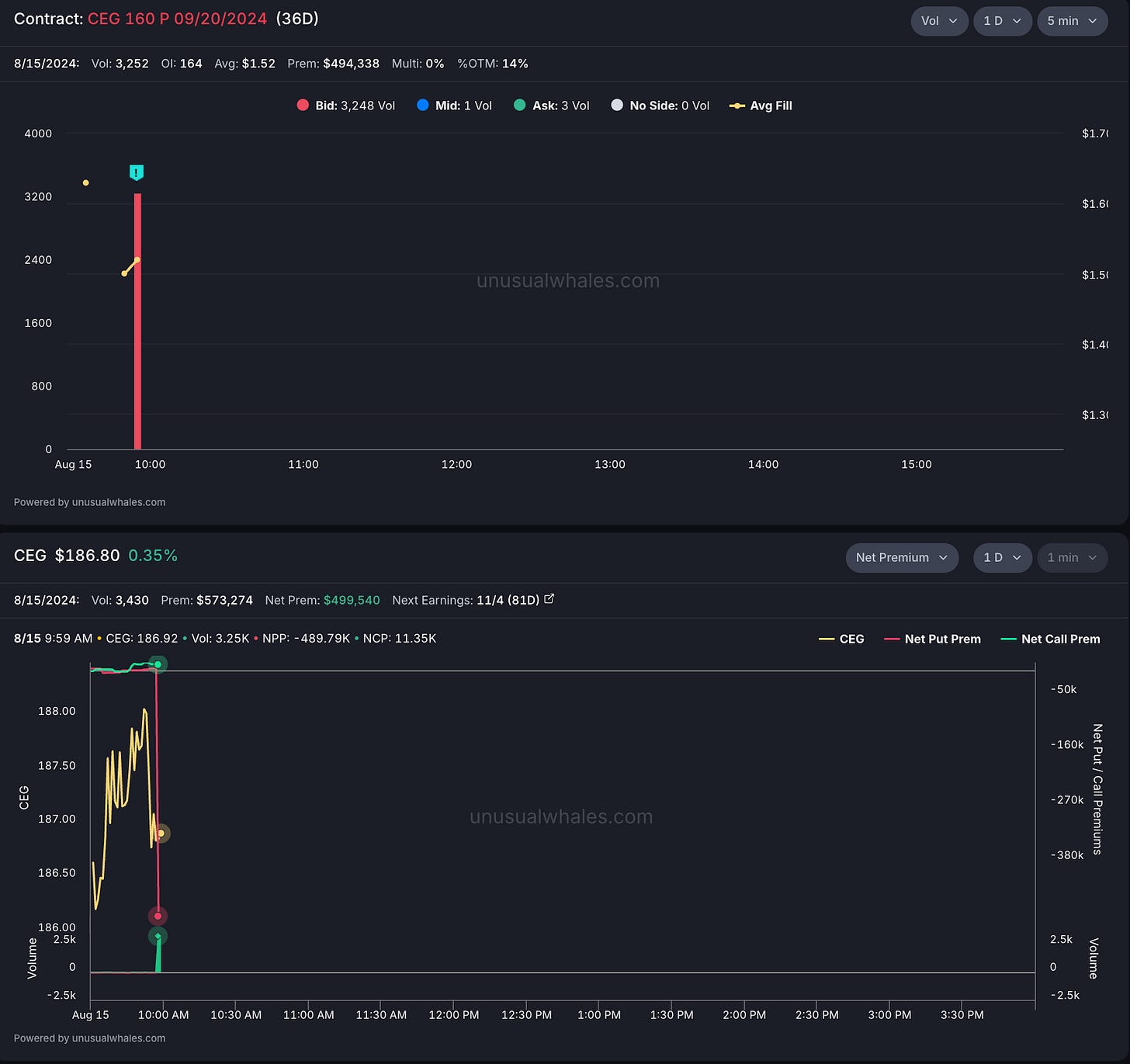

CEG 0.00%↑ 160P STO 9/20 Exp

Vol: 3,278 OI: 164 Avg: $1.52 Prem: $497,290

Whales are taking a more conservative approach into these longs but are still bullish, instead of opening calls they are using a STO (sell to open) strategy on puts, betting that the stock will be above 160 by 9/20. By looking at the drop in the put net-premium and the action towards the Bid-side we were able to make the assumption that this position is a STO. Why not STC (sell to close)? OI is 164 and Volume is 3.4k meaning that only 164 contracts were held overnight and closing 3.4k contracts would not add up.

The chart is showing us a significant recovery since that -34% drop that took place between May and July. Almost half of those losses have been recovered, the stock was able to find support close the 200EMA and reclaimed it within a couple days. It is now trading right at the 50EMA and trying to make its way back to the 197 resistance.

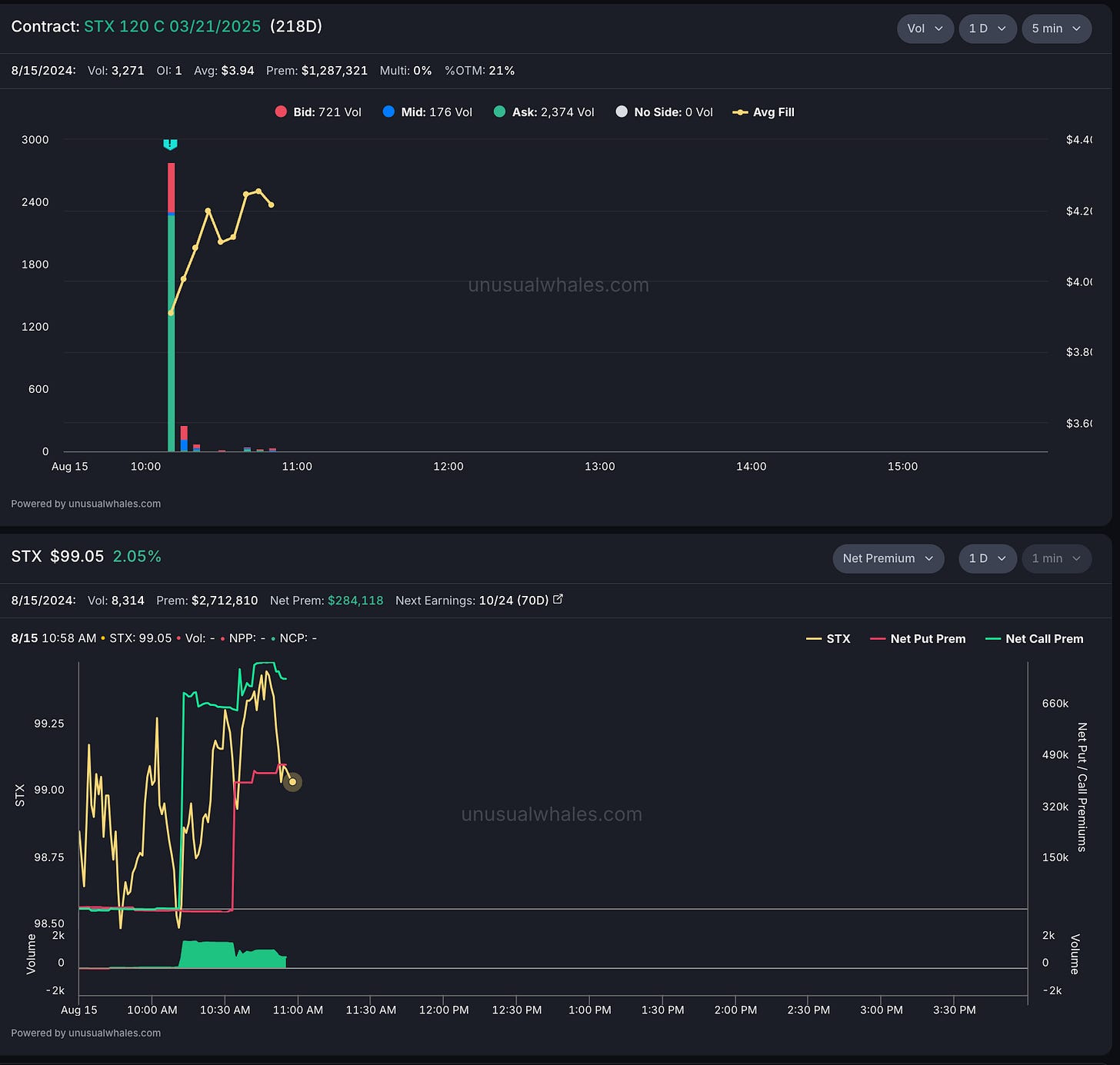

STX 0.00%↑ 120C 3/21/25 Exp

Vol: 3,547 OI: 1 Avg: $3.96 Prem: $1,404,941

Whales are betting for more upside by adding longer-dated calls 21% OTM. This is a clean example of a BTO (buy to open) order, where we can see one big trade taking nearly all of the daily volume. OI was 1 meaning only 1 contract was being held before this trade. This number should be above 3k the following day assuming the OI sticks and carries overnight.

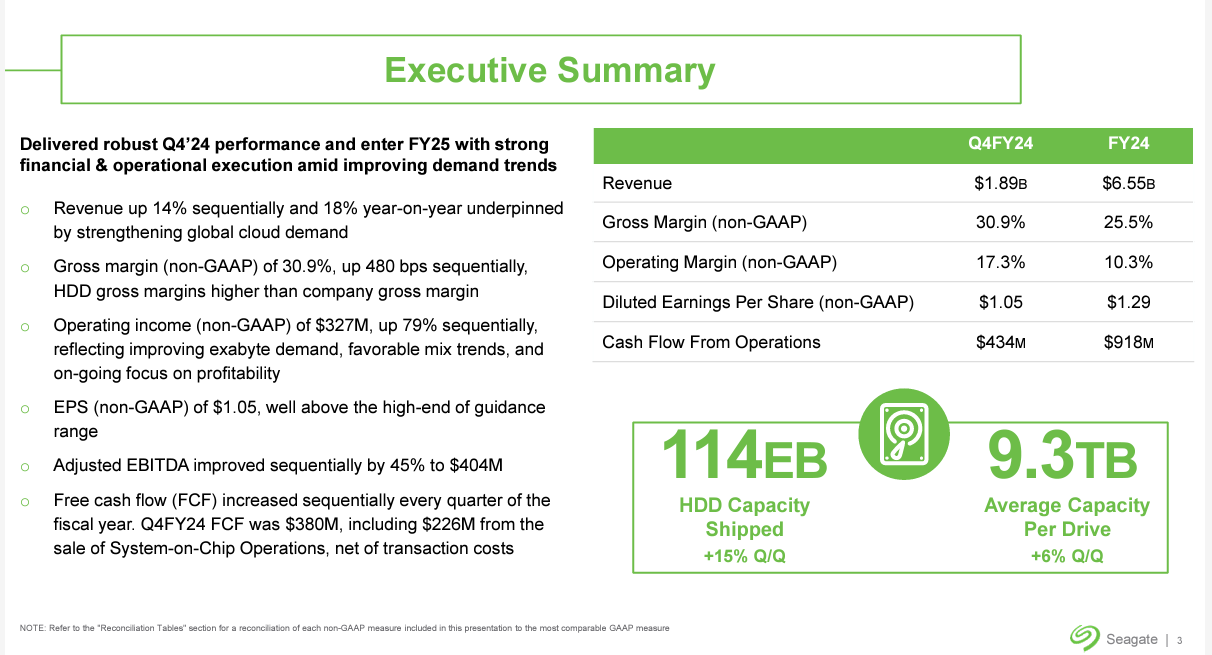

The company reported earnings on 07/23 and dropped sharply even with the results supporting its growth. Revenue grew 18% YoY, EPS beat previous guidance, Adjusted EBITDA improved, and FCF has increased on every quarter.

The chart is showing a recovery after that post-ER dip and the 200EMA being held and working as support. The yearly high is at 113.56 which is lower than the 120 strike bought, so even if the whales don’t see their calls go ITM, they should still be pretty happy by getting that high of the year. We will just need to keep track on the whales and see where they start to take profits or cut for a loss if the trade does not work for them. The stock is currently testing some important levels such as 99.5 resistance from May, the 50 and 20 EMAs, and the 100 level which could potentially become a big psychological resistance.

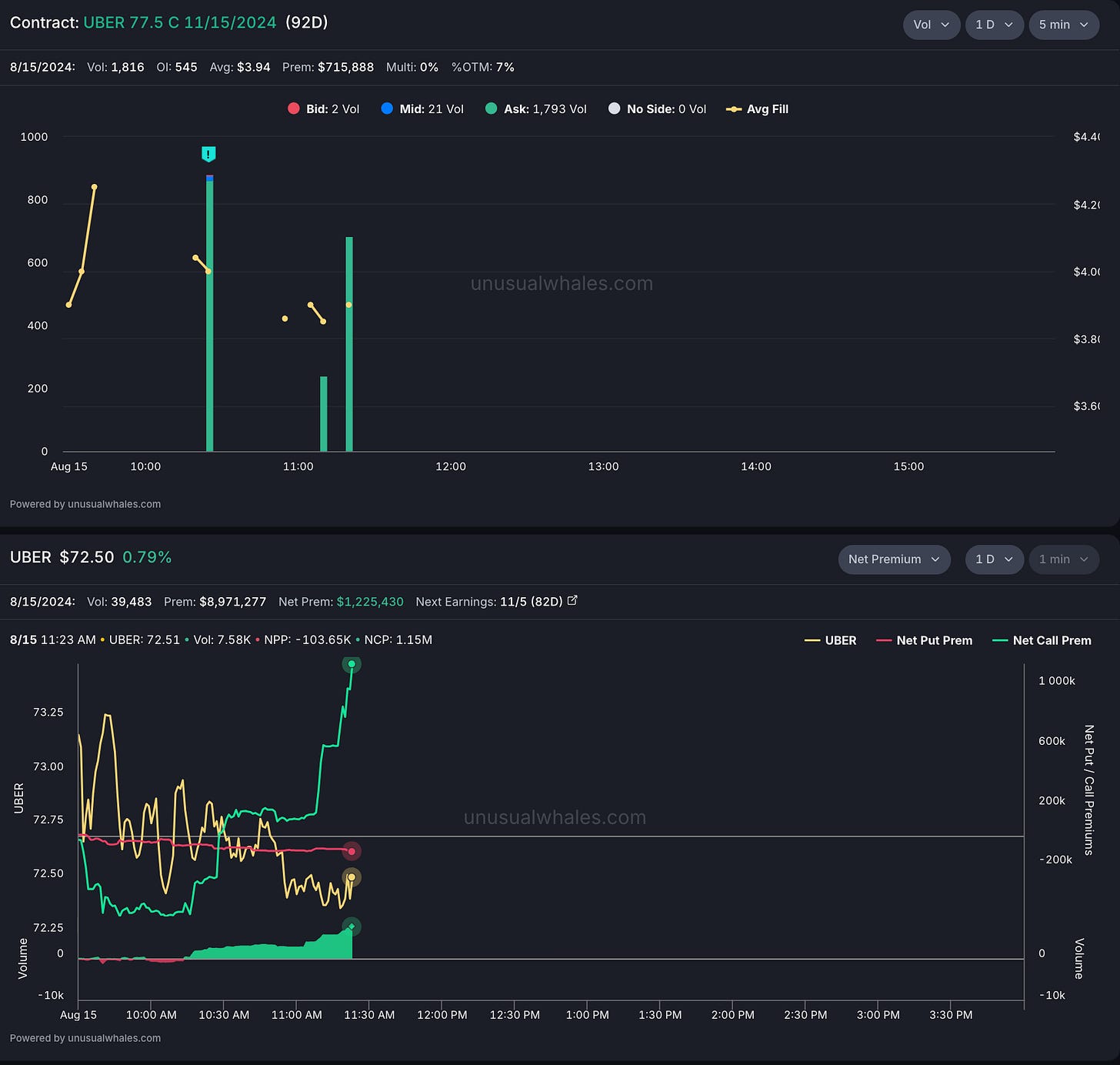

UBER 0.00%↑ 77.5C 11/15/2024 Exp

Vol: 1,851 OI: 545 Avg: $3.95 Prem: $730,278

A lot of bullish activity on the call side today, whales are opening 7% OTM calls for November as well as 87.5C for January 2025.

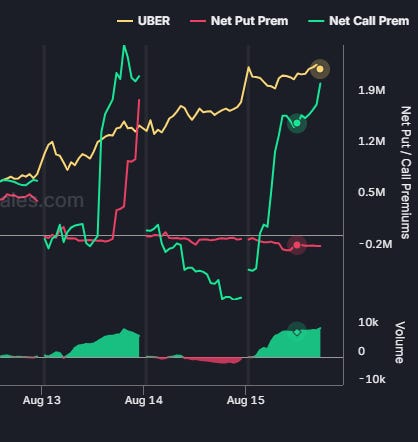

The net premium chart below shows mixed action for calls and puts this week but slightly favoring the call side, now it is a matter of time to see if the call activity continues through the end of the week and bulls get more confident

The stock lost -33% since its a all-time highs at 82 but has been recovered after reporting great earnings with Gross Bookings growing 19% YoY, an income from operations of $796 million, Adjusted EBITDA of $1.6 billion (up 71% YoY), and FCF of 1.7 billion.

We have been discussing UBER and its improvement for some time now, expanding their business and adding segments such as Uber Eats (which accounts to almost half of its revenue) has allowed the company to become the industry leader

Looking at the chart there is are some resistance levels at 73.1 and 75.5 after that it seems like there is a good chance to retest 80 and maybe back to ATH (all-time highs) but watching this 73-75 area is going to be key, especially for the whales that just opened calls after a 34% rally in the last 2 weeks.

Certainly a mixed basket today but some really good technical setups with fundamental backing for logical thesis’ to pair with Mr. Whale’s large bets. Always nice to see our flow working each day from previous posts that can be found here. Tomorrow’s post will be a recap & review post. Any notable flow from Friday’s session will be included in the Sunday letter. I hope you all enjoyed today’s read and look forward to continuing to publish these. As always, if you enjoyed it, likes are always appreciated and comments are neat.

Cheers,

I love these posts. Thank you for taking the time to explain in a way someone like myself who is still learning, can understand. Has really helped me plan my trades for the coming day.

Gm