Fintech On the Run

Weekend Flow 11/17

Hello all - We will jump right into today’s basket since we have already covered a brief market overview for you all today.

Notable Flow:

COIN 0.00%↑ 490C 03/21/2025 Exp

CVNA 0.00%↑ 260C 12/06 Exp

WFC 0.00%↑ 90C 06/20/2025 Exp

SOFI 0.00%↑ 20C 06/20/2025 Exp

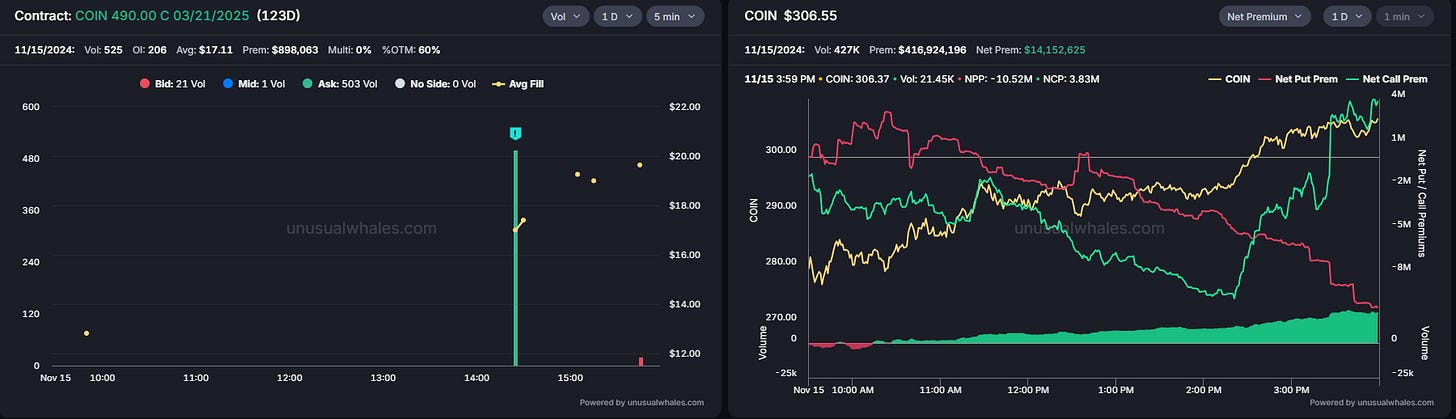

COIN 0.00%↑ 490C 03/21/2025 Exp

Vol: 525 OI: 206 Avg: $17.11 Prem: $898,063

This whale traded 500 contracts at the Ask, paying $850k for the trade. The stock has been extremely volatile since it reported its 2024 Q3 Earnings on 10/30. It missed analysts ’ expectations with an EPS of $0.28 and Revenues of $1.205 billion. However, it had an average 90% run towards the upside after the Elections.

About 60% OTM and well above all-time highs. Either this whale has completely lost the plot, or he is onto something. In weeks past, we have seen some max strike options get bought across a few names that hit their stride and jack premiums up (AFRM, APP, etc.). I have pulled both the weekly and daily charts below. The weekly report clearly displays a massive breakout, continuing into “IPO” levels. Although it may seem extended, you can reference the daily chart below and see this is untrue. With the 10MA just below, it is safe to assume that it has now “caught up” and can continue to grow if momentum and crypto price action cooperate.

We’ve got immediate support around 281.50 and resistance just overhead, slightly above 300. Besides that resistance level, it gets pretty thin as it has hardly traded above these levels and has not been 300+ since the tail end of 2021. Dips and pullbacks are to be seen, but imagine they get eaten quickly. CONL is the leveraged play for COIN here.

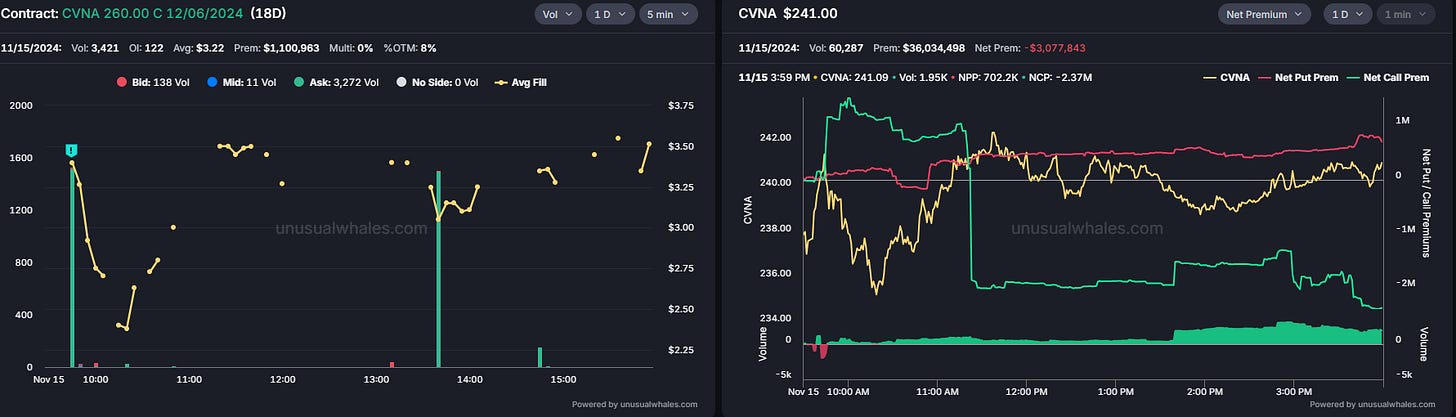

CVNA 0.00%↑ 260C 12/06 Exp

Vol: 3,421 OI: 122 Avg: $3.22 Prem: $1,100,963

With 2 volumes spike in the Friday session, the first one happened at 9:45 am ET and the second at 1:40 pm ET, each with over 1.5k contracts traded at the Ask with an aggregate premium of over $ 1 million. Carvana recently announced its 2024 Q3 earnings reporting:

Net Income of $148 million and Net Income margin of 4.0%

Record Adjusted EBITDA of $429 million

Record Adjusted EBITDA margin of 11.7%, a new all-time best for public automotive retailers

RecordGAAP Operating Income of $337 million

Last week, we noticed a lot of overall market weakness, with the indices dropping anywhere from 3-5%. IWM, in particular, saw losses exceeding this mark from high to low, dropping -6.02%. With Carvana holding up extremely well overall, it is worth noting the relative strength of the asset displayed throughout the week.

We’ve firmed out support at 230-233 and resistance at the upper half of 240, which is 247, and change. The strike here correlates to local highs, which came the day after their Q3 earnings report. Friday at close, CVNA reclaimed the 10MA, giving traders even more optimism heading into the week ahead.

Just going to drop this tidbit of information here as an addition to the message above about small caps as a whole.

WFC 0.00%↑ 90C 06/20/2025 Exp

Vol: 2,182 OI: 734 Avg: $2.00 Prem: $436,680

This chain has been accumulating Open Interest since the end of October. Friday finally caught our attention when a spike in volume of almost 2k contracts traded at the Ask and over $400k hit the live flow feed almost at the end of the trading session.

A couple of bank names for us to note here. Wells Fargo has been coming in with extreme strength in the last two months, increasing by over 36%, and this whale is looking for more. Earlier today, we noted the strength that goes hand in hand with these banks having relative’ relative strength in a weak market this previous week.

This is the highest mark Wells Fargo has ever closed regarding entry here. Breakout buyers could flood in on Monday morning, driving the price higher off the bell. Or we could dip back into the lower half of 70, providing bulls with a good entry off daily support, with the 10MA located at 70.50.

As previously mentioned, resistance at all-time highs is tough to predict, but shorter-term indicators such as the 5DMA can help you trail any open positions or look for bid spots on potential weaknesses.

I have included the daily chart below.

SOFI 0.00%↑ 20C 06/20/2025 Exp

Vol: 10,897 OI: 7,218 Avg: $1.06 Prem: $1,153,247

This chain had no Open Interest on 10/15, but it has been getting constant adds and a current OI of over 7.5k contracts since then. On Friday volume exceeded OI for the first time in November with over 10k contracts traded and 7.5k contracts traded at the Ask. If our assumptions are correct, OI should update it tomorrow to somewhere around 15k.

Looking to continue the massive breakout here on SOFI, this whale is grabbing contracts with just over 45% OTM and over six months’ worth of time behind them until expiration. The obvious difference between the aforementioned bank, WFC, is that we DO have clear resistance levels from previous marks dating to 2021. This gives us a better idea of locations to expect trouble and trim some profits, assuming the trade works well. These marks are shown clearly on the chart, but I would lean into that 14 & 17 level pretty heavily as big spots.

The daily chart (not pictured) also displayed a bull flag of the gap up and held that gap after testing it during Thursday and Friday sessions.

I hope you all enjoyed the read. Let’s get after it this week. There are plenty of things to see and money to make. If you enjoyed today’s read, likes are greatly appreciated.

All the best,

Kian, Jersace, & Jon.