Gambling Giants

Notable Flow 8/13

Are you smiling? I’m smiling. We’re a fun hospital and this is getting more fun.

Some nice hits from yesterday’s piece (all of them…) - OI stuck overnight on virtually all of those names which was nice to see. As of this very moment, each of the ideas are green including nearly a double on the largest flow ($1.1M on TAN weeklies) overnight.

The reaction to the data this morning was overwhelmingly good leading indices higher and many of the mega caps names with it. CPI comes in tomorrow morning with everyone holding their breath in hopes this bounce continues to trend back towards recent highs.

Overall, today was pretty light in regards to the flow - anyhow, let’s give today’s basket a look…

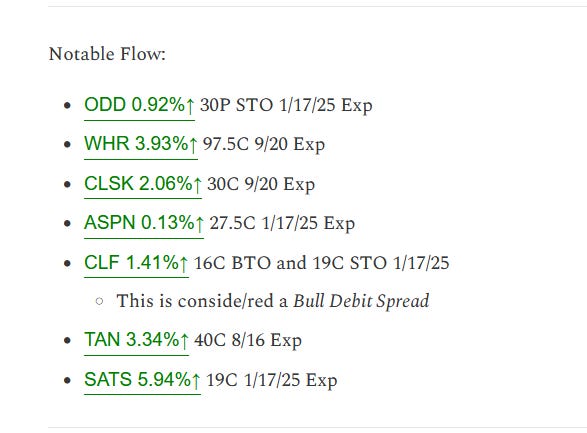

Notable Flow:

CZR 0.00%↑ 50C 1/16/26 Exp

MSTR 0.00%↑ 139C 10/18 Exp Rolled to 155C 8/16 Exp

can we get a wellness check on this guys’ mental?

PFE 0.00%↑ 29C 8/23 Exp

NTNX 0.00%↑ 57.5C 1/16/26 Exp

NFE 0.00%↑ 20P 8/16 Exp Rolled to 13P 9/20 Exp

CZR 0.00%↑ 50C 01/16/26

Volume: 4541 OI: 3624 Premium: Over $2M Fill: 4.48/Contract

Caesars Entertainment as we all know it is one of the leading gambling & entertainment companies in the world that has seen a 60% drop in value since 2022 providing investors with plenty of upside opportunity.

Displaying a nice wedge on support with plenty of time and upside potential, this seems like a favorable bet to investors who want to earn some of the money they lost at Caesar establishments. Obviously you’d like to see this itm as soon as possible, but upside targets with over a year of time until expiration make you think bigger picture, 60-70-82.. etc.

MSTR 0.00%↑ 139C 10/18 Exp Rolled to 155C 8/16

Size: 29,750 Volume: 30,854 OI: 30,857 Premium: $1.7M Fill: 0.57

This may very well be one of the more risky trades we have seen. Mr. Whale is selling their MSTR 139C for October and rolling it to 155C for THIS WEEK nearly 12.5% OTM. Absolutely outrageous confidence in $BTC this week and will be interesting to follow along.

$BTC chart looks great (shown below), a weekly & monthly Cup + Handle after wicking below the support line of 50,650 and being bid straight back up off the 50 wk MA into the balance of the handle / range. Looking for continued upside towards ATH’s and SOON, as Mr. Whale has made his confidence quite evident in today’s Gambling edition.

The chart on MSTR seems decent range trade off highs and lows but with $BTC seemingly surging, could get a good bit of action off this push towards 62,750.

PFE 0.00%↑ 29C 8/23 Exp

Volume: 22,427 OI: 1,670 Premium: $970,000 Fill: 0.43

Pretty sizable bet on Pfizer here with plenty of variables at play constantly in this sector ranging from drug approvals, buyouts ($VKTX - Kian is praying), and overall market sentiment just to name a few.

From a technical standpoint, the risk is pretty defined with the session lows just above the 200DMA yet holding and purchasing an ATM call with 2 weeks to expiration. Also have noted that it does have a falling wedge look to it that could propel this higher coinciding with the strike chosen on a potential break of this pattern. Relatively safe bet all things considered in today’s read with a defined risk.

NTNX 0.00%↑ 57.5C 1/16/26 Exp

Volume: 2,465 OI: 46 Premium: $2.1M Fill: 8.55/Contract

For a stock that doesn’t typically get too much options flow, we figured this was worth the note today. Mr. Whale is betting a 13% move to the upside or higher by expiration as the stock sees 6.42M in call premium v. 2.2M in put premium. Certainly worth keeping an eye on as it has a ton of time behind it so can always grab at discount if OI carries over.

Important to note that this has an earnings report within the following two weeks and having beat the most recent four exceeding expectations and estimates each time. Since this flow has a ton of time behind it, I looked towards a higher time frame which looks pretty decent and worth a punt as it caught bids off Q4 ‘23 - Q1 ‘24 support in a falling wedge looking to break up. However, it is of note to consider the 10 and 50 wk MA’s slightly above current levels that could bring some fight.

NFE 0.00%↑ 20P 8/16 Exp Rolled to 13P 9/20 Exp

Size: 2,250 Volume: 11,703 OI: 188 Premium: $1.26M Fill: 1.08/Contract

This NFE bear initially purchased the 20P you see being rolled above for 0.98 on 7/16 and cashed majority of the position out for 6.9/Contract. The remainder of the position is now being rolled to the 9/20 Expiration with a strike of 13.

“Pigs get fat, hogs get slaughtered”

I’m typically not a man of many quotes but this one felt appropriate as he caught just over 41% on his first trip before looking for more.

Really not much to note here from a technical stance other than the fact we are currently at July 2020 lows with seemingly bidless action. Guess he just wants to play limbo and see how low it can go with some profits.

That just about wraps it up for us today as we head into CPI on a good note with the market running over 160 bps today. I’m personally still thinking about the MSTR guy. Quite absurd if you ask me, but to each their own. I hope you all enjoyed today’s read, we will continue to post OI update checks in the subscriber chat each morning from previous posts. If you enjoyed the read, likes are always appreciated, and feel free to comment below anything you’d like to see going forward.

All the best,