Game On at the Dealership: High Scores, Test Drives, and Delivery Dashes!

Notable Flow 8/28

Hello all - As the world awaits Nvidia’s earnings report, we have seen a bit of selling in the broader market which some could argue was much needed for a cool off from the 10% rally since August 5th. Not much of a drop as we are only -1.6% from highs and retesting key spots such as 5565 on SPX.

All eyes on Jensen.

Notable Flow:

GEV 0.00%↑ 175P STO 09/20 Exp.

ELF 0.00%↑ 220C 03/21/2025 Exp.

CVNA 0.00%↑ 110P 11/15 Exp.

RBLX 0.00%↑ 47.5C 03/21/2025 Exp.

UPS 0.00%↑ 125P STO 11/15 Exp.

GLNG 0.00%↑ 45C 01/16/2026 Exp.

GEV 0.00%↑ 175P STO 09/20 Exp.

Vol: 1,085 OI: 611 Avg: $3.90 Prem: $423,150

This Whale is placing a bullish bet by selling puts. 1085 contracts were traded at the Bid, taking all the daily volume in this options chain. A decrease in the Net put premium while this trade was placed confirms that the puts were being sold.

GE Vernova launched GRiDEA on 08/26/2024, a comprehensive suite of innovative solutions aimed at decarbonizing the electrical grid and supporting the transition to a more sustainable energy future.

GE Vernova is an emerging leader in the renewable energy and power grid sectors. The company, a spinoff from General Electric, focuses on developing technologies that support grid modernization and the global transition to cleaner energy. GEV is currently rated as a "Moderate Buy," with price targets ranging from $200 to $220, reflecting confidence in its future growth prospects

Seemingly a prime setup for bullish sentiment as the stock is gaining more eyes and momentum at the top of the range in a pretty tight flag. Ideally the stock breaks above this flag and runs into expiration for Mr. Whale. A flag break as of now, can be viewed as the 185 level.

ELF 0.00%↑ 220C 03/21/2025 Exp.

Vol: 545 OI: 0 Avg: $9.53 Prem: $519,230

Bulls are paying $519k for these calls, which are 44% OTM.

The charts below show the 3 orders placed by these Whales, totaling 545 contracts traded at the Ask.

e.l.f Beauty announced a $500 million share repurchase program yesterday, 08/27.

Pretty big news all things considered and lines up with the higher time framed chart (weekly). Shown below is the standard deviation range of ELF on a weekly basis where you can notice that it has broken below this channel. Many traders use these channels as an entry/exit point when stocks peak above/below to de-risk longs, go short, or enter a long position such as we see here. Paired with the previously mentioned repurchase program, retail traders are not in this one alone.

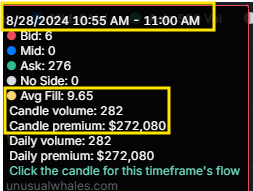

CVNA 0.00%↑ 110P 11/15 Exp.

Vol: 2,871 OI: 271 Avg: $4.29 Prem: $1,232,096

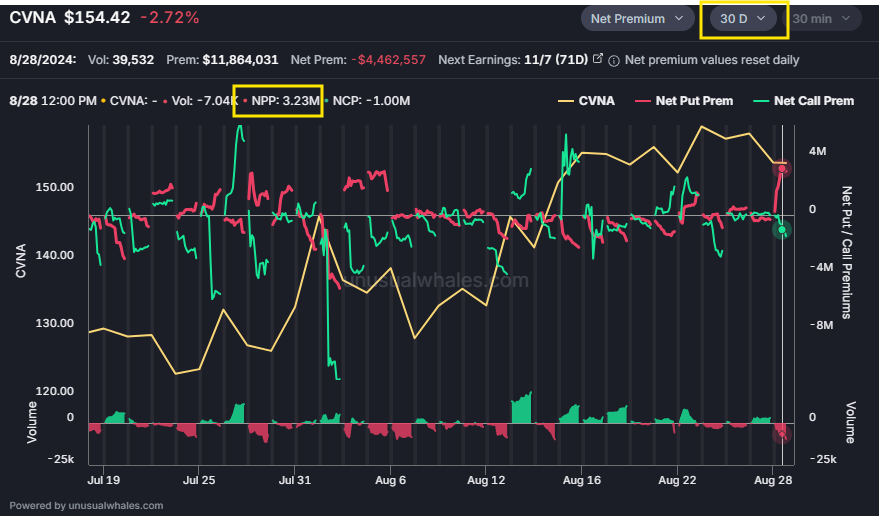

This Whale is trying to call the top in a stock that has been insanely strong this year, with 216% YTD gains. This trader opened approximately 2.5k contracts of puts 29% OTM, with a total premium of over $1 million.

The Net premium chart below shows us the highest put-buying activity in the past 30 days.

The company reported its 2024 Q2 earnings on 07/31/2024 and delivered a Net income of $48 million and a Net Income Margin of 1.4%. This was the company’s second profitable quarter in a row and second-best after 2024 Q1 when the company announced record results in Net income, adjusted EBITDA, and Operating income.

Although the company’s financial condition has improved sharply, the stock price has risen considerably, trading at 47.8x trailing EV/EBITDA and 24x forward EV/EBITDA. These metrics make it the most overvalued stock in its industry.

Shown far left is the opening candle post the company’s most recent ER. From there to now, we are resting atop a trendline that has acted as somewhat of a ceiling/resistance for slow and steady upside. Back-testing this same trendline from above now, could provide accelerated selling below and a pullback enough for the whales to earn some profits. 110 is a good bit OTM and may be a little risky, but not a bad spot to try I suppose.

RBLX 0.00%↑ 47.5C 03/21/2025 Exp.

Vol: 1,220 OI: 429 Avg: $5.05 Prem: $616,114

This one is a little trickier since not all the contracts were traded at the Ask, and the call Net premium also spiked down before it turned net positive. We believe most of the contracts were opened, but OI will confirm tomorrow. If the trade is carried, it should be around 1k.

On 08/26, Roblox announced that it would live broadcast the keynote addresses from its annual Roblox Developers Conference (“RDC”) on Friday, 09/06.

Up 26% since August 5th, Roblox has been a massive range trade basing from 24 to 47 for over 2 years now dating back to Q2 of 2022. This 47.5 spot is exactly a level it needs to break for meaningful and continued upside on a larger scale. Acting as resistance for the previous couple years we see the stock coming into the upper half of this range attempting yet another breakout. All moving average’s beneath supporting movement and small cap season potentially around the corner.

UPS 0.00%↑ 125P STO 11/15 Exp.

Vol: 667 OI: 493 Avg: $4.95 Prem: $329,989

The Whale is bullish on the stock by selling puts 1% OTM. The volume chart below shows the trade in more detail and when the 650 contracts were filled at the Bid.

We previously wrote up a similar put sell on UPS in one of our earlier letters. Unsure of whether that whale is still actively in his position, we have another. Same idea as last time in “Shake n Bake”. Nothing special about the chart, but seemingly bottom fishing.

GLNG 0.00%↑ 45C 01/16/2026 Exp.

Vol: 5,004 OI: 33 Avg: $2.45 Prem: $1,226,648

This was a Floor Trade which means it took place on the floor of an exchange. A total of 5k contracts were traded, mostly at the Ask. The chart below shows the orders coming in and the size of those orders, the increase of IV and Ask action as the orders get bigger let us assume that these are BTO. OI tomorrow should be around 4.5k - 5k if the trade is carried in full-size.

The company recently reported a solid Q2 2024, with a profit of $25.9 million, although its earnings were slightly below expectations. GLNG's stock is currently rated as a "Moderate Buy" by analysts, with a 12-month price target averaging $45.10, suggesting significant upside potential from its current price ~32.75. This price target correlates to leaps purchased above expecting around a 37% move in equity with a ton of time behind it. The stock has propelled off a round bottom already gaining over an 83% increase in value from the beginning of February.

Are you surprised we didn’t note any NVDA flow? Don’t be. It’s a mess. A crime scene. There’s sparks flying everywhere and people are screaming at their account managers as you read this. We mentioned a degen idea to play it in the subscriber chat earlier today and Kian has posted a few other insane positions taken on his twitter as well. Good luck to all the NVDA gamblers tonight, may the odds be ever in your favor.

Thanks as always for giving us a few minutes of your time to read our post. We hope you enjoyed today’s read, likes and feedback comments are always appreciated.

Cheers lads,