Jersace's Juice List - Vol. 2

The Juice List

Hello all - to those that have followed me for quite some time or even chat with me regularly, you may be familiar with my funny phrase of “Jersace’s Juice List”. I first compiled this list early on in Q1 at the tail end of January. This first list performed exceptionally well throughout the quarter with many stocks performing all year long. The goal here is to touch on some ideas/themes that I find interesting heading into 2025. A few names included in that first list that made my year:

PLTR

VST / CEG / POWL

VRT

IOT

DELL

Let’s dive into the everchanging list of mine to start off the year & see if the juice is in fact worth the squeeze.

TSLA

The interesting angle here outside of their impressive line of products and diversification into AI, robotics, FSD etc. is the unique developing relationship with President-Elect Donald Trump. Elon & Tesla should directly benefit from this as we have already seen with deregulations of autonomous driving.

Tesla's advancements in full self-driving (FSD) technology and artificial intelligence are expected to be major catalysts. Analysts estimate that the AI and autonomous opportunity alone could be worth at least $1 trillion for Tesla.

The anticipated Trump administration is expected to create a favorable regulatory landscape for Tesla, potentially fast-tracking initiatives like the robotaxi service. This could accelerate the adoption of Tesla's autonomous technology.

Optimistic price targets for Tesla stock in 2025 range from $515 to $650, with some analysts suggesting the potential for a $2 trillion market cap by the end of 2025. The most bullish forecast from the Economy Forecast Agency even suggests a price of $1,109 per share…

Breaking out of a massive monthly downtrend after being beaten down the first half of 2024, Tesla has surged over 250% from 2024 lows making new all time highs and seeking further expansion towards 500. The cult is alive and well looking for opportunities to get in with many fomo buyers entering along the way.

AUR

To continue this story of deregulation on autonomous driving and FSD, Aurora stands to be another beneficiary. Deregulation could speed up Aurora's plans to launch commercial operations of its autonomous trucking technology. The company aims to deploy up to 10 driverless trucks by mid-2025, with plans to scale to "tens of trucks" by the end of 2025.

An interesting note from Benzinga:

Faster scaling: Aurora's asset-light and high-margin business model could allow for rapid scaling once regulations are eased and commercial operations begin.

GOOGL

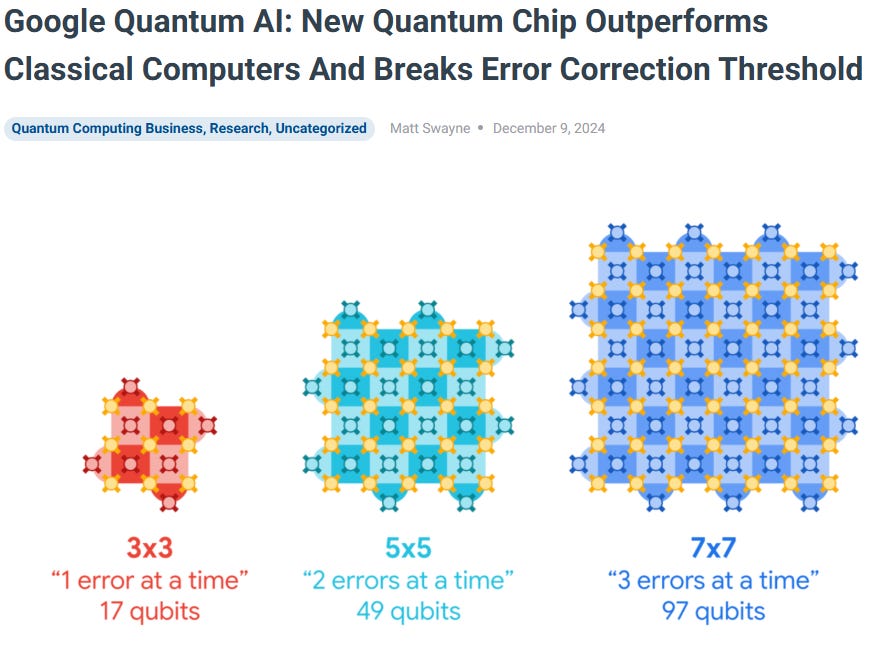

Alphabet's significant investments in artificial intelligence, including advancements in Google Search, Cloud, and DeepMind, position the company as a leader in AI technology. This could drive growth across multiple business segments and maintain Google's dominance in search. Let’s talk about Willow, Google's new quantum chip. Willow represents a significant breakthrough in quantum computing technology.

Computational Power

Willow demonstrates unprecedented computational capabilities. It can perform calculations in under five minutes that would take today's fastest supercomputers approximately 10 septillion years to complete - a timeframe that vastly exceeds the age of the universe.

My vernacular can only take me so far in this world when it comes to quantum computing and physics but the developments and endless possibilities ahead are astounding. Now - it is worth noting that practical, widespread applications may still be years away. Nevertheless, this development positions Google as a frontrunner in the race towards scalable and commercially viable quantum computing systems.

IONQ

Fun speculative idea of even further expansion here as IONQ taps into a niche market and becomes widely popular among retail & momo traders. Max strike calls have been getting purchased for about two weeks now heading into the new year that just make you scratch your head and begin to wonder how high this really can go behind the everchanging and advancing tech they plan on releasing.

Just a fun theme and idea to watch on dips as it has ran over 500% in the previous few months…

UBER

One of my favorite picks into 2025 with a compelling risk/reward argument is the infamous modern taxi service, Uber. Recently Goldman Sachs made their case for the asset as well claiming it to be one of their top picks for the year ahead with a buy rating and price target of $97/share.

Sheridan highlighted that Uber (UBER) is mired in a series of short-term debates, including discussion on pricing inflation and competition impact on mobility growth, as well as medium/long-term industry concerns over the impact of autonomous vehicles on supply/demand if not outright disintermediation. "Against that backdrop, we see a company that can continue to deliver on its February 2024 Investor Day commitments despite the rise of autonomous vehicles," countered Sheridan.

Uber continues to dominate the ridesharing industry, controlling 68% of the U.S. market share. This strong position, coupled with user loyalty, provides a solid foundation for future growth. Uber has successfully diversified beyond ride-hailing into food delivery (Uber Eats) and freight (Uber Freight). The company is also venturing into healthcare, autonomous vehicles, and AI which could open up new revenue streams.

The autonomous driving speculation largely driven by Tesla’s most recent event, caused negative outlook on the asset as it currently rests ~29% from all-time-highs. While this is cause for concern, nobody knows the real timeline on such a thing and while many argue that it is further out rather than closer. Mopex week of December, the broader market was pretty ugly throughout the day while Uber showed relative strength showing signs of a potential bottom being placed in the low 60’s. That’s where we get the risk/reward. Being that ATH’s is $87 and Goldman has a price target of $97, the upside to ATH’s is 40%, GS target 57% making this a feasible long off a supportive trendline shown below.

Let’s talk about some energy related names as this theme from 2024 looks to continue its run into the new year with many different opportunities arising with our upcoming administration…

XOM

ExxonMobil aims to increase its upstream production to 5.4 million oil-equivalent barrels per day by 2030, with over 60% coming from advantaged assets. This growth trajectory is likely to show significant progress by 2025. The acquisition of Pioneer Resources is expected to yield over $3 billion in annual synergies by 2025, a 50% increase from prior guidance. This acquisition strengthens ExxonMobil's position in the Permian Basin, potentially doubling production to approximately 2.3 million oil-equivalent barrels per day by 2030. The company plans to invest $27-$29 billion in cash capex in 2025, while also committing to $20 billion in share repurchases. This balanced approach to growth and shareholder returns could drive stock appreciation.

While Trump has promised to "drill, baby, drill" and boost domestic oil production, ExxonMobil's CEO Darren Woods has expressed a more cautious stance:

Woods stated that U.S. oil production is not currently constrained and there may not be much opportunity to significantly increase production in the near term.

He emphasized that the level of production in the U.S. is not being restricted by external factors.

However, Trump has pledged to ease regulations and increase access to federal lands for drilling, which aligns with some of the oil industry's interests.

While the stock has failed the monthly breakout at the moment, there is still good opportunity ahead with the aforementioned in mind off this supportive trendline risking the bottom of this multi-year range. Various targets have been placed on the asset for year end 2025 ranging anywhere from 17-25% upside. Controversy over gas & oil assets will remain constant, but it’s imperative to recognize the opportunity risk.

CVX

Similar idea to XOM here with a relatively better looking chart.

Bank of America has named Chevron a top pick for 2025, with a price target of $180, representing a 20% upside from current levels. The average analyst price target stands at $175.19, indicating a potential ~21% or more upside.

EQT

Little bit of a different approach here as we tap into the renewable energy market of natural gas.

EQT plans to increase production in 2025, reversing the trend of cuts seen in previous years. The company expects to boost output to around 6.03-6.58 billion cubic feet of gas equivalent per day (bcfed) in the fourth quarter of 2024, with further growth anticipated in 2025. This production increase is supported by EQT's industry-leading operational efficiency, with a corporate break-even point for 2025-2026 estimated at $2.40-2.45 per thousand cubic feet (Mcf), reportedly the lowest among its peers. Source

Data centers and AI have been quite a theme coming on this year and look to expand into 2025+ as a main focus. EQT, one of the largest natural gas producers in the U.S., is positioning itself to meet the growing energy demands of data centers and AI technologies:

EQT's CEO, Toby Rice, predicts that AI-related electricity demand could translate to an additional 6-13 Bcf/d (billion cubic feet per day) of natural gas demand in the short term.

The company sees opportunities to supply natural gas to data centers in Virginia, known as "Data Center Alley," as well as in the southeast and regions closer to Pittsburgh, Ohio, and West Virginia

On the verge of a monthly breakout, EQT is poised for upside with a cooperative and momentous theme & market for 2025.

GEV/VST/CEG

Traded all of these all year long remain top traders heading into 2025. GEV particularly has the best setup currently yet VST and CEG present appealing ADR’s for traders consistently.

In regards to setups, GEV has that look to it on the weekly for further expansion into the new year continuing to grow it’s market cap as a separate entity from GE. A move towards 400+ seems in play and will be interesting to keep track of this name to see where the market values the ‘new’ independent entity.

TLN

Newish name in the sector with Amazon backing and rumors looming of an entire Amazon buyout… Source Not many eyes are on Talen Energy (TLN) as a power generation and digital infrastructure co as people turn towards the more popular names previously mentioned.

Being well positioned in the PJM market, Talen is expected to see significant growth in demand and reduced reserve margins. I mentioned Amazon just above which they do have an existing partnership with supplying long-term & carbon-free power for data center development.

From the technical standpoint the back-test of the recent breakout could not be more perfect as it held where it needed to and looks to continue its growth turning this previous supply zone to demand for 2025.

GTLB

As a leader in AI-powered software development platforms, GitLab is well-positioned to capitalize on the increasing demand for integrated development tools. The company's financial performance, with revenue growth projected to reach $36-37 billion by FY25, underscores its potential.

The adoption of AI throughout its product suite, particularly in the Ultimate package, is expected to be a major growth driver. With a high gross margin of 89% and improving operational efficiency, GitLab is on track to achieve profitability. The company's strong customer retention rate of 124% and expanding enterprise client base further support its growth trajectory. While the stock has faced volatility, analysts maintain a bullish outlook with an average price target suggesting potential upside. As GitLab continues to innovate and capture market share in the $40 billion DevOps market, it presents an attractive opportunity for investors looking ahead to 2025.

The monthly chart displays one of the largest inverse head & shoulders I can find as well being in a range from early 2022 to now. Not to mention Google’s stake of 22% through its venture capital, GitLab is in good company.

ASAN

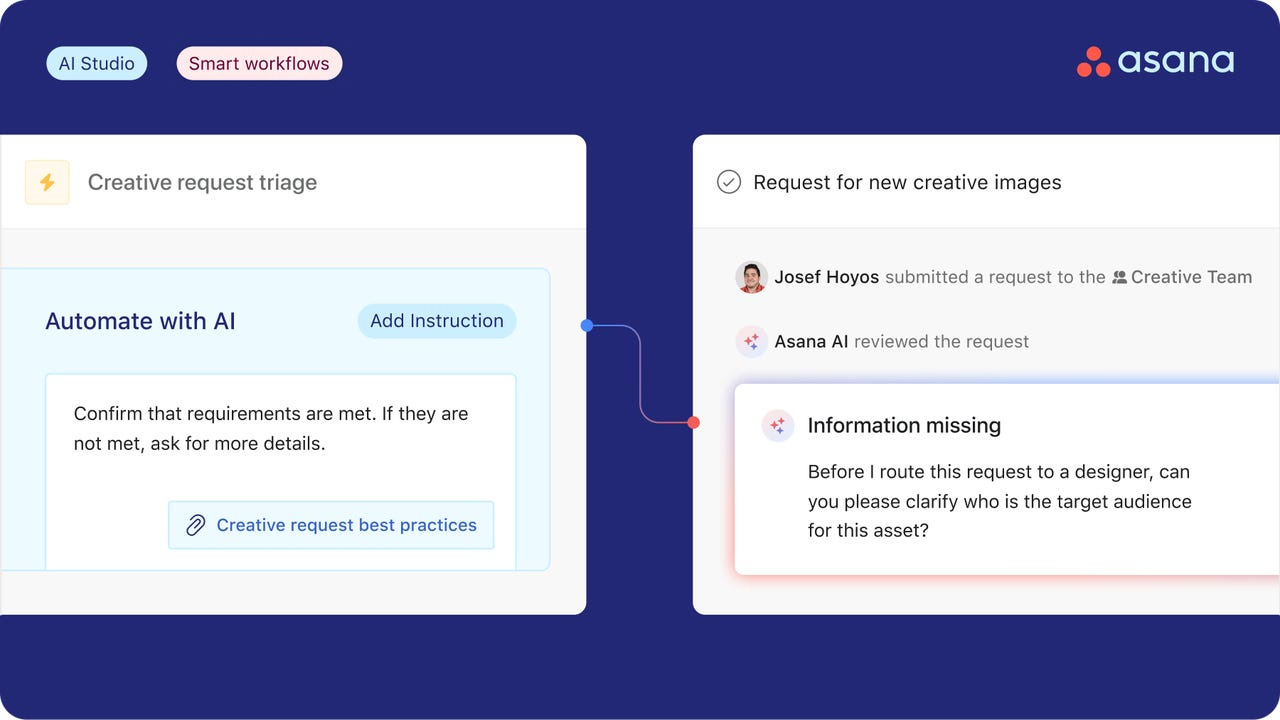

While we’re on the theme, might as well touch on a good risk/reward idea here off their latest earnings coupled with a large surge based around their AI Agents & announcement plans of their AI Studio launch.

AI Studio is a no-code platform that allows teams to create and integrate customized AI agents into their existing workflows. This innovative tool enhances Asana's work management capabilities by combining AI-powered automation with the company's existing rules engine.

Some Key Features of the new AI Studio include:

Workflow Creation

AI Integration with AI Agents

Customization of Workflows

Multiple Applications

Security & Compliance

The technical look is great here as well as we are flagging into a back-test of the most recent breakout from a multi-year base creating an appealing PEG setup. An attractive spot for investors with little to no exposure as risk is quite defined and intermediate targets presenting a good risk-to-reward ratio.

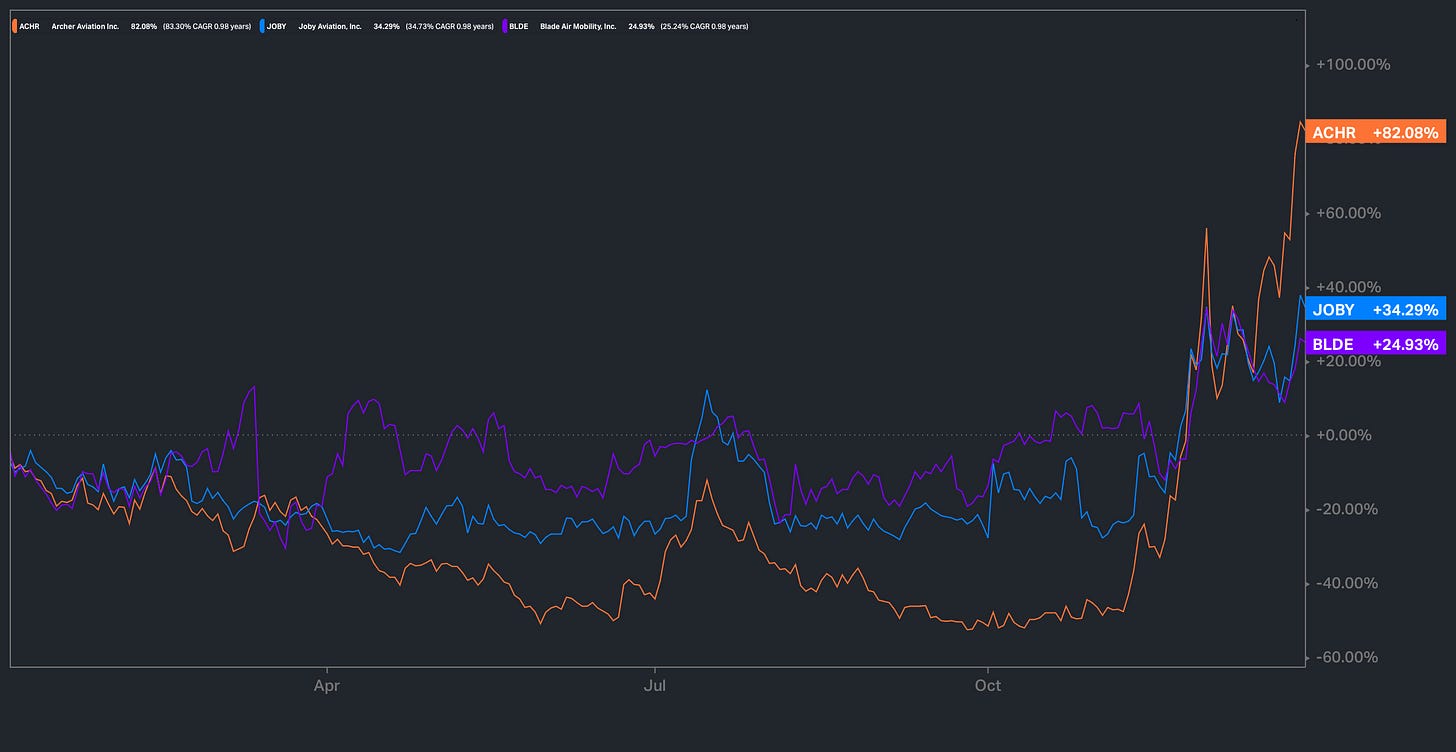

JOBY/ACHR/BLDE

Let’s talk about these aviation names.

eVTOL’s have been a hot and speculated theme for a few months now and seem to continue as one into 2025 with many promised deliverables. As opposed to diving into each individually, I’m going to take this time to compare JOBY & ACHR.

Production Goals:

Joby is focused on certification and initial commercial operations

Anticipated commercial passenger service launch in 2025 (NYC & LA)

Possibly beginning operations with the U.S. DoD ahead of commercial launch.

Archer Aviation targeting commercial operations in 2025

Planning to launch air taxi networks in California airports as well as a potential network in LA by 2026.

Partnerships/Funding:

JOBY is currently partnered with Delta Air Lines and Uber for U.S. market operations & secured a six-year exclusive deal to operate air taxis in Dubai - who just built an entire eVTOL airport (source). Also existing ties with the DoD (Dept. of Defense)

JOBY recently received an additional $500 million investment from Toyota bringing the car manufacturer’s total investment to ~$894 million.

ACHR has been collaborating with Stellantis for manufacturing support + $55 million investment from the manu co.

Archer currently had ~$406 million cash on hand earlier in 2024.

While both companies are targeting 2025 for commercial operations, Joby Aviation is taking a more vertically integrated approach with strong backing from Toyota, while Archer Aviation is leveraging existing aerospace suppliers and partnering with Stellantis to create a leaner business model. Archer has set more specific production targets for 2025, while Joby is focusing on certification and initial operations in key markets.

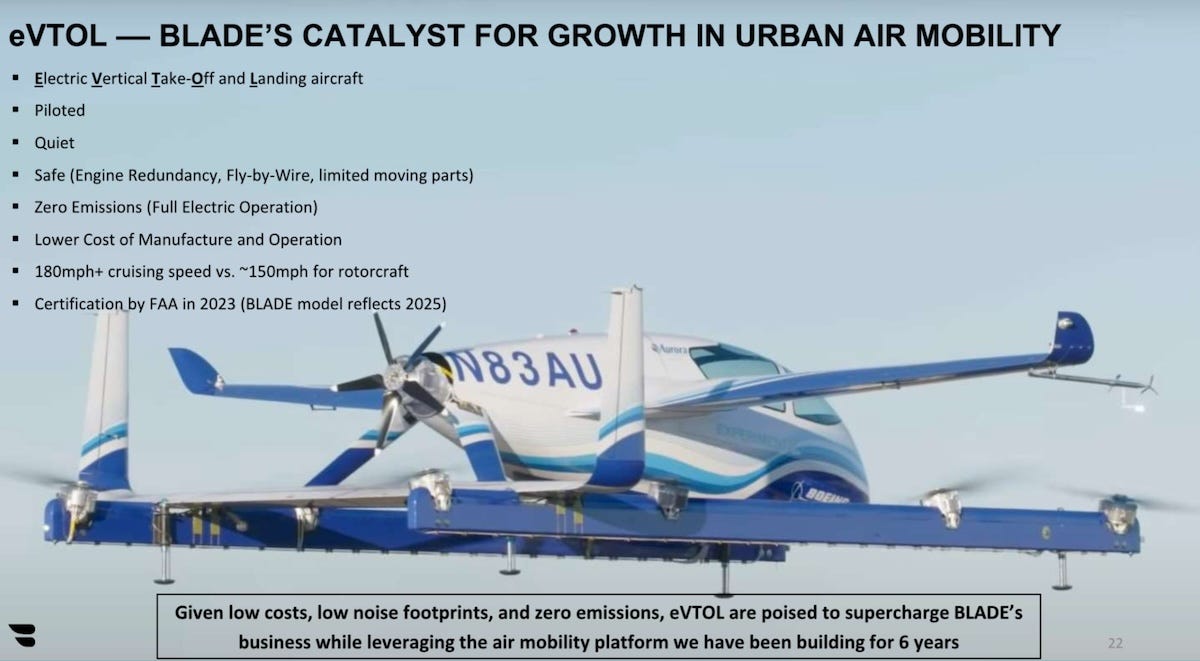

Blade Air Mobility (BLDE) presents a unique position in the urban air mobility sector, differentiating itself from companies like Joby Aviation and Archer Aviation.

Blade is taking more of a service provider approach rather than manufacturing the aircraft themselves such as the two aforementioned companies. Currently partnered with a network of aircraft operators, Blade aims to continue their business model while integrating eVTOL aircraft from various manufacturers into its network upon availability.

Interesting enough, BLDE has already been operational with an existing customer base from passenger and medical transport services, offering a different angle from the other two companies. The kicker here is that while Blade has been growing its network and deals, they have also been leveraging its existing operations and partnerships to prepare for the integration of eVTOL technology. This strategy allows Blade to benefit from the advancements in eVTOL without bearing the full risk and cost of aircraft development, potentially making it a key player in the future of urban air transportation. Majority of these names have warrants available to play as opposed to common stock / options.

HIMS

Poised for continued substantial growth in 2025, analysts are projecting revenues of $2.04 Billion (a 64% YoY Increase) with expectations of the company to hit its $100 million EBITDA target. While this growth is driven by the expansion of personalized healthcare solutions such as the new GLP-1 weight loss drug, HIMS has also expanded their product line among other avenues such as hair loss & ED. Quickly taking a majority of the market share and outpacing its peers, the company continues to grow institutional ownership offering investors confidence. A concern is regulatory issues if they were to arise, but outside of that, analysts continue to raise their price targets with the chart displaying a breakout and retest of the monthly cup and handle.

OUST

Pretty simple angle here. Autonomous cars and robotics catching tons of momentum and theme, of course. What people aren’t asking is the how. OUST presents the how. Ouster is a leading provider of high-performance digital lidar sensors for automotive, industrial, robotics, and smart infrastructure markets. The company develops and manufactures a range of scanning and solid-state digital lidar sensors, as well as software solutions like Ouster Gemini and Blue City. Following its merger with Velodyne Lidar in 2023, Ouster strengthened its market position and reported record revenue of $83 million for the year. The company's focus on digital lidar technology.

Not familiar with LiDAR? Let me show you.

Pretty interesting, innit? LiDAR technology continues to evolve, with improvements in resolution, range, and cost-effectiveness making it increasingly valuable across multiple industries. The largest order in the company recently came from a leading technology company and there is speculation that company is in fact Amazon. That’s the shill.

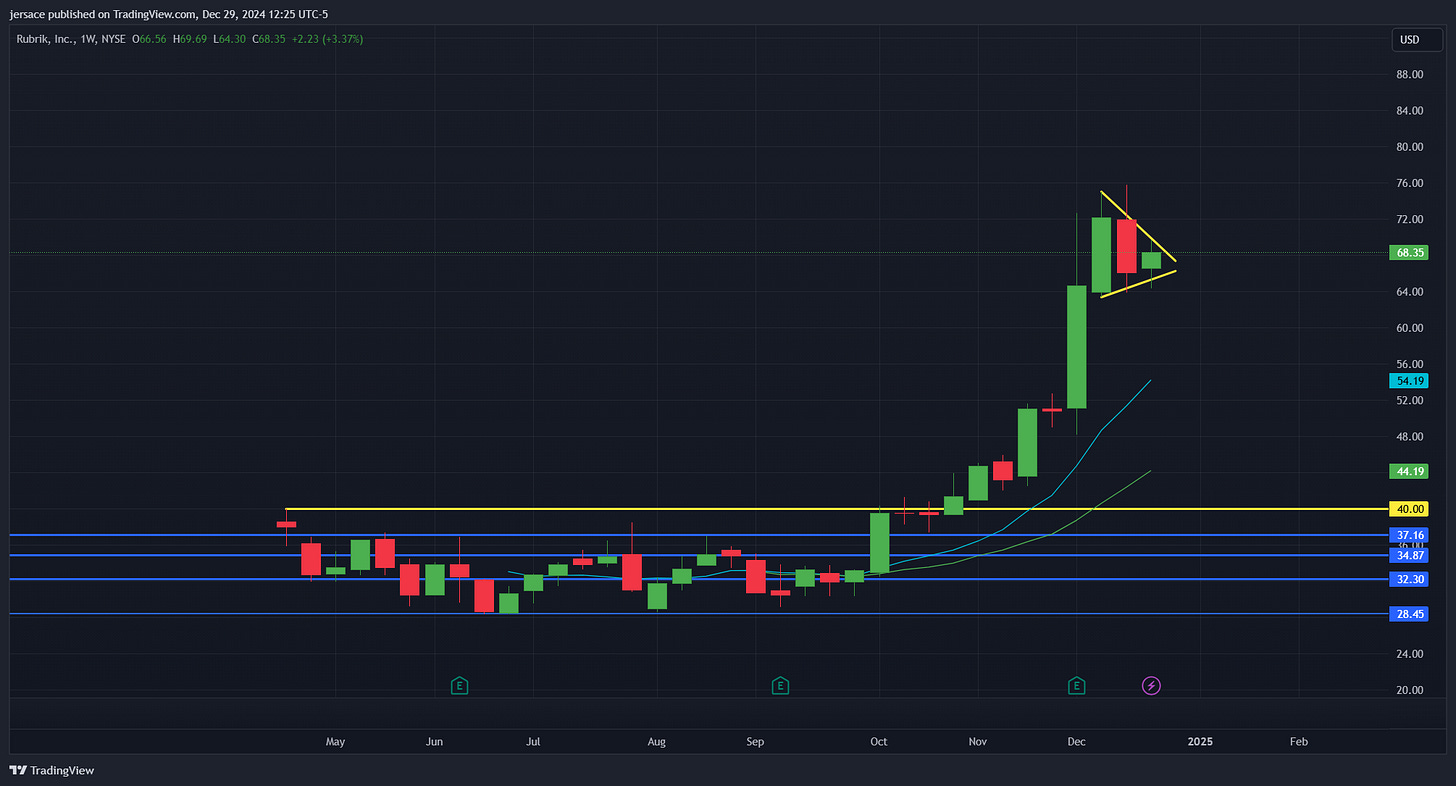

RBRK

A leading provider of data security solutions with a specialization in cyber resilience (word salad) & AI driven recovery, is none other than Rubrik.

The best bellwether for the AI theme is NVDA GPU sales which Morgan Stanley just revised their estimates to be 800K units for their next ER vs the original estimate of 500-550K. This just tells me that the theme is still hot and ramping up into the new year.

A few things to consider when looking at RBRK:

Expanding Market Presence

The company is capitalizing on the growing demand for data security and cyber resilience solutions, with a total addressable market estimated at $53 billion by 2027.

AI Integration

Rubrik is leveraging generative AI and machine learning to enhance its security offerings, positioning itself at the forefront of AI-driven data protection.

Strategic Partnerships

Notably, Rubrik has a strong partnership with Microsoft, which made a significant equity investment in the company in 2021. This collaboration includes integrating Rubrik's solutions with Microsoft Azure and Microsoft 365, as well as joint development of AI-powered security tools.

Bottom Line - The Microsoft backing provides Rubrik with additional credibility, resources, and market reach, further strengthening its position in the rapidly evolving cybersecurity landscape with a high and tight wedge on the weekly seeking expansion. The last ER setup an episodic pivot, blue skies + earnings gap up similar to that of ALAB/RDDT.

LCID

This is a really fun speculative turnaround story. I actually saw a Lucid car commercial for the first time ever the other day which got me to thinking and digging into it. The cars themselves look incredibly sleek and sporty which catches the eye. The company's innovative technology, particularly its flagship Lucid Air sedan with industry-leading range and performance, positions it well in the luxury EV segment. Lucid's planned expansion, including the introduction of the Gravity SUV in the 2025 model year, could drive significant growth. The company's strategic partnerships, such as its deal with Aston Martin to provide battery tech and drivetrains, demonstrate its technological prowess and potential for diversified revenue streams. The Saudis are also backing Lucid with a plethora of investments throughout 2024 claiming the Saudi Arabian Public Investment Fund (PIF) 60% of the company.

Analysts project potential upside, with some price targets reaching as high as $12 by 2025. The growing demand for sustainable vehicles, coupled with Lucid's focus on high-end consumers, could help the company carve out a profitable niche in the competitive EV market. If Lucid can overcome it’s issues with production scalability and turn that corner, profitability should soon follow making them a real competitor to other EV’s and Car companies alike. The risk/reward here is too great to ignore.

Well - that was a lot to take in. I appreciate you all taking the time to go over some of my favorite thoughts into the new year and hope you all had a great holiday season with loved ones. 2024 was a spectacular year and I look forward to making 2025 even more memorable. All the best.

Cheers,

Always a pleasure reading Mr Jersace