JP Morgan's New Strategy: Ozempic for Leaner Loans, Antidepressants for Tech Bros, and a Bullish Boost to Silicon Valley!

Notable Flow 9/10

Good evening all, no recap today, just going to dive right in.

Notable Flow:

HIMS 0.00%↑ 20C 02/21/2024 Exp.

AXSM 0.00%↑ 80P & 50P Debit Spread 01/17/2025 Exp.

JPM 0.00%↑ 185P STO 10/18 Exp.

NXT 0.00%↑ 40C BTO & 30P STO Bullish Risk Reversal 02/21/2025 Exp.

HIMS 0.00%↑ 20C 02/21/2024 Exp.

Vol: 5,845 OI: 2,920 Avg: $1.11 Prem: $650,725

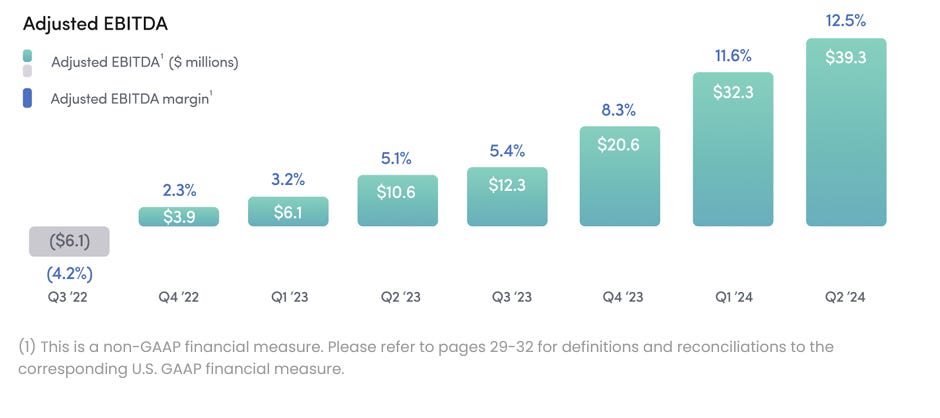

This Whale is betting that the stock will rebound after a rough August when it dropped almost 40% following the market sell-off. However, the company’s revenue grew by 52% YoY in 2024 Q2 due to the weight-loss market boom. Additionally, the company has reported three consecutive profitable quarters and is on track to report its first profitable year. Their adjusted EBITDA has been growing considerably, with a total of $39.3 million in 2024 Q2 compared to $10.6 million in 2023 Q2.

We previously covered the exact same strike and date on this name mid august, nearly three weeks ago. Our thoughts on this previously can be found here. Although we displayed a cup + handle previously, it now trades below the bottom of the handles range. Could it be the same person trying their luck again here? Possible. This strike is now ~36% OTM yet carries a ton of time. A catalyst for such a move can be driven by their next earnings report which comes in early November.

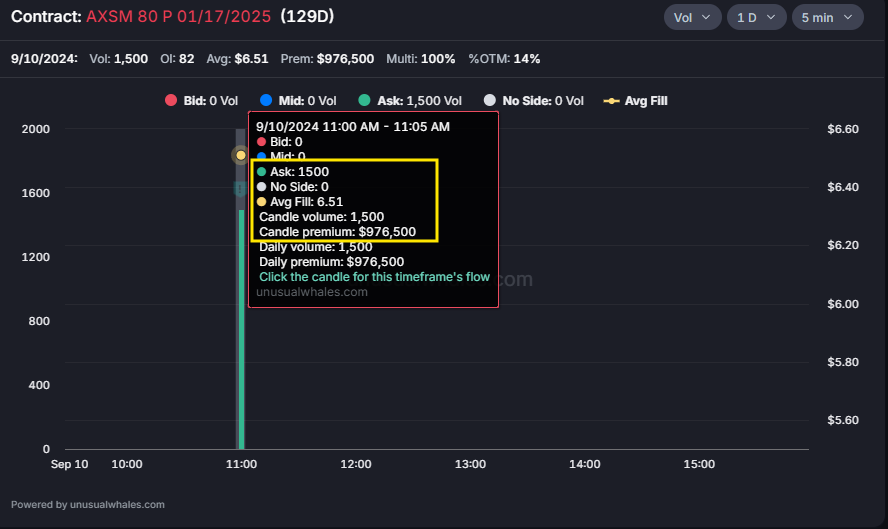

AXSM 0.00%↑ 80P-50P Debit Spread 01/17/2025 Exp.

This Whale is bearish on the stock and placed a multi-leg trade with 1.5k contracts of the 80P for $976,500 BTO and 1.5k contracts of the 50P STO for $151,500. The trader paid $5.5 x 100 per contract and a total premium of $825,000 on the trade.

A clear level of historical resistance being shown on the weekly chart, Mr. Whale has placed his wager. Axsome Therapeutics has never reacted well to this mark of 98 and we see the flow telling us that someone is fairly confident that the end result will ultimately be the same this go around. For what it’s worth, last time Axsome tested this level, we saw a -30% decrease over the course of the following four weeks.

JPM 0.00%↑ 185P STO 10/18 Exp.

Vol: 11,248 OI: 1,506 Avg: $2.51 Prem: $2,820,998

This Whale is placing a bullish bet on the stock after trading 10k contracts at the Bid, paying over $2.5 million. Shares in JPMorgan Chase shares slid 6.7% in recent Tuesday trading after Chief Operating Officer Daniel Pinto said that expectations for its 2025 net interest income "are a bit too high," according to a Capital IQ transcript. "That is not very reasonable because the rate expectation is lower by 250 basis points. So I think that, that number will be lower," Pinto said, according to the transcript. "We are not going to guide on that now, but the $90 billion is a bit too high." Said Pinto at the Barclays annual financial services conference.

Placing his wager at a relatively pivotal spot, JPM manages to hold previous resistance levels as current support with today’s action seemingly being a failed breakdown of this 205 mark while testing 200. Also shown is a trendline from 2023 October’s lows which rarely gets tested. It did today, and held. Likely an overreaction wager as the stock leaked for a majority of the day but finds some bidders into the end of the session, a top bank such as JPM could show resilience in coming days.

NXT 0.00%↑ 40C BTO & 30P STO Bullish Risk Reversal 02/21/2025 Exp.

This trader speculates that the stock price will go up and volatility will increase or remain the same. Selling 1,500 contracts of the 30P on credit and using that credit to buy 1,500 contracts of the 40C. This trader will need the stock price above $40 by 02/21/2025 to have a positive PnL. Additionally, another 800 contracts of the 40C were traded at the Ask for a total cost of $258k. The stock had its highest options volume today in the past 30 days.

To pair with this information, NXT is currently down ~47% from the all-time-highs marked in June of this year. Not much historical price action to look at here as it is all shown on the chart below, yet we find a somewhat supportive zone in the low 30’s. Likely a bet on the upcoming earnings report for a volatile catalyst to propel this asset back to highs, Mr. Whale is attempting to catch this knife.

Meanwhile, the S&P500 looks to be putting in a massive hammer candle on the daily chart which is usually very bullish. However, it is important to note that we do have some key events this week that could bring more volatility to the markets (..yay). These events such as the presidential debate, tonight, as well as CPI tomorrow (the most important one of your lives, until the next one) can certainly shake things up. Stay safe out there folks.

If you enjoyed today’s article, likes are greatly appreciated.

Best Regards,

Kian, Jersace, & Jon