Level Up Your Business: Power Up with Solar Tech, Build an Ecommerce Empire, and Game Your Way to Tech Success!

Notable Flow 9/9

Mandatory Monday gap up? Palantir is the future? Few understand. Let’s get the week rolling as discounted purchases from weeks previous are likely paying bountiful gains amid today’s action. Enough rambling, here we go.

Notable Flow:

SAP 0.00%↑ 200P STO 10/18 Exp.

SHOP 0.00%↑ 70C STO 12/20 Exp.

RUN 0.00%↑ 20C 12 /20 Exp.

PLAY 0.00%↑ 30P STO 09/20 Exp.

SAP 0.00%↑ 200P STO 10/18 Exp.

Vol: 2,437 OI: 21 Avg: $2.21 Prem: $538,350

This Whale is placing a bullish bet by selling these puts. Almost 2.5k contracts were traded at the Bid within an hour of the market opening, causing a big decline in the put Net premium. This is the highest option volume that SAP 0.00%↑ has had in the past 30 days.

Over the past year, SAP’s stock has shown positive movement, primarily driven by its focus on cloud transformation and digitalization trends. Like many technology stocks, $SAP is influenced by broader market conditions, especially those affecting the technology sector, such as interest rate fluctuations and global economic trends.

Resting upon the 50DMA, Mr. Whale has chosen this was a good spot to sell itm puts as a bullish bet of a bounce here to reclaim that premium that has been juicing over recent sessions since losing this level previously. This level is essentially all-time-highs slightly over 4% up from here.

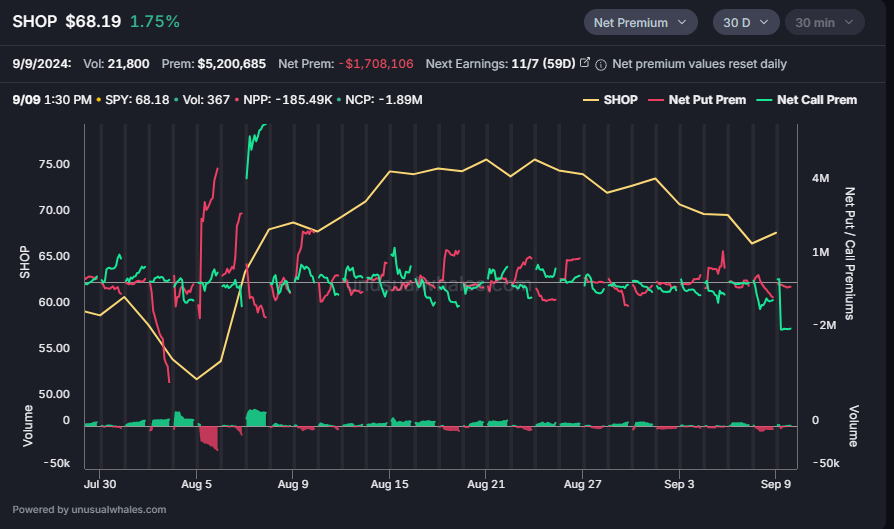

SHOP 0.00%↑ 70C STO 12/20 Exp.

Vol: 3,045 OI: 2,378 Avg: $6.80 Prem: $2,070,869

This Whale opened 3k contracts with a cost basis of $2 million on credit, making this a bearish trade. The chart below shows that the net call premium hit its lowest flows in the past 30 days at $1.9 million, while puts remained neutral.

Shopify’s stock has been highly volatile, particularly influenced by macroeconomic factors such as interest rates, inflation, and overall market sentiment towards growth stocks. It saw massive growth during the pandemic but also corrections as the e-commerce boom slowed down post-pandemic. Shopify has often been seen as overvalued by traditional valuation metrics (like Price-to-Earnings), given its aggressive growth strategy and market positioning.

Coming off a rounded top and the loss of major supportive moving averages such as the 200DMA, it bleeds lower into the 50DMA. A failure of holding this last significant moving average on the daily chart would trigger continued downside action as it would at that point trade below the 10/20/50/200 moving average’s. The white line displayed is a support line dating back to October ‘22 lows.

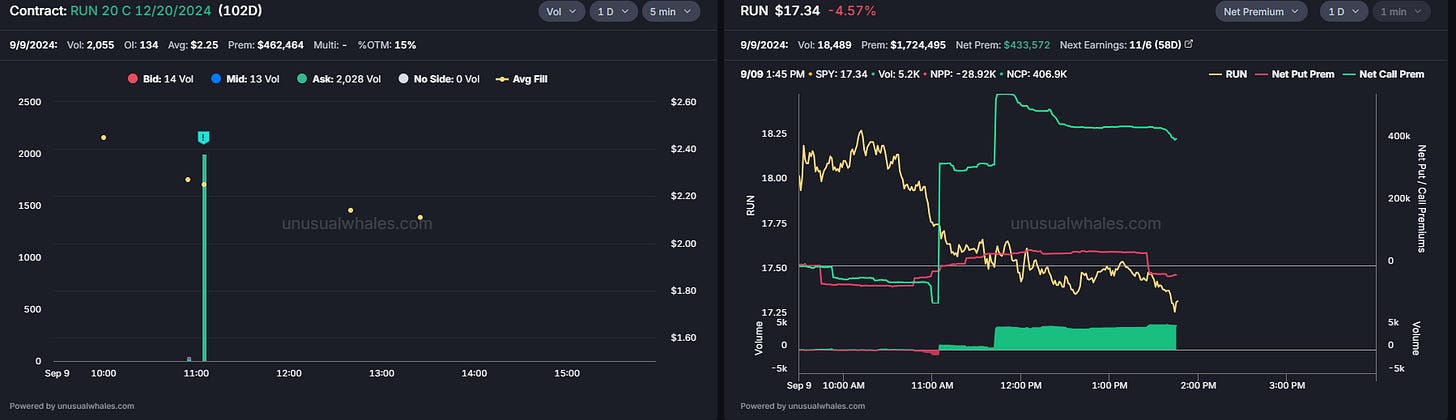

RUN 0.00%↑ 20C 12/20 Exp.

Vol: 2,055 OI: 134 Avg: $2.25 Prem: $462,464

This trader opened 2k contracts with a $450k cost basis, speculating that the stock price will go up and placing a bet with calls that are 15% OTM. The stock has dropped 20% in the past couple of weeks, mainly following the big tech selloff. But let’s not forget that it had a run of +50% in August after the company announced its 2024 Q2 Earnings. The company released great numbers that motivated investors, announcing a cash generation of $217 million in Q2, introducing a cash generation guidance of $350 million to $600 million in 2025, and reiterating cash generation guidance of $50 million to $125 million in 2024 Q4.

PLAY 0.00%↑ 30P STO 09/20 Exp.

Vol: 20,659 OI: 550 Avg: $1.85 Prem: $3,817,175

This trader is placing a bullish trade by selling puts to open. Over 20k contracts were traded at the Bid with a cost of almost $3.7 million. This is the highest options volume that the stock has had in the past 60 days.

The company will report earnings for its 2024 Q2 on September 10 at 4:05 PM ET. Investors expect an EPS of $0.842 and Revenue of $560.646 million.

My parents always told me not to run with scissors, but failed to mention anything about catching knives. Apparently, Mr. Whale is in the same boat as he attempts to catch this falling knife on the daily chart off the 50DMA. Currently trading just below this mark at the time of writing, a daily close above would be ideal for his positioning otherwise could test lower levels of support before turning back to the upside.

Quick, short, sweet, and to the point. My wife hates it, but surely you all love it. Thanks for tuning in for today’s read, I hope you all enjoyed it as much as we did writing it. As always, let us know if there is anything we can provide in regards to improving the substack and likes are always appreciated.

Take Care,