Morning🪵: Megflation. Mega Millions Goes from $2 to $5 Next Year—Because Losing More, Faster, is Better.

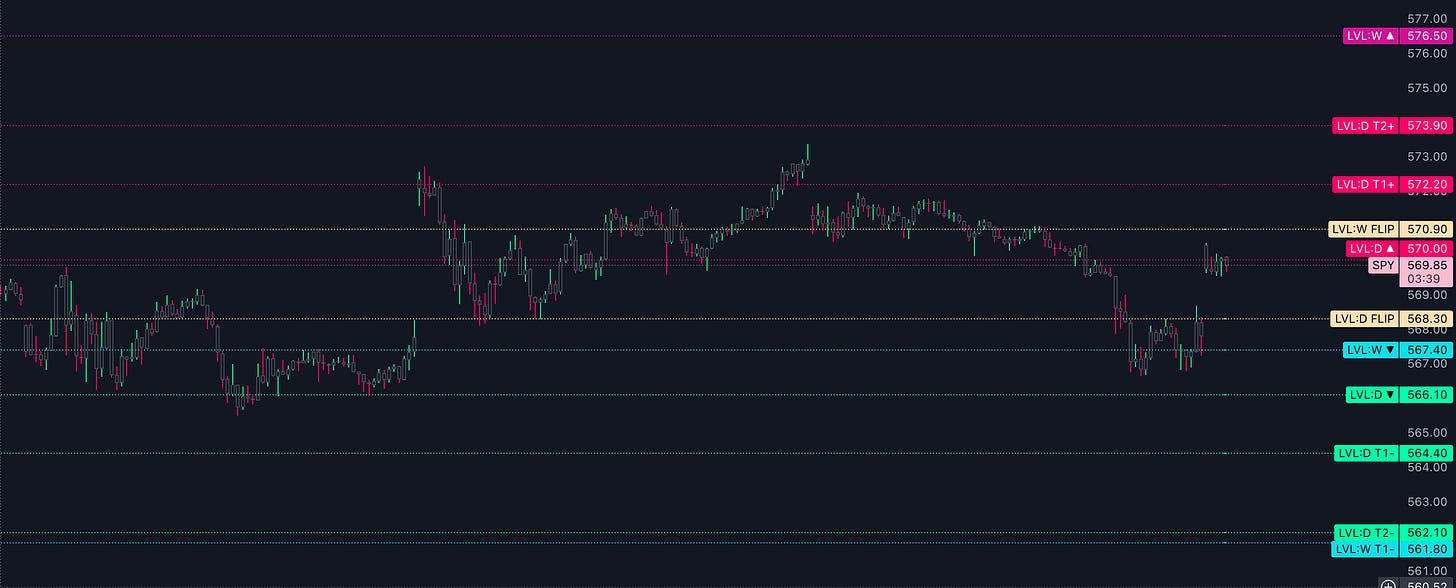

SPY / SPX / QQQ Key Levels: Tuesday 10/8/24

Higher Cost, Same Odds—More Ways to Burn Cash on That Afternoon FourLoko run.

NOTE: D = Daily. W = Weekly. FLIPs = key decision points for direction

Adding pivots / volume to the charts

Plan the trade, trade the plan.

Daily SPY

Decision point rests at $568.30

Looking for calls over $570.00 with $572.20 and $573.90 trims

Looking for puts below $566.10 with $564.40 and $562.10 trims

Swing ideas:

Price remains near the Weekly ▼ at $567.40.

If price moves above $570.90 (W FLIP), expect potential moves toward $576.50 (W ▲).

If price continues below $567.40, targets are $561.80 (W T1-) and $558.30 (W T2-).

Daily SPX

Decision point rests at $5,702.90

Looking for calls over $5,719.00 with $5,741.90 and $5,758.00 trims

Looking for puts below $5,679.90 with $5,663.90 and $5,640.90 trims

Swing ideas:

SPX is trading near the Weekly ▼ at $5,695.10.

If price rises above $5,730.10 (W FLIP), look for a move toward $5,786.20 (W ▲).

If it breaks below $5,695.10, watch for support at $5,639.00 (W T1-).

Daily QQQ

Decision point rests at $483.60

Looking for calls over $485.30 with $486.20 and $488.00 trims

Looking for puts below $482.70 with $481.00 and $480.00 trims

Swing ideas:

Price is close to the Weekly FLIP at $484.40.

A move above this level could target $491.40 (W ▲).

A drop below $480.40 (W ▼) may aim for $473.40 (W T1-).