Puts for Sale: Traders Betting the Farm or Just Mowing the Lawn?

Notable Flow 9/18

Was FOMC everything you ever hoped it would be? Did you blow up your portfolio in one session gambling on the first, second, or third move? Chat, is this move fake or real? If the answer to any of these questions was yes, please seek help. Anyways, let’s take a look at the basket —

Notable Flow:

CRDO 0.00%↑ 30C 11/15 Exp.

DDOG 0.00%↑ 97P STO 11/01 Exp.

BABA 0.00%↑ 90P STO 04/17/2025 Exp.

BSX 0.00%↑ 76P STO 11/01 Exp.

CRDO 0.00%↑ 30C 11/15 Exp.

Vol: 3,252 OI: 629 Avg: $1.60 Prem: $518,971

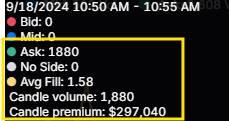

This Whale traded 1.8k contracts at the Ask, paying $297k. Additionally, the chain got more volume, with most contracts traded at the Ask but some Mid and Bid action. The Net premium chart favors calls, but we must double-check how much of that volume sticks to the OI when it updates in tomorrow’s pre-market.

Credo Technology provides high-speed connectivity solutions for data centers, networking, and telecommunications. Analysts maintain a consensus "Moderate Buy" rating, with a price target of $34.00 which is just above our whale’s chosen strike of 30. After a failed breakout of the nearest resistance around 28.70, it has pulled back towards the 10DMA. This could help give some support in this sort of limbo range while it attempts another break of the aforementioned resistance triggering further upside. I would also like to point out that it is nearing the lower half of the STD range which also tends to be favorable for a bounce.

DDOG 0.00%↑ 97P STO 11/01 Exp.

Vol: 5,301 OI: 4 Avg: $1.13 Prem: $599,015

This trader is placing a bullish bet, selling 5.3k contracts of these puts on credit. The Bid action and drop in the put net premium make us speculate that the position is being sold and not bought; since OI is only 4, we can almost be certain that the contracts are being opened and not closed. The Whale is betting that the stock will trade above $97 by expiration.

Seems like we are catching a decent bit of tech based names lately as most of them have seen quite a sizable pullback from the recent highs in the broader market although we have just made another.

In a downtrend from the start of July, DataDog has lost ~16% in stock value but seems to have formed somewhat of a base in recent sessions. Most notably the stock seemed to have bottomed of that major drop on August 5th just above the chosen strike, 97. Positioned about 15% OTM, this can be looked at as a good way to collect premiums while the stock has plenty of cushion in both directions. A peak above this downtrend trendline would give us immediate targets of 115 (50d), 117 & 121.

BABA 0.00%↑ 90P STO 04/17/2025 Exp.

Vol: 2,000 OI: 376 Avg: $10.03 Prem: $2,006,336

This call seller is placing a bullish bet by selling 2k contracts of ITM puts on credit. This is a riskier bet than selling OTM puts, but it could also indicate conviction since the contracts have time. The stock is now trading at around $84; this Whale needs the stock price to go above $90 by expiration so the put can expire worthless, and the seller keeps the premium collected from the sale. Selling a 90-strike in this scenario reflects a belief that the stock price will recover or stay stable near that strike price.

After nearly a 20% rally in the e-commerce asset, this whale is looking for continuation as it tests the downtrend from mid July ‘22. In recent attempts however, the stock lost 5.5% & 20% respectively. To his credit however, a pop of this trendline could warrant anywhere from 10-25% upside into resistance levels shown below. Supportive moving averages, flow, potential breakout candidate, and a lovely writeup!

BSX 0.00%↑ 76P STO 11/01 Exp.

Vol: 6,831 OI: - Avg: $0.84 Prem: $573,799

This is another flow where the Whales are selling puts for credit. In this case, the strike is 8% OTM, which is below the stock price, making it a safer bet than selling ITM puts. This Whale traded 6.83k contracts at the Bid for a total credit of almost $574k, causing the net put premium to spike toward the downside.

After rallying 17% from August 5th lows, it saw a small and healthy pullback of 2% into the 20DMA. Currently just below the 10d but seeing healthy action across the sector/industry, BSX 0.00%↑ seems like a potential leader. The company recently announced the acquisition of Silk Road Medical for $1.1 billion, enhancing its portfolio with products designed to prevent strokes in patients with carotid artery disease. Strong name, resiliency, and flow makeup a typical winner. However, time will tell.

Thanks for joining us today in our FOMC-Flow pull. We hope you guys had a great day truly and enjoyed reading our article as we appreciate it each day. Give us a like if you found it useful and the chat is open to subscribers for any questions/suggestions. Tomorrow we will have a special guest to talk about his thoughts on the Fed’s decision today so it should be an info-packed article!

All the best,

Kian, Jersace, & Jon