Quick Look

Week Ahead

Good morning everybody, writing to you from the lounge at the airport. I want to put out a weekend letter this week given the recent action across the markets there is plenty to be discussed. For starters, the noise has gotten got quite loud on both ends of the spectrum with people calling for a bubble burst on one hand and others calling for a Santa Rally to 7000 SPX by year end / everything is normal / nothing ever happens. While there is merit to both arguments, it’s important to recognize what has happened previous and what is shaping up to happen again. In April we saw the market have tremendous downside as a kneejerk reaction to the infamous tariff chart sending the broader market into a steep decline / plunge. Shortly thereafter with some chop along the way, we had a snapback rally into new highs while securing trade deals with many of the affected trade partners as well as positive developments among major trade partners such as China whom we have not secured a deal with at this time.

The headlines are still essentially he said she said at this rate in regards to Trump / Xi - while we are being told that the conversations are going well and that a meeting between the two will be held in the coming weeks. Looking at the overall market, things still look decent. Plenty of names needed to be corrected / come back to reality / reset for further upside. The lucrative gap & go theme on many of these shitco’s / higher beta names was of course not only not sustainable but a bit over done in many regards. Now looking at these charts, again, I see them setting up for more opportunity going forward (this is healthy).

Everybody wants a pullback, until they get one…

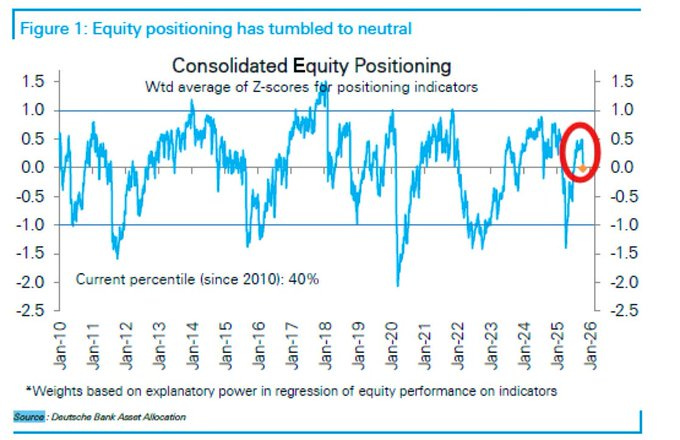

Over the past two weeks, the broader market saw just over a -3% decline into the 50D SMA / 10wk SMA and net equity positioning has already returned to neutral with the fear & greed index in the mid 20’s.

Since that test of the 50D, we’ve already had a ~1.7% move back towards highs on spooz. While it has been ugly / choppy, many names under the hood are looking to go again as I mentioned before.

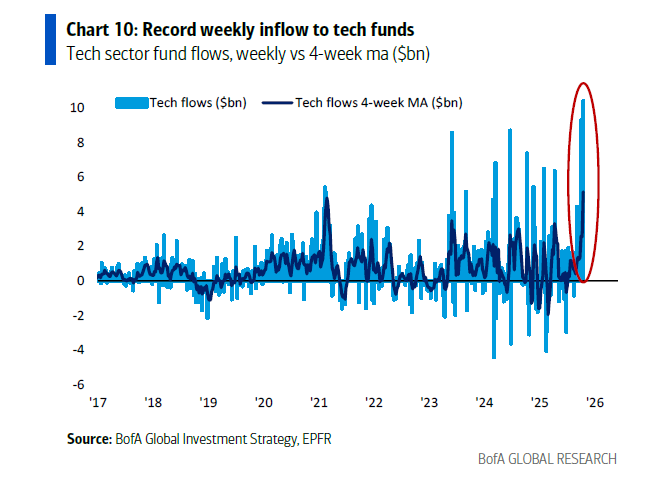

Bank of America had this to say “Tech Stocks just saw a weekly inflow of more than $10 Billion, the largest in history”…

Some headlines from Friday:

*TRUMP, ASKED IF HIGH CHINA TARIFFS WILL STAND: NO

*TRUMP: I THINK WE’LL BE FINE WITH CHINA

*U.S. President Donald Trump confirmed Friday he will meet Chinese President Xi Jinping in two weeks.

This brings me to my next point, being China assets. As I had teed this up earlier, this is an eerily similar playbook to what we saw back in April. The post Liberation Day rally has provided not only investors, but traders alike, a tremendous gain on the year and given folks plenty to be happy with while easing into year end in anticipation of a bigger correction / bubble burst as many are calling for.

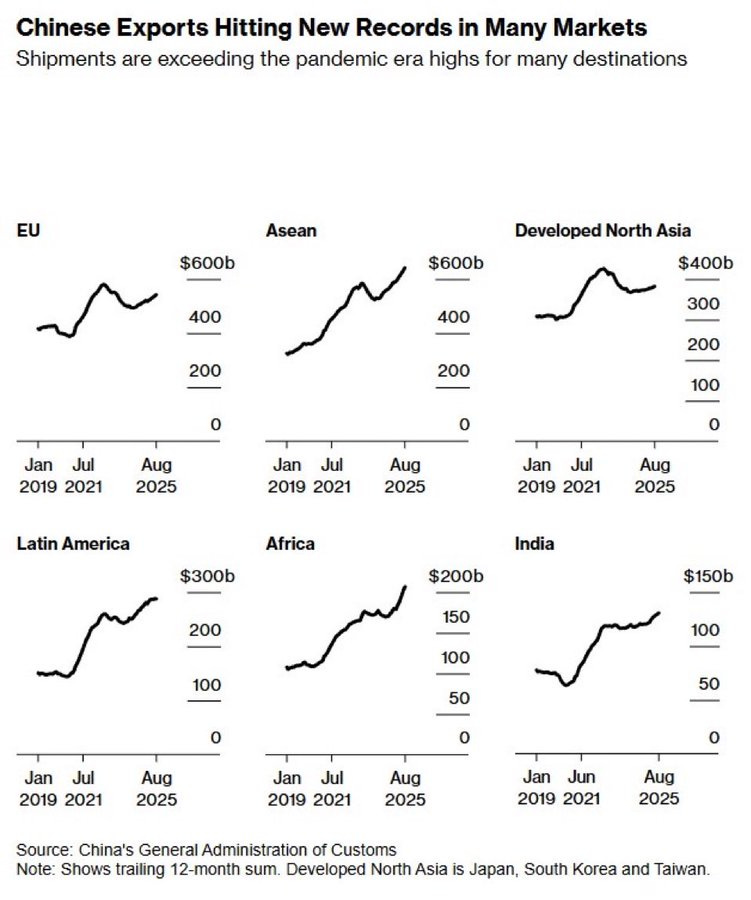

As shown above - China has essentially benefit from this entire mess with exports steadily increasing to this point rather than declining. We also have to remember the man in the office is quite vocal about his reputation and has upcoming midterms. It would shock me if this was not resolved before then to help boast his approval ratings and ultimately assist him / republicans in the upcoming midterms. Something’s got a to give as is per usual in all negotiations in business and it will most likely be worth the concession to maintain a healthy relationship with a major trade partner going forward.

Not too concerned with the credit / banking fears personally…

We had XLF retest previous ATH’s and hold following the credit / banking snafu we saw earlier in the previous week while also testing the bottom of the weekly standard deviation chain. In April, as shown above, we saw this band break undercutting the 50wk before snapping back and continuing with our regularly scheduled programming to where we are now. Not to beat a dead horse here, but the theme is very similar while shaping up to hold up better than the former reaction.

Things under the hood look GOOD - not great, but GOOD. Moving on…

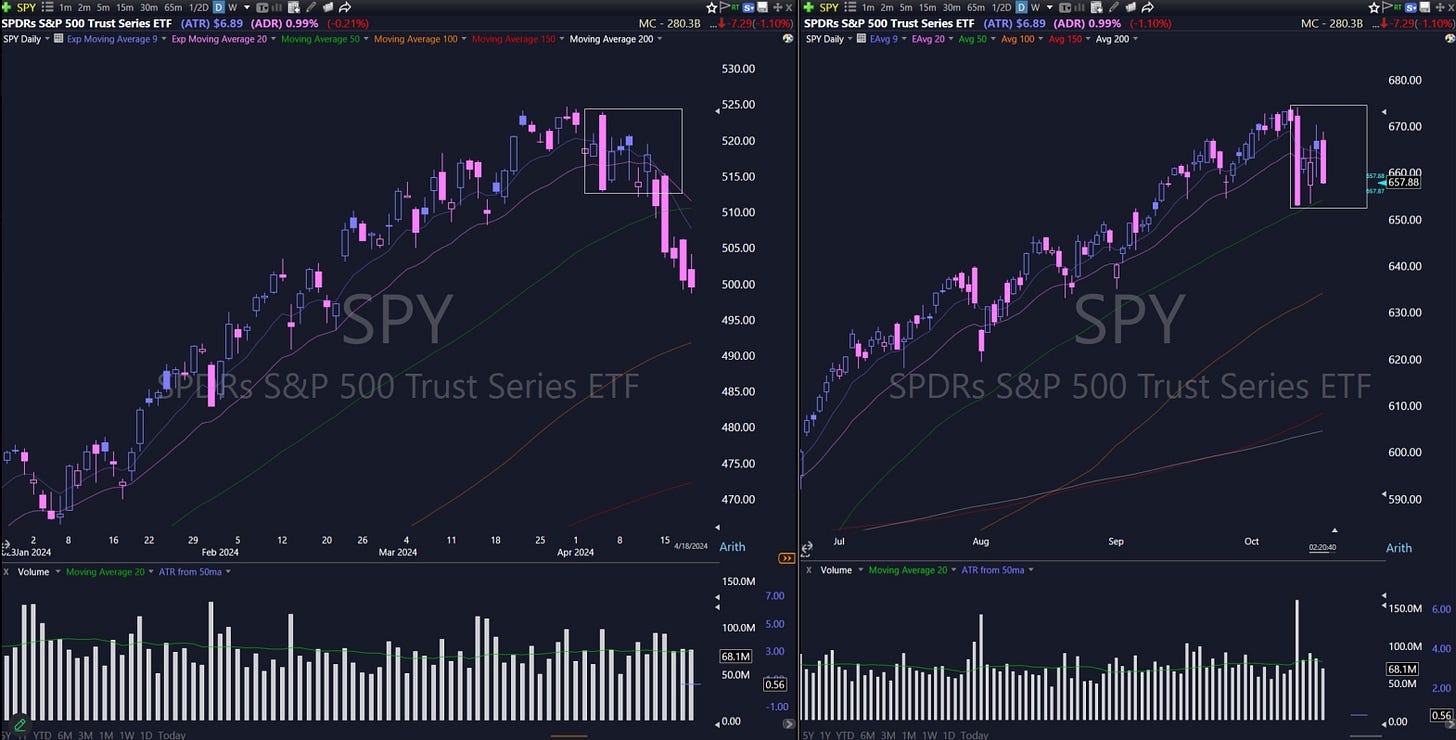

The indices, again, have a similar look to April, shown below.

SPY

Pulled this comparison from a colleague of mine, Bracco. Bracco has a keen eye when it comes to setups and market conditions alike. I am going to go ahead and get ahead of the “but you said” crowd in regards to what happens next in the chart on the left back in April as I’d like to note that while this is the same playbook, conditions and sentiment is entirely different in Liberation pt. 2. This comparison was also made on the 16th of October, and we saw those previously mentioned headlines a day later boosting sentiment / easing greater fears into the weekend.

While rejecting the daily 10 / 20D SMA’s, we also remained to bid off the 10wk / bottom STD channel (daily). Nothing is for certain, but things are looking up and I imagine it will remain as such. Higher.

Responsibly - additional cash on hand, smaller sized positions, and cushion is the way forward until things become more clear / less murky. Worth pointing out that we also have CPI this upcoming Friday.

QQQ

Similar story here as Spooz in regards to current standing here on the Q’s yet they closed above the 10/20D SMA’s.

Now this, this is worth recognizing. Money is still flowing into the market evidently and it seems as many investors are not flinching.

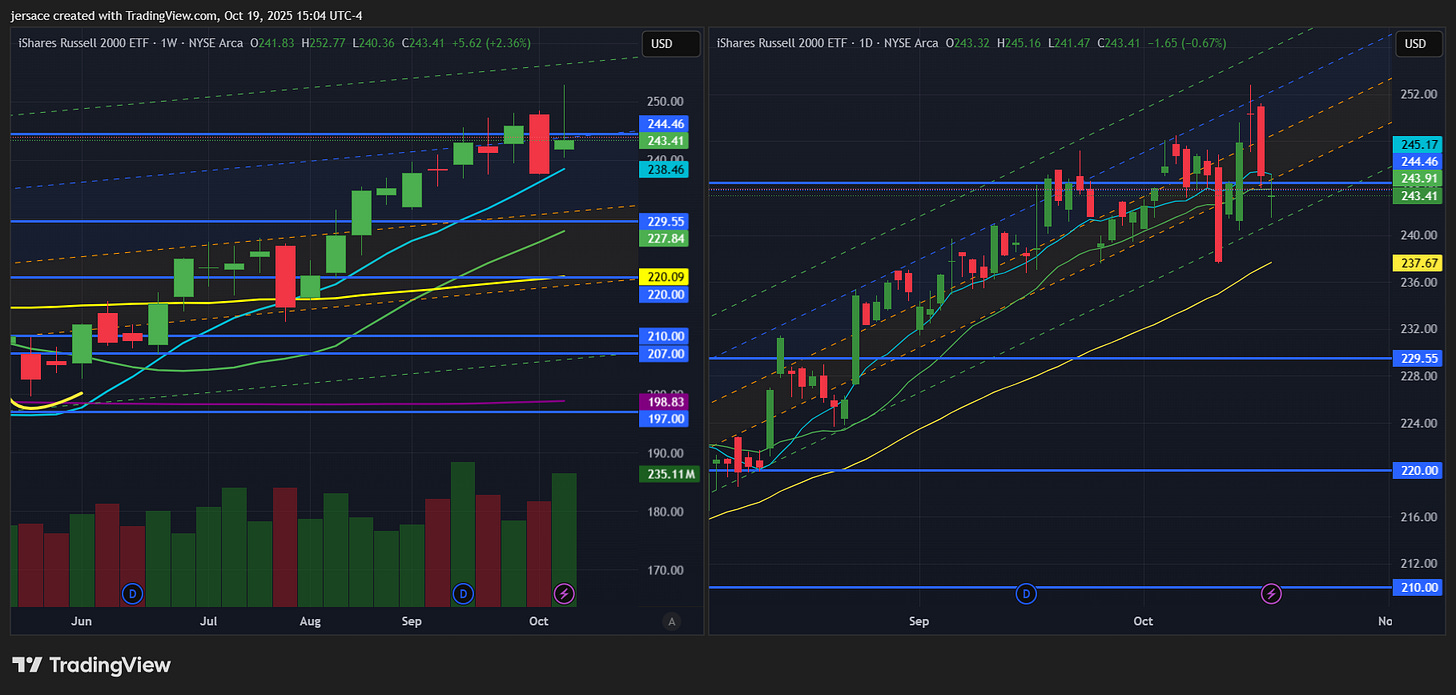

IWM

Feels like the entire world is waiting for this breakout. Pretty nasty weekly close below the mark and we’ve got another two weeks before the end of October. A monthly close above 250 would likely solidify this breakout. Plenty of fun to be had in small caps if this decides to go.

BTC

All in all pretty constructive move on Bitcoin with a daily candle triggering upside pivot. A move towards upper teens will present us with a great deal of sellers once again, yet a hot market this week paired with any positive resolve with China & this see’s new highs, quickly.

Not going to do any flow today as I’m sure there will be a lot to unpack during tomorrows session, but let’s take a look at some setups I’m eyeing for this week and into year end.

TSLA

Nice consolidation here allowing the asset to cool off after the relatively recent explosive breakout from 360 with the moving averages catching up. Been a bit choppy alongside the rest of the market and we’ve got earnings this week. Could be some fireworks.

PLTR

Nice high and tight weekly flag on PLTR here just grinding higher.

CLS

Nice flat top daily breakout on this name - can play this either way as a trading vehicle for quick gains long / short targeting 300 long side and retest ~260 downside depending on the broader market strength.

XOM

Energy demand ramping again / name has been sideways all year long / next leg up feels imminent here.

ISRG

Love this chart for good value / defined risk / tight leash. Pretty clear we’ve got support just below us ~435.50 heading into earnings which could boost this back into the recent balance of $500/share. Will be looking for flow on this one certainly.

Buying names of support has been working considerably better than buying breakouts the last couple weeks so here’s another for you to keep an eye on.

BE

Another fun trading vehicle for short term scalps / day trades dependent on broader market strength is BE. This name moves a ton and catch some pretty sick moves on weekly contracts for some quick hits. Any meaningful dip on this should probably be bid until the theme breaks.

SMH

Semi’s should be a top watch going forward given this flat top base here ready to go for a blue skies breakout. Paired with this, ARM has been a great swing providing quick profits in overnight sessions and even some nice moves during regular hours.

ARM closed just above the breakout level giving it yet another backtest on this race to 200.

That’s all for today, just wanted to put something out to get the bells and whistles moving around before we jump back into things later tonight with futures / market open tomorrow morning. Feel free to jump in the chat and discuss other ideas / any of these presented today with questions, thoughts, concerns.

If you enjoyed the article, likes and comments are greatly appreciated. Feel free to share the publication with anyone you may think would be interested in us.

Cheers,

Jersace.