Rollercoasters & Revisions

Notable Flow 8/21

Bear Market! Bull Market! Bear Market! Bull Market!

Ladies Ladies Ladies. It’s just the market. Breathe in, breathe out. Seemingly a scalpers wet dream today as there has been a ton of action in both directions with NFP data, chopping again leading into J-Hole this Friday. The S&P500 has traded in a 50 point range for the last two sessions gearing both sides up for a larger move.

I’d like to say congratulations to all the degens out there who took a gamble on GDS 0.00%↑ earnings as the stock is up 18% off the report. GG’s.

Anyhow, let’s dive in.

Notable Flow:

UAL 0.00%↑ Bearish Risk Reversal 47C STO & 42P BTO 01/17/2025 Exp.

ABT 0.00%↑ Bullish Risk Reversal 105P STO & 115C BTO 10/18 Exp.

WYNN 0.00%↑ 80C 11/15 Exp.

JD 0.00%↑ 30C 12/20 Exp.

CRC 0.00%↑ 55C 12/20 Exp.

MSFT 0.00%↑ 445C STO 09/20 Exp.

UAL 0.00%↑ Bearish Risk Reversal 47C STO & 42P BTO

Selling the 47C for $888k and buying the 42P puts for $1.31M. 3.3k contracts on both

This Whale is speculating that the price of the stock will decline and volatility will remain flat or increase. The Trader is receiving a credit for selling the 47C and is using that credit to buy the 42P. If the price of the stock remains between 47 and 42 the trade will be at even, if it goes above 47 it will be unprofitable, and if it goes below 42 it will be profitable.

When taking a look at the Net Premium chart below, we can observe a spike in the put side and a decline in the call side. Which means that more puts are being bought than sold and more calls are being sold than opened.

Judging by the chart, it appears as though the whale is seeing a look above and fail of upside triggers paired with declining moving averages seeking lower. A weekly close below the trendline drawn could accelerate the downside action making the wager profitable as previously mentioned.

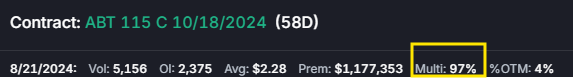

ABT 0.00%↑ Bullish Risk Reversal 105P STO & 115C BT

Selling the 105 put for over $420k and buying the 115 call for $906k. 5k contracts on both

Another Risk Reversal trade but this time bullish, the Whales are expecting the price of the stock to go above 115.

We are able to identify these trades by using the Unusual Whales software and looking at the multi-leg %.

Afterwards, we have to find the relation between both trades. In this case we saw the amount of contracts being roughly over 5k on both trades while no other trades on this stock had any comparable volume.

Nice move off the 200D so far as it pushes into this flat top resistance at 112. A break above can trap shorts and bring forth chasing buyers to warrant more upside volume. Being a prominent player in the healthcare sector, Abbott Laboratories remains a solid choice for investors seeking exposure. Two months until expiry, and essentially ATM (at the money), this is one of the seemingly “safer” bets we have noted.

WYNN 0.00%↑ 80C 11/15 Exp

Vol: 2,182 OI: 254 Avg: $3.86 Prem: $842,757

Whales are opening a new position with volume surpassing OI by almost 10x. Looking at the Net Premium chart (right) it seems like most of the action today favored the Call side.

As of August 2024, the company's stock performance reflects both its strong market position and the challenges it faces, particularly in the Asian market. Their operations in Macau have warranted some worry for investors and challenges for their valuation, but recently has reported a solid Q2 performance with revenue growth driven from their operations in Macau. Struggles and rebounds folks.

Decent upside outlook from here as it has taken a beating YTD while Mr. Whale looks to catch some upwards momentum.

JD 0.00%↑ 30C 12/20 Exp.

Vol: 11,291 OI: 3,572 Avg: $1.40 Prem: $1,580,238

Whales are buying into the selloff today, after the stocked dropped 6% due to Walmart selling a $3.74 billion stake.

There is a lot of volume in this Options’ chain as well as others due to the volatility driven by the news. However, there are two particular trades in this chain that caught our eyes. Below we can see 2.7k contracts traded at the Ask between 10:50 AM - 10:55 AM ET and 3.7k contracts traded at the Ask between 12:15 PM - 12:20 PM ET.

From looking at the weekly chart, we can see how much upside potential resides here with a break of this long term trendline from ATH’s. The stock saw heavy selling pressure in after hours yesterday because of the announcement from Walmart as stated above which sought out new and pre-existing buyers looking for a discount. JD announced a buyback this morning as a rebuttal to this news which powered the stock to regain some of those losses in today’s session.

CRC 0.00%↑ 55C 12/20 Exp.

Vol: 3,003 OI: 430 Avg: $2.50 Prem: $749,699

This trader opened about 2.5k contracts paying close to $640k for this position, accounting for almost all the daily volume.

The chart below is showing us that today the stock had its highest Options volume in the past 90 days.

Another nice bet here as the daily session pushes into the 200 daily moving average just below the shown trendline acting as an upside trigger into a level of resistance of 55. Supportive moving averages of 10/20/50 all curling up giving the stock a good bit of help from below. If you decide to trade this, you can use these moving average’s as your defined risk on daily candle closes depending on how much lee-way you’d like to give.

The company focuses on producing low-carbon intensity oil and is also expanding into carbon capture and storage through its subsidiary, Carbon TerraVault. This aligns with its strategy to transition toward more sustainable energy solutions. CRC presents both opportunities and risks, particularly due to its involvement in the volatile energy sector and its ambitious carbon management initiatives.

MSFT 0.00%↑ 445C STO 09/20 Exp.

Vol: 10,880 OI: 6,594 Avg: $3.04 Prem: $3,303,249

Our Whale friend is taking a Bearish bet in the stock by selling these Calls. The Whale traded 10k contracts at the Bid which accounted for a $3 million position, making up for almost all the daily volume on this chain.

By looking at the drop in the Net Premium (right chart above) and Implied Volatility (below) we can assume that these Calls are being Sold To Open.

Interesting wager here as we trade above 5600 (SPX) about 60 handles from previous ATH’s while Microsoft is still ~10% away from their ATH’s. This is a massive bet. Quite possible that the reasoning is they believe the bounce from August 5th is fugazi and expect another pullback as the broader market nears ATH’s into Jackson Hole. Otherwise, they will just look to collect premiums while others place wagers for higher and new ATH’s into the event.

There is definitely some overhead resistance at 426 yet it holds this trendline from August 5th reclaiming all moving averages shown other than the 50. Worth noting that in today’s session, the 10MA has crossed over the 20MA to the upside. Good luck Mr. Whale.

Thanks for playing. We hope you guys have thoroughly enjoyed these posts as much as we have enjoyed writing them. It truly is a pleasure to assist others with the knowledge that we have obtained over the years along with the tools of incoming flow to create some thoughts circulating the everchanging day to day actions of the market. As always, if you enjoyed the read, likes are appreciated.

All the best,