Running of the Bulls

Notable Flow 8/19

Good afternoon people of the republic, today we have a mixed basket as each flow varies from sector to sector. Nonetheless, notable in many facets. The market overall today has been quite intriguing to kick off the week with a slow and steady grind up providing many multi % reversals after the morning dip.

As of this moment, we are over 500 points from recent lows on SPX providing what looks to be a complete and utter lockout rally favoring those who went shopping for discounts with many of the market leaders rallying over 20%.

We hope you enjoy reading this as much as we did writing it. Let’s get into it.

Notable Flow:

GCT 0.00%↑ 25C 1/17/2025 Exp

TDS 0.00%↑ 22.5C 09/20 Exp

UPST 0.00%↑ 45C 10/18 Exp

TERN 0.00%↑ 8C 9/20 Exp

PDD 0.00%↑ 157.5C 08/30 Exp

CENX 0.00%↑ 14/16 Call Debit Spread 1/17/2025 Exp

GCT 25C 1/17/2025 Exp

Vol: 2,952 OI: 1,332 Avg: $3.01 Prem: $889,870

Almost 3k in Volume added to this chain that already had 1.3k of Open Interest (OI) which should update tomorrow to somewhere around 4k.

Looking at the Net Premium chart we can see a spike on the call side while little to no activity to the put side.

Looking at the chart the stock has been consolidating in a $1 range between 22 support and 23.2 resistance, we can see a volume shelf building in that area creating a balance between buyers and sellers. The 8EMA is currently at 23.19 and its acting as resistance. Whales need a break above this 23.2 level for a potential retest to the 21EMA to see their contracts ITM (In The Money).

It is worth to note that the stock had a significant pullback from its March high to its August low with approximately a 50% drop which caused the 200EMA to trade above the 21 and 8 EMAs.

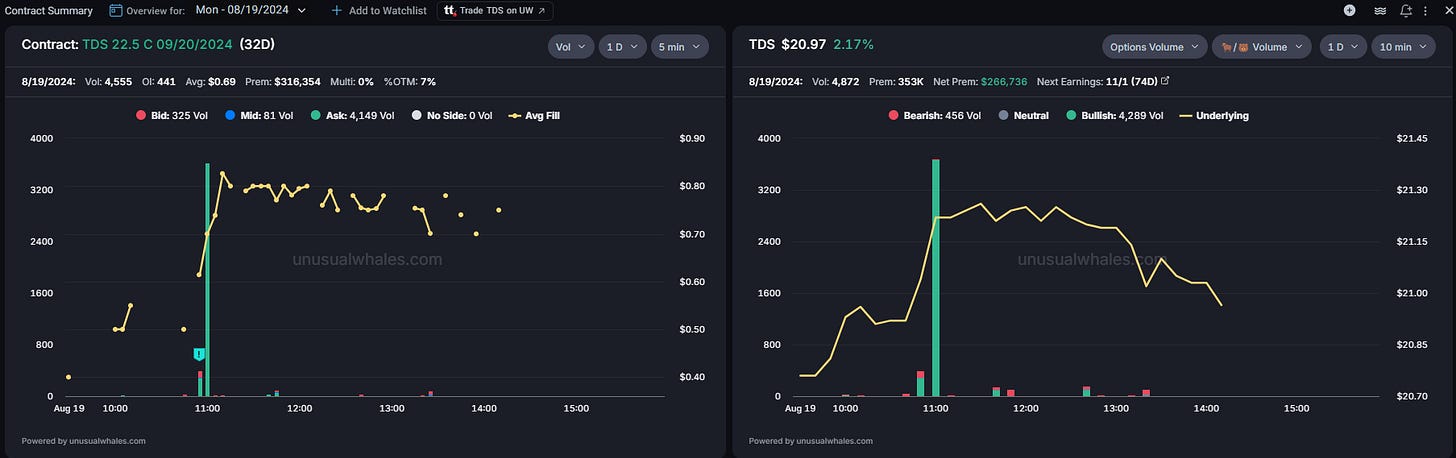

TDS 22.5C 09/20 Exp

Vol: 4,550 OI: 441 Avg: $0.69 Prem: $315,979

This is a name that rarely gets any short-dated call flow like this. It seems like a reckless bet but the reward could be great for the Whales if they are right.

When it comes the technicals, the stock found support close to the 200EMA after announcing strong Earnings on August 2nd with a 13% growth in their adjusted EBITDA compared to 2023 Q2. It is currently trading in a range between 19.9 and 21.3 creating a balance between buyers and sellers. Looking at the Volume Profile we can observe that the POC (point of control) is at 20.6 which is causing this fight between Bulls and Bears. The 50EMA is trading at 20.26 and it has been working as support, it is also worth pointing that the 8EMA and the 21EMA are touching each other. Since these Whales are bullish, they want to see the 8EMA trading above the 21EMA.

UPST 45C 10/18 Exp

Vol: 1,638 OI: 523 Avg: $2.86 Prem: $469,207

It looks like about 1.5k contracts are being added to the 523 OI to these calls that are 15% OTM but for extra confirmation we will check the OI update tomorrow before the market opens. It seems like the Whales are betting on the squeeze to continue.

The chart is showing us almost a 100% rally since the August low which was the same level from the May low. The stock is trading above the 8, 21, 50, and 200 EMAs. And on August 15th we had a 50/200 EMAs crossover. The stock is currently trading above 40 which was a support level back in December 2023. I bet our Whales will be pretty happy if the stock can retest the 49.62 high from December.

TERN 8C 9/20 Exp

Vol: 1,781 OI: 226 Avg: $1.95 Prem: $347,656

A name that barely gets any volume in options saw some unusual activity today. Researching a little further we found a catalyst that could explain this flow:

Top-line data from Phase 1 trial of TERN-601 (oral GLP-1) for obesity expected in September 2024.

Looking at the chart, the stock is trading above the 8EMA for the first time since July 26th, as well as the 21 EMA attempting to cross the above the 50 EMA for the first time since May. Additionally, buyers are creating an imbalance in the volume profile by taking the stock above the POC (point of control) at 7.51 and breaking the volume shelf aiming to take the price above 8.

PDD 157.5C 08/30 Exp

Vol: 5,230 OI: 144 Avg: $4.03 Prem: $2,106,405

The Whales are making a big bet here with short-dated calls believing that the squeeze on Chinese stocks will continue, it is a risky position but they could make a high return if they are right. With 45 minutes of the market left today 08/19 it seems like they are going to hold this position overnight.

The chart is showing us a 24% rally in the past 3 weeks, with a long-legged Doji candle forming on the daily chart and testing the 153 resistance level from January and June of this current year. For those who remember, this stock had an incredible run from April to May with almost a 50% rally, possibly our Whales friends are hoping for a similar upside move.

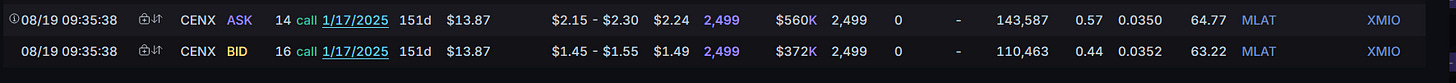

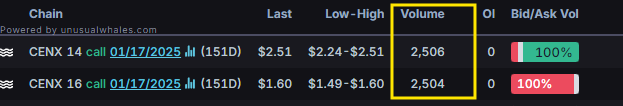

CENX 14/16 Call Debit Spread 1/17/2025 Exp

We were able to determine that the 14C was a multi-leg trade by looking at the “multi-leg %” tab in Unusual Whales.

Looking further based on the Ask action that the 14C were being bought and the 16C sold based on the Bid action. Both chains are showing 100% of multi-leg action by looking at the Volume and OI we can assume that this is the came trade.

The Whales will make a maximum of $1.25 x 100 ($125) if the contracts go ITM by the expiration date.

Looking at the chart we see that the stock is reclaiming the 200EMA and it is attempting to trade above the 21 EMA for the first time since July. If the Whales are right in their bet the stock should retest the 50EMA at around 15.35 and create a balance between buyers and sellers at the volume shelf that it is around the 17 level. They are playing it safe by adding time and using the Call Debit Spread strategy.

Alright, I’ve done enough rambling for the day. This should help guide you in a direction of confidence with the data points provided in hopes of making some extra weekend money. Maybe some extra cash to pay the utility bills as well. Speaking of utilities, pretty notable move on XLU today. Bags are packed. I would also be remiss if I didn’t say anything about Kian’s first born child, VKTX 0.00%↑ having itself an absolute day out of nowhere. Potential buyout inbound? Pfizer??? Time will tell.

Cheers and see you all tomorrow morning for the OI check.