Spray and Pray

Notable Flow 8/12

Good evening all and welcome back - going to cover a few things we saw come in today.

If you haven’t read our first substack, you can find that here.

Overall today was pretty boring in the market as indices chopped around for majority of the day with SPY 0.00%↑ closing pretty much flat on the day heading into PPI & CPI along with plenty of other data the following days.

However, bets are wagered. Let’s take a look.

Notable Flow:

ODD 0.00%↑ 30P STO 1/17/25 Exp

WHR 0.00%↑ 97.5C 9/20 Exp

CLSK 0.00%↑ 30C 9/20 Exp

ASPN 0.00%↑ 27.5C 1/17/25 Exp

CLF 0.00%↑ 16C BTO and 19C STO 1/17/25

This is conside/red a Bull Debit Spread

TAN 0.00%↑ 40C 8/16 Exp

SATS 0.00%↑ 19C 1/17/25 Exp

ODD 0.00%↑ 30P STO 1/17/25

Volume: 3876 OI: 53 Premium: $756,000 Fill: 1.95/Contract

This trade is notable being 21% out of the money and all at the bid. Aside from August 7th, there hasn’t been much option flow. Today was the third highest volume in about 30 days.

Betting on this name not seeing $30 anytime soon and continuing it’s bounce from the local low trendline after a pretty good earnings report last week (8/7) surprising estimates by 13.50%. The company reported strong financial results for Q2 2024, with revenue of $192.8 million, reflecting a 27% increase year-over-year.

WHR 0.00%↑ 97.5C 9/20 Exp

Volume: 2542 OI: 106 Premium: $431,000 Fill: 1.70/Contract

The main reason we are noting this flow standing out is because all of the volume in this contract was purchased in the last 10 minutes of today’s session as well as being 6% OTM. If we are looking at the top options chain, this is the most notable as well as far as the amount of volume seen.

Seeking Alpha reported rumors of a potential buyout by Robert Bosch, which briefly pushed this name higher, however these rumors have cooled since then. Although they have cooled off, this still indicates that Whirlpool might be undervalued at current levels given it’s low PE ratio compared to market average.

Declining moving averages with a decent bit of overhead resistance has me pondering what Mr. Whale see’s/knows. Only time will tell here.

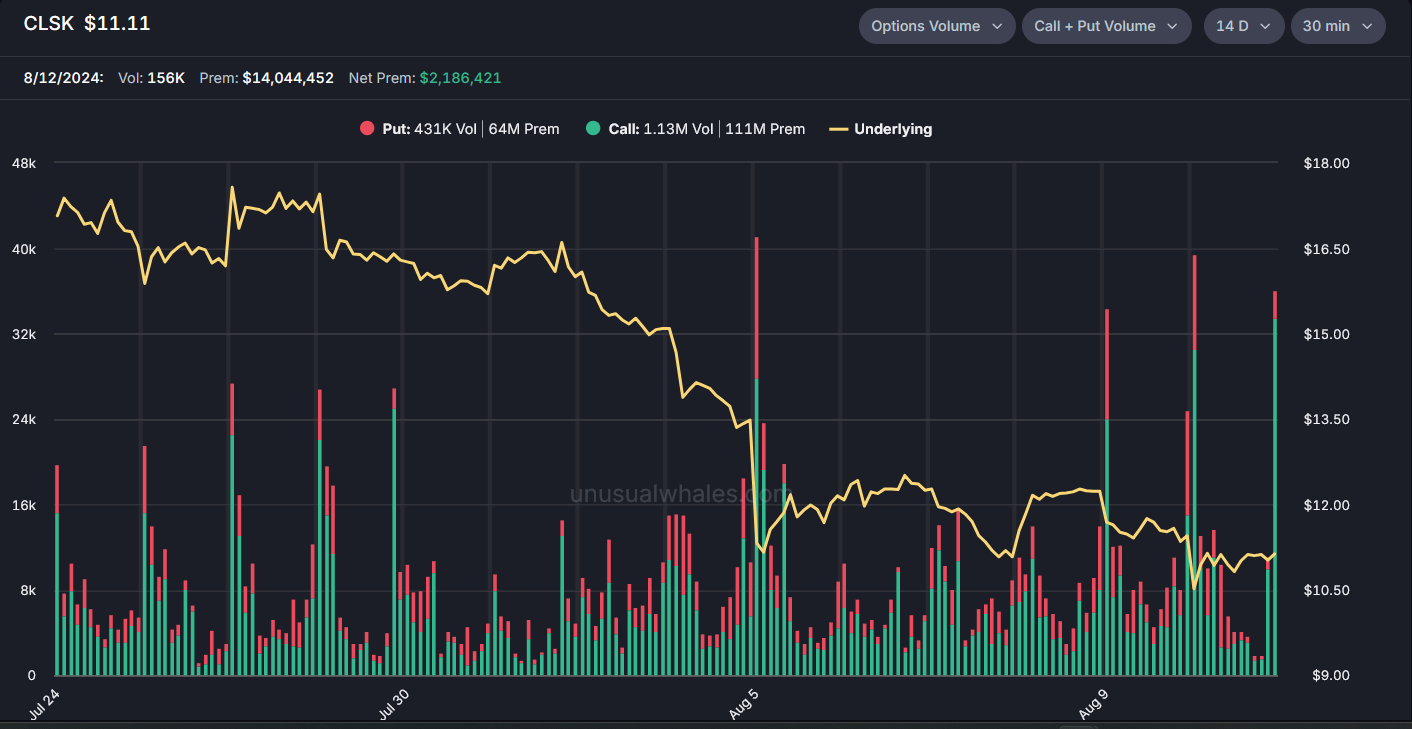

CLSK 0.00%↑ 30C 9/20 Exp

Volume: 20,800 OI: 18,828 Premium: $186,000 Fill: 0.09/Contract

Floor Trade - Traders who are on the floor of the stock exchange purchasing these derivatives for themselves. This doesn’t sound like much, but who is paying this amount of money for a contract 169% OTM with 39 days until expiration?

All $186k was purchased within the last 15 minutes of today’s session. The total call premium has been favoring the call side with 1.13M volume on call side vs. 431k volume on the put side.

Not much to note on this chart as it has essentially been range bound since February. There is great volatility that comes with these $BTC miners. While CleanSpark is growing its operational capacity by way of expanding its mining sites across the country, they face numerous challenges with meeting revenue expectations impacting investor sentiment.

ASPN 0.00%↑ 27.5C 1/17/25 Exp

Volume: 3093 OI: 9 Premium: $979,000 Fill: 3.17/Contract

Some notable factors here is that this is a 19% OTM trade with a put/call ratio of 0.08 and has $1.5M in call premium vs. $191k in put premium.

A very popular name on FinTwit the last few months is having its moment. After a significantly strong earnings report last week surprising estimates by 340%, the stock has gained just over 35% in value.

Aspen has strategically positioned itself within the growing EV market through its PyroThin thermal barriers which address challenges within lithium-ion batteries. Definitely one to keep an eye on going forward.

Top tier setup here on the weekly chart with a beauty Cup + Handle forming with tons of upside. The only notable moving average on the daily chart is the 50ma around 25 and change. Aspen had a great day in the market today rising 5.45% while the broader market traded nearly flat majority of the day.

CLF 0.00%↑ Bull Debit Spread - BTO 16C STO 19C 1/17/25 Exp

Size: 10,000 Premium: $390,000 Fill: 0.39/Contract

With the current stock price of 12.73, the buyer is expecting a 27% move or greater by expiration. We can also see that the stock currently has $2.45M in call premium vs $1.77M in put premium.

CLF 0.00%↑ being a prominent player in the steel industry has had quite the challenging 2024 thus far dropping roughly -35% YTD. Despite this decline, there is argument to be had for potential upside at current value presenting an opportunity for those willing to take the risk, such as Mr. Whale if the broader steel market stabilizes/improves.

I will say, it’s quite tough to make any sort of argument for this chart. Daily, weekly, monthly, all seem very poor as it slips lower and lower trading below the 10/20/50/200 moving averages on each of the aforementioned time frames.

Best of luck Mr. Whale.

TAN 0.00%↑ 40C 8/16 Exp

Volume: 17,500 OI: 1188 Premium: $1.1 Million Fill: 0.63/Contract

Before going any further, it is worth noting that this is a bet on PPI/CPI data in the coming days.

As shown above this is the 2nd highest options volume since July 15th. We can also see that there is $1.46M in call premium vs. $194k in put premium. Pretty nice size there.

Ah yes, the Solar ETF. Talk about a roller coaster - trading in roughly a 30% range both directions since October '23 warranting tons of potential gains to both sides. Right now the whale is taking his talents to the upside as he tries to bid support levels near lows in hopes the volatility goes their way. Obviously there are a multitude of various factors that go into trading an ETF (especially solar) such as the broader market view, specific developments, and global economic conditions.

SATS 0.00%↑ 19C 1/17/25 Exp

Volume: 1800 OI: 67 Premium: $281,000 Fill: 1.56

This play is 23% OTM and is the 2nd highest options volume day in the last 30 days. Notable, innit?

EchoStar Corporation recently released its Q2 ‘24 financial results which were disappointing to say the least missing estimates by a significant margin of ~187%. Revenue’s dropped by -9.3% YoY to $3.95 Billion facing notable challenges with their subscriber base.

I imagine that Mr. Whale is a big Black Friday shopper looking for discounts as he bought the dip post earnings after seeing approx. a -16.6% fall & -23% by today’s closing bell. The stock found buyers once it broke below the 200 daily moving average reclaiming the level (15.16) and closing above (15.50). It’s also worth noting that the strike chosen is relatively the same price as the current 10 DMA.

Value play? Chapter 11 Bankruptcy? Nothing burger? Bottom Fishing? I want answers!

That just wraps it up for today folks. We’ll be back tomorrow to check on Mr. Whale(s). If you have any questions or anything you’d like to see going forward, leave a comment below. If you enjoyed the article, likes are always appreciated. Carry on and enjoy your night.

Best Regards,