Stuck Together: How Managed Health Care, Banks, Duct Tape, and Metals Are Binding the Future

Notable Flow 9/19

Hello all—today, we will be joined by Eliant Capital to discuss the highlights and takeaways he gathered from yesterday’s FOMC before jumping into today’s notable flow. Eliant is well versed in all things market and will provide you with top-tier information and insights on the matter.

In reviewing yesterday, for starters, I included some key statements from Powell that stuck out to me personally below from yesterday:

FED'S POWELL: NO ONE SHOULD LOOK AT TODAY AND THINK THIS IS THE NEW PACE. (We cut 50bps today, but that doesn’t mean this is a standard moving forward).

FED'S POWELL: WE CAN GO QUICKER OR SLOWER, OR PAUSE, ON RATE CUTS IF IT IS APPROPRIATE. (The Fed will adapt as they go to data but has no set-in-stone guide or outlook.)

FED'S POWELL: FED PROJECTIONS ARE BASELINE PROJECTIONS; ACTUAL THINGS WE DO DEPEND ON HOW THE ECONOMY EVOLVES. (Fed’s decisions from here on out will remain dependent on economic data… essentially whether or not the labor market remains strong & or weakens).

The main takeaway is that the Fed will closely be watching every datapoint / remaining data dependent & will allow that to guide their future decisions. Part of the negative reaction from yesterday likely derived from the uncertainty arising given there is no set in stone guide in regard to what the next Fed cut / decision will be from here on out, but as we see today, the markets up massively… stocks / commodities etc… How come?

I included some comments from Powell on the economy below:

FED'S POWELL: OUR PROJECTIONS SHOW WE EXPECT GDP GROWTH TO REMAIN SOLID.

FED'S POWELL: THE FED CAN MAINTAIN LABOR STRENGTH WITH POLICY ADJUSTMENT.

FED'S POWELL: OUR DECISION TODAY REFLECTS GROWING CONFIDENCE THAT STRENGTH IN THE LABOR MARKET CAN BE MAINTAINED.

What’s the main takeaway & why are stocks/commodities reacting so positively? Powell said the economy is in a good position, so the 50bps cut yesterday WAS NOT a panic cut… they cut 50bps to get ahead of schedule & also likely to make up since they didn’t cut in July as well. So, if the economy is humming along & the Fed just cut 50bps into it… why wouldn’t stocks/commodities react positively?

After all, that’s very stimulative considering the Atlanta Fed just the other day came out with GDP printing with a 3-handle & here we are previously with the market stuck on the recession narrative; hence we’re seeing a ton of those moves get faded as the Fed cuts into OK growth which is good for stocks as long as the economy holds up / great for commodities considering they were priced for a hard landing and net exposure is VERY LOW & bad for bonds given inflation is likely bottoming around these levels & may start to pick back up & lastly, we’re seeing the dollar work lower today which is an interesting dynamic considering bonds are lower as well but commodities are raging… potentially a sign that the Fed’s credibility is at risk and the market is sniffing it out.

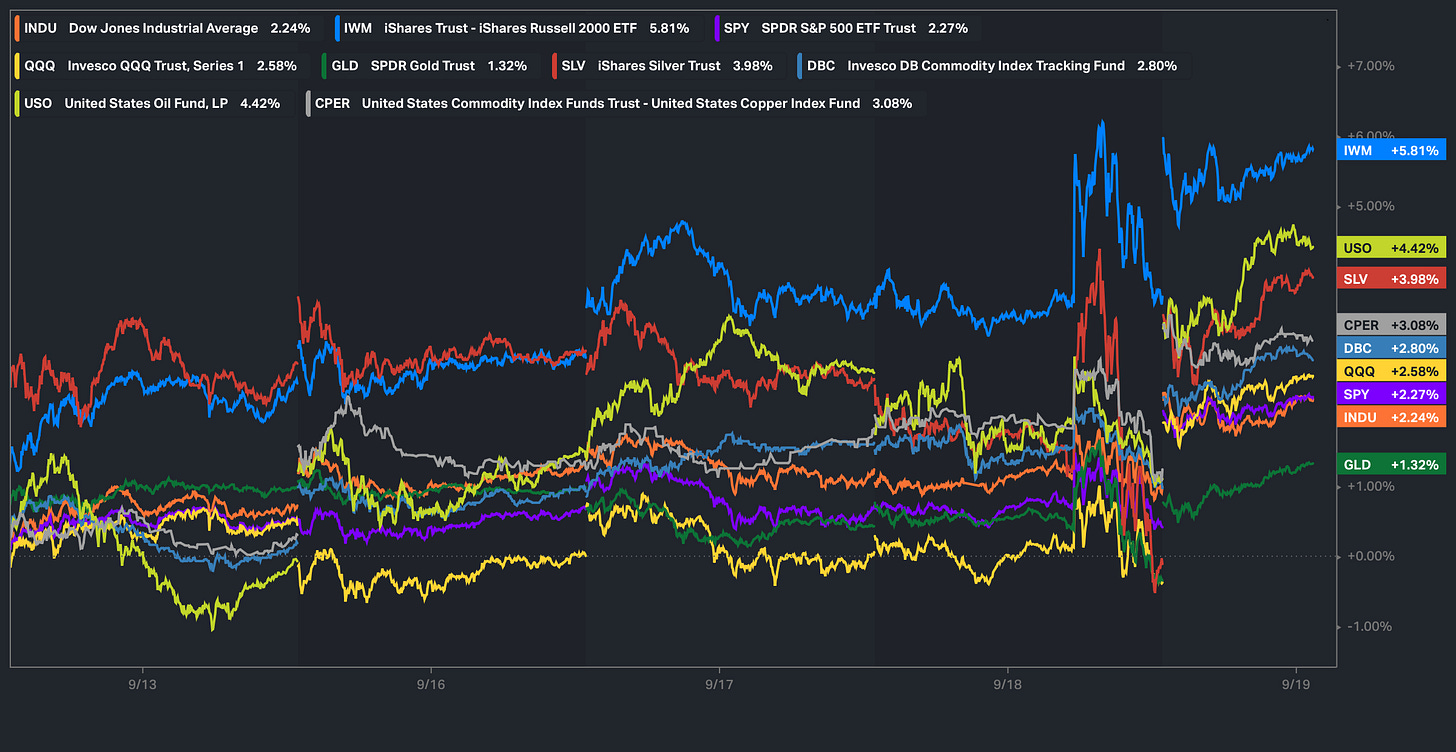

As you can see below, commodities have snapped back hard off the lows & the 10Y has started to pick up off the lows yet the dollar has remained relatively muted… important correlation to watch these coming weeks / months.

In regards to performance on the week, small-caps have performed the best, but what’s right behind that? Commodities… would sure be something if just as the Fed cuts, China goes ahead and stimulates…. It would be a big pain for the Fed and drastically increase inflation risks.

Lastly, a couple weeks back, I published a collaborative piece w / Le Shrub discussing the “What Ifs” & parallels looking back at the past compared to where we are today. The comparisons we made looked back at the '60s-70s when the Fed was choosing to support growth / stimulate & with some combined forces of supply constraint as well; it led to the second wave of inflation that we all famously know… are we headed there next & did Powell just reveal himself as the ghost of Arthur Burns? Maybe… for those who may have missed the piece and would like to read it, a link to the write-up can be found here.

Giving thanks,

Eliant.

Notable Flow:

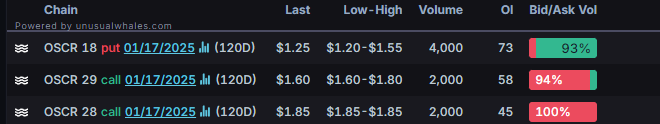

OSCR 0.00%↑ Bearish Risk Reversal: 28C & 29C STO and 18P BTO 01/17/25 Exp.

MMM 0.00%↑ 150C 09/19/2025 Exp.

COF 0.00%↑ Bullish Risk Reversal: 155C BTO and 130P STO 12/20 Exp.

RIO 0.00%↑ 75C 04/17/2025 Exp.

OSCR 0.00%↑ Bearish Risk Reversal: 28C & 29C STO and 18P BTO 01/17/25 Exp.

This trader placed a bearish bet by selling 2k contracts of each call on credit and using that credit to buy 4k contracts of the puts. The Whale speculates that the stock price will decrease and volatility will increase or remain the same.

Oscar has seen a large increase in value over recent months and now comes into a pivotal spot of resistance, seeing levels that haven’t been traded for years. This is a pretty big inflection point here as the whale looks to risk a rejection of this zone and back into the balance of recent trading levels. OSCR carries some risks with a high PE ratio and moderate volatility. It is definitely a stock to keep a close watch on for both parties going forward.

MMM 0.00%↑ 150C 09/19/2025 Exp.

Vol: 701 OI: - Avg: $9.42 Prem: $660,680

This Whale is starting a position with no previous OI and adding 700 contracts that were traded at the Ask. The call net premium reached its highest levels today in the past 14 days.

Another key spot here for the widely renowned company of 3M as it tests a major downtrend coming out of a rounded base. It has faced several challenges in recent years, including inflation, supply chain disruptions, and weaker sales in the consumer segment. Despite its recent recovery from June 2022 lows, 3M has underperformed the broader market since 2021 compared to the S&P 500. Future performance remains tied to broader market economic conditions and its ability to manage ongoing headwinds. Trading just above the trendline seems like a breakout, and trading above all relative moving averages warrants further supportive upside.

COF 0.00%↑ Bullish Risk Reversal: 155C BTO and 130P STO 12/20 Exp.

This trader sold over 3,000 contracts of the 130P on credit and used that credit to buy over 3,000 contracts of the 155C, speculating that the stock price would increase and volatility would remain the same or increase. For this trade to have a positive PnL, the stock price must go above $155 by the expiration date.

Capital One operates primarily in consumer and commercial banking, focusing on credit card lending. Recently, concerns over rising credit card delinquency rates have been noted, impacting investor sentiment. However, institutional ownership remains strong, with large hedge funds and investors holding significant positions. Testing two resistance-related trendlines, COF seems poised for a breakout toward recent highs after finding a base near the 50-week moving average.

RIO 0.00%↑ 75C 04/17/2025 Exp

Vol: 3,705 OI: 179 Avg: $1.48 Prem: $549,390

Today the stock had its highest options volume in the past 60 days, favoring the call side. These Whales particularly traded calls 15% with 210 days to expiration.

After a few failed breakout attempts, RIO is again testing this trendline break. Being a major player in the global mining industry, they are mostly known for producing iron ore, aluminum, and copper, among other minerals. This provides the company with diversified exposure that offers growth potential going forward. Going out to the end of Q1 2025 provides plenty of time for this trade to take action, with recent Fed decisions factoring into play. Certainly, a long-term play here as commodities can be tricky regarding timing, but ultimately, it could be worth the punt front running this breakout.

Wow — information packed post today. We were super excited to share his knowledge with you all today and we hope you enjoyed it. As always if you appreciated and enjoyed today’s read, likes are greatly appreciated. Be sure to check his substack out as well as he posts great information regularly throughout the week.

Cheers gents,