Sunday Snack

It's Over / We're So Back

Good morning, lads - I hope you’re riding into the new week sharp and have enjoyed your weekend thus far. We’re coming off a choppy finish to the last week, markets are starting to flip their script, money’s rotating, and volatility is back in the driver’s seat. One clear theme: elevated options / single-stock vol is signaling that the market is bracing for something.

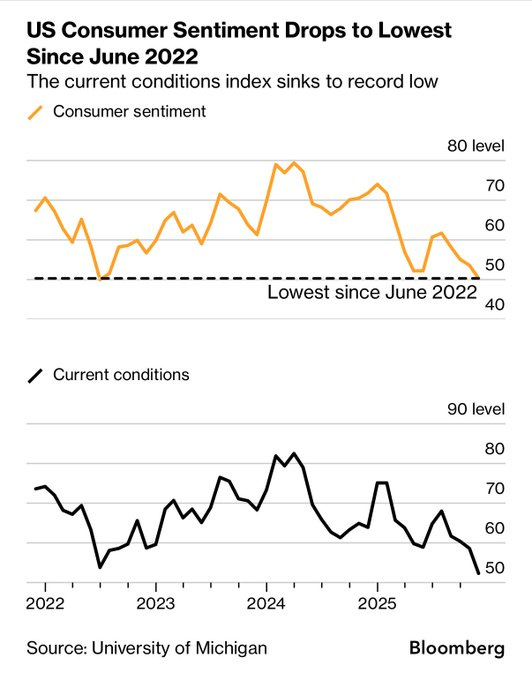

On the news front, two key points to anchor: First, the ongoing U.S. government shutdown continues to eat into the normal flow of economic data, delaying major prints and forcing traders to rely more heavily on corporate earnings and Fed chatter. Second, big tech and data-center names remain in focus, from AI infrastructure deals to holiday consumer sentiment at lows / these are the “live wires” behind where capital could flow next.

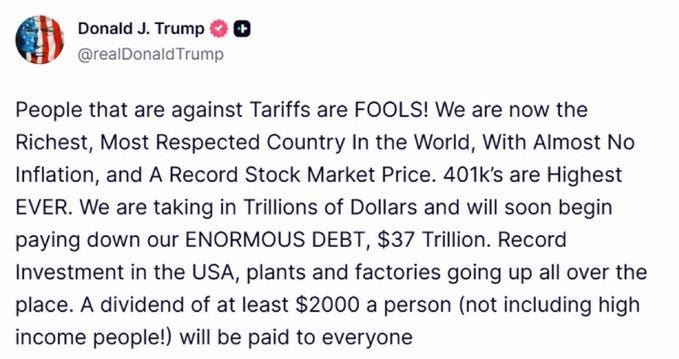

Trump has been very active today on Truth social highlighted by announcing a $2,000 Tariff Dividend - oh?

The real kicker is when the government shutdown will end. It feels as though the street, among many others, are growing increasingly impatient with the shutdown causing a bit of unrest / uncertainty in the broader market. What this means for the week ahead?

Data headlines will be thinner, so flow, volume, and conviction…

Earnings news (especially in tech/AI relative) will create the real breaks or fails.

Indices are caught in a bit of a holding pattern — waiting for clarity. This is a week to pick your lanes carefully, not throw everything at the board.

Keep an eye on Fed speakers, small business data (NFIB), and the leadership names around AI or spending that could pivot the market.

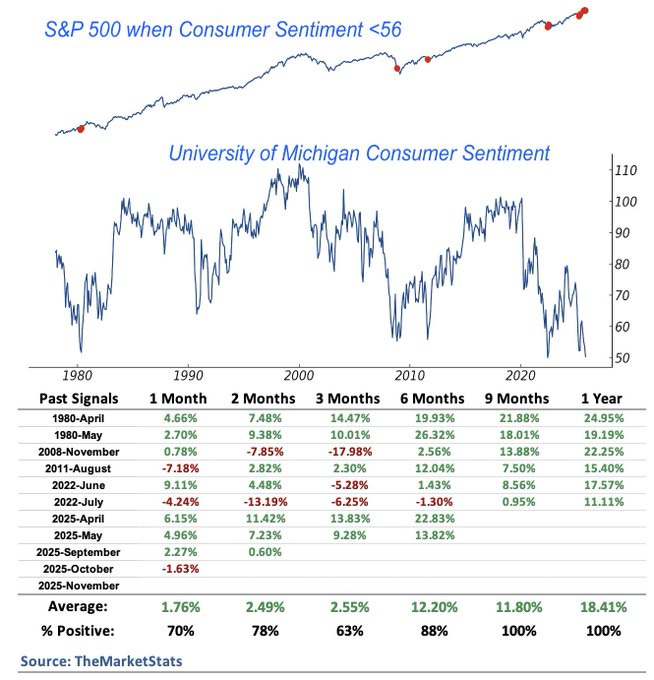

The indices are still just below all-time highs ~2.79% (SPY) with the Fear and Greed Index still in extreme fear territory. Which brings me to my next point - sidelined money. Hypothetically, if we were to reclaim key / pivotal prices in the broader market & many leaders, how much money flows would we see come back into play to drive this market even higher into EOY? Conversely, we could reject the aforementioned pivots / levels confirming the resistance and continuing to break the uptrend as we correct into Q1. Personally I’m in the camp of higher for longer once we get clarity from the gov’t shutdown ending, whenever that may be - this week please and thank you.

Looking at the indices, the risk seems pretty clear at the moment shown below.

SPY

So we’ve got a clear undercut & reversal (UnR) of the 50D SMA and putting in a hammer candle right into previous high / gap support. Opening futures action and into Monday’s session will be interesting to see how we act around this zone. Upside is intact, but conviction is weak. Without a decent volume burst or a headline trigger, this index could stall or reverse. Support remains around the prior breakout levels. For this week, watch for a clean test of resistance or a sharp undercut of support for directional clues. Also worth pointing out that we have broken / closed below the bottom deviation channel for the first time in a month (Oct. 10). A intermediate snap back move into the channel as we began to see Friday afternoon feels more than likely / appropriate.

When looking at the weekly and just simply ‘zooming out’, everything is fine yet fear is still ticking lower… 10wk SMA UnR, correction to median channel, and upward sloping moving average’s paint a much more calming picture in the grand scheme of things.

QQQ

Similar look / commentary as I had on SPY here with tech having been the leader for much of the most recent run. This remains the most interesting animal. QQQ is showing more strength, likely because growth/AI stories still get the spend. The bear case however, if tech stumbles - watch the pull-under scenarios fast.

IWM

IWM is out of favor relative to the other two. More volatile, more sentiment-sensitive. With thin data this week, the risk is that small caps diminish without leadership. But if a surprise flows in (policy shift, spending bill, stimulus chatter) - IWM could catch up quickly. For now, treat it as the “risk-trigger index” - good for breakout plays, bad for fade plays.

Let’s jump into our current positions & setups to watch for in the week ahead.