The Beginning of the Bitcoin Brothers?

Notable Flow 10/29

Hello all, today we notice tons of crypto related flow coming in as Bitcoin nears previous ATH’s and traders chasing the move on miners in hopes of parabolic upside as we have seen in the past. I for one, am depressed because the Yankees are more mid than American fast food. I’m sure nobody else cares, but I felt the need to make it known.

Notable Flow:

APD 0.00%↑ 340C STO 12/20 Exp.

BITF 0.00%↑ 4C 05/16/2025 Exp.

BTBT 0.00%↑ 5.5C 02/21/2025 Exp.

EW 0.00%↑ Call Debit Spread: 75C BTO & 90C STO 01/17/2025 Exp.

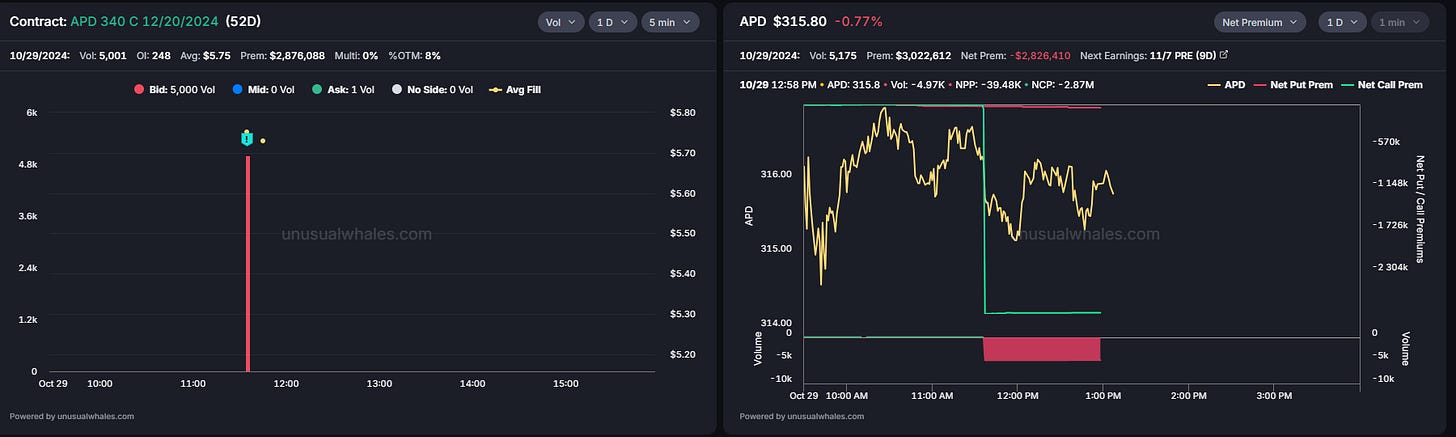

APD 0.00%↑ 340C STO 12/20 Exp.

Vol: 5,001 OI: 248 Avg: $5.75 Prem: $2,876,088

This floor trader is placing a bearish bet on the stock by selling 5k contracts of these calls on credit, receiving almost $3 million. The trader speculates that the stock price will remain below $340 by expiration. If the contracts expire OTM, they will be worthless, and the trader can collect the premium and keep it for profits when the trade is closed.

Today was the highest options volume the stock has had in the past 14 days. The company reports its 2024 Q3 Earnings on 11/07. Investors expect revenues to be $3.214B and EPS to be $3.478.

APD's stock has underperformed year-to-date, down by 17%, and has decreased by 9.4% over the past month. This downward trend suggests investor sentiment may be negative. Analysts predict a drop in current quarter sales by -6.20%. The stock has recently rejected prices above the previous range and continued the rejection today with an outside day with a lower low triggering further downside in days ahead. Also being as extended as it is from the nearest moving average’s, it certainly has some correcting to be done considering the recent rally.

BITF 0.00%↑ 4C 05/16/2025 Exp.

Vol: 19,924 OI: 2,332 Avg: $0.45 Prem: $900,935

The stock has gained almost 40% upside since October 10th, surging with other crypto names. However, whales are still bullish, and opening calls in this particular flow, the 4C, are 73% OTM and have 199 days until expiration. The net call premium reached its highest levels in the past 30 days. Additionally, the stock had its highest options volume today in the past 90 days.

Bitfarms signed a hosting agreement with Stronghold Digital Mining to accelerate the deployment of 10,000 Bitmain T21 miners, expected to add ~2.2 EH/s to operational capacity. Basically, more miners, more coins, more revenue. As I mentioned in the intro, with Bitcoins surging breakout, miners tend to run alongside with some parabolic moves as they can be heavily shorted. Assuming Bitcoin is able to break previous ATH’s and continue it’s run towards 80-100k, many of these names have potential for further upside exceeding 50%.

BTBT 0.00%↑ 5.5C 02/21/2025 Exp.

Vol: 9,648 OI: 3,196 Avg: $0.84 Prem: $815,163

Another crypto name that has had an amazing month is up almost 60% from its October lows. Whales still believe in more upside by adding the 5.5C with 115 days to expiration. The call net premium reached $730k today, the highest amount in the past 30 days.

BTBT has a strong balance sheet with over $160 million in total liquidity and zero debt as of March 31, 2024. The company is also diversifying into AI infrastructure, targeting a $100 million annualized revenue run-rate for this segment. They reached their end-of-year efficiency target of 21 w/TH ahead of schedule, which should improve profitability. This information paired with my previous remarks on the price action of Bitcoin in the last segment bodes well for BTBT as more traders pile into this option chain across various strikes and expirations alike.

WEN BANANA ZONE

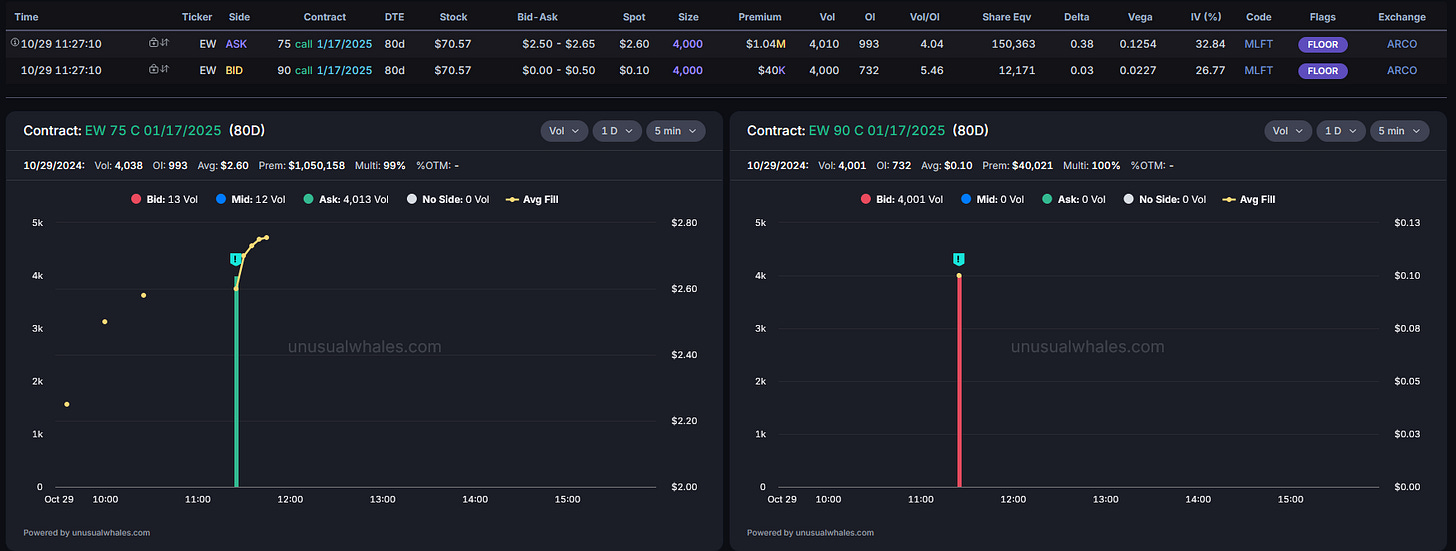

EW 0.00%↑ Call Debit Spread: 75C BTO & 90C STO 01/17/2025 Exp.

This trader opened 4k contracts on each chain by receiving credit for selling the 90C and using some of that credit to buy the 75C. The trader paid $2.5 per contract and a total of $1 million for the entire trade. The company recently reported its 2024 Q2 Earnings and a disappointing cut in its revenue guidance for the TAVR platform. However, the stock price has recovered some of its losses from its weak ER.

EW is a leader in artificial heart valves and “hemodynamic monitoring”, presents an intriguing opportunity for a reversal strategy into January. The company's strong position in the growing TAVR market, recent positive trial data, and analyst upgrades support a potentially optimistic outlook. With upcoming earnings on January 30, 2025, and the stock currently trading below the average analyst target of $74.59, EW could see upward momentum. The chart itself doesn’t exactly have the sexiest appeal to traders although, it does seem to have found a base making higher highs and holding lows after a significant drop-off a couple months back. Traders will seek to reclaim the 20wk-MA and remain below the price of 90 for optimal returns on this strategy.

That’s all from us today. I wanted to note that as many of you may know, Jon’s twitter account was recently compromised due to a phishing scam circulating X. Beware of any and all links from suspicious messages or people you do not trust as the internet is a wild west in regards to such things. As always, I have linked our twitter accounts below so be sure to follow him once again. Thanks for joining us and we hope you like the basket.

Cheers,