Tomorrow is Today...

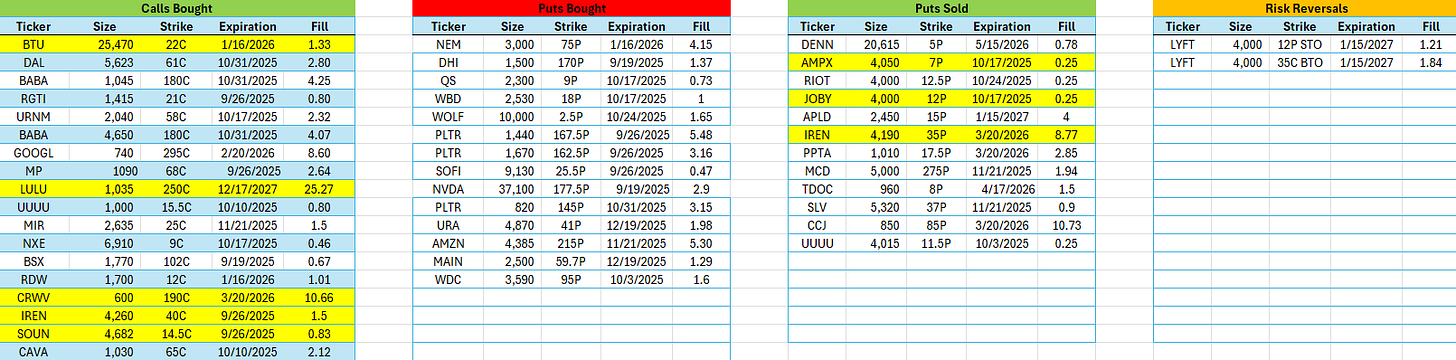

Notable Flow 9/15

Good morning everyone - hope you all had a great weekend and got some time to unplug before we dive back into another busy week in the markets. There’s plenty on deck over the next few days, and while majority of it already feels “priced in” we could be in store for some surprised fireworks (unlikely however).

The big story right now is the fact that everyone is anticipating a 25 bps cut by Powell & friends after recent CPI/PPI numbers paired with the jobs data we saw a week previous. Betting markets are pricing the possibility of multiple cuts before year end while a cut this week is nearly a given. If for whatever reason (unlikely) they were to not cut, this would be the surprise…

Over the weekend, we also got some incremental updates on trade. The US and China reportedly agreed on commercial terms for TikTok’s US operations, which at least removes one uncertainty from the tape, and US / India trade talks are back on the calendar. Meanwhile, we’re still staring down housing affordability issues and an uptick in jobless claims, which could weigh on consumer confidence if this trend continues.

Plenty of trades / ideas to be had in an environment such as this, and the flow can help direct us towards some of these charts that we may have missed. Before we get into all of that, let’s take a look at where we’re sitting at on the indices.

📊 SPY, QQQ, IWM - “Market Pulse”

SPY Daily

QQQ Daily

IWM Daily

Not really going to touch on these charts too much as we’re really awaiting confirmation from Powell on the direction of the next few weeks. Tech seems to be the leader. Remain course…

Closed Trades from previous alerts in the subscriber chat:

OKLO 10/17 85c +345%

OKLO 12/19 90c +135% (runners)

UNH 10/24 350c +65%

TSLA 9/12 355c +1000% (last weeks “lotto”)

TSM 10/17 260c +55% (trimmed at 100%)

IREN 10/17 30c +210%

Each trade is called out in the subscriber chat during market hours along with live flow & discussions. Feel free to come hangout! Friday’s are free for everyone, with Mon-Thurs for paid only.

Let’s jump into the meat on the bone per say with today’s flow grab, idea generation, and lottery segments for paid subscribers.

Notable Flow:

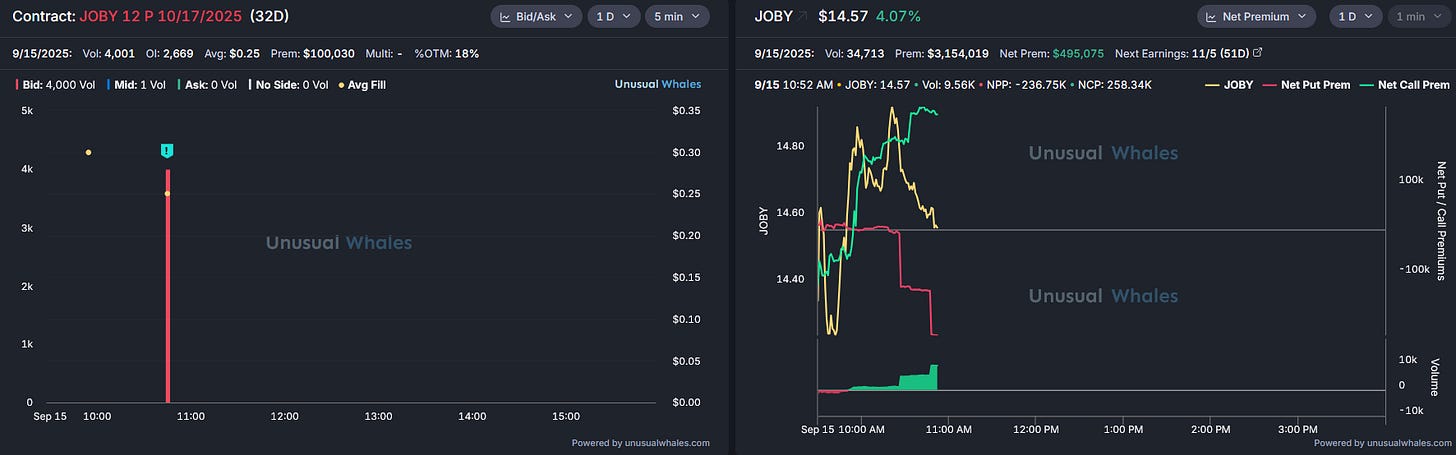

AMZN…

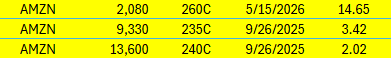

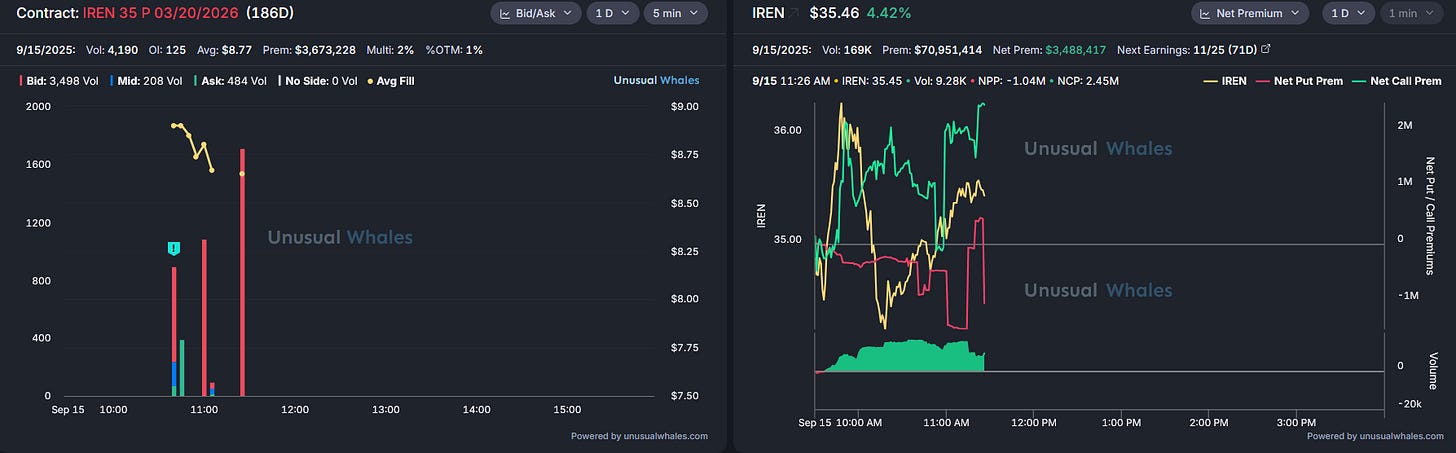

IREN 09/19 40C & 35P STO 03/20/26

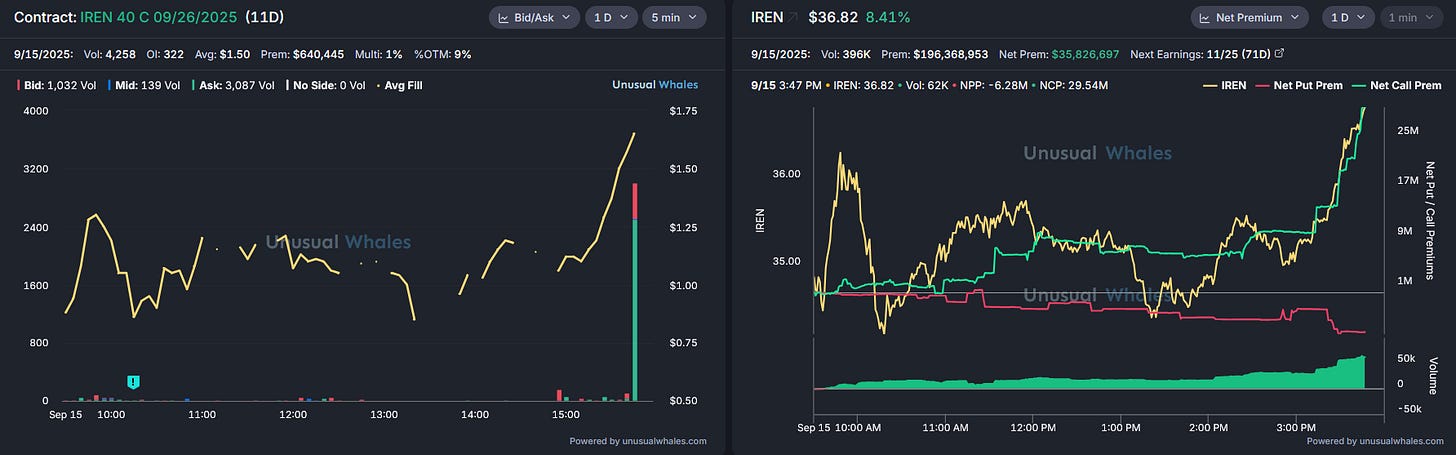

JOBY 10/17 12P STO

AMPX 10/17 7P STO

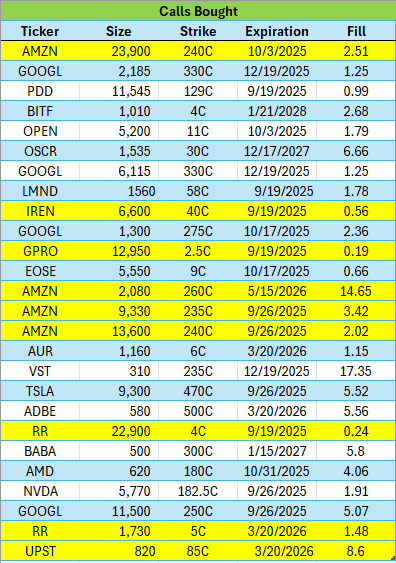

AMZN

One of the few Mag-7 names that has yet to make ATH’s since earlier on in the year before the tariff & war headlines piled on. Amazon got flooded with call buying nearly all session today as many on the street predict this could be the quarter that AWS really turns it up and boasts their dominance. Their next earnings report is October 23rd, so keep note of that when entering a position on this name. In regards to the flood of flow mentioned previously…

Tech continues to climb, but Amazon still has yet to reach that new high benchmark as GOOGL / META / MSFT / NVDA all have. AAPL & TSLA join AMZN in this essence but their time seems to be coming. Last week we had also noted year end 200P STO with decent size putting in a nice floor on the asset assuming nothing catches the market too offsides and we continue this trajectory into year end.

IREN

These hyper-scaler names have been SCORCHING HOT as of late with narrative meeting reality. We saw NBIS get a deal, we saw CRWV get a deal, we saw IREN get a- wait… We have not seen IREN get a deal yet and this stock is above ATH’s and soaring blue skies on sentiment. While the call buying has not been exceedingly jaw dropping, the asset has surged as of late. One of the better setups we recognized the previous week as we got long right on PEG support & the 10D SMA. One of our better trades last week and looking for more now.

If / when IREN gets their deal, this name could see $50+ with ease and that’s a relatively conservative target from me.

Absolutely textbook entry the other day on this name. Sick move to cap it off. Bulls are chasing this name higher and higher with call buying each session.

Idea Generation…

Below are a few idea’s based off of put sells that I find interesting on a equity trade basis rather than selling the puts you see below. Both have great charts and existing / potential incoming news behind them. I’ve said plenty of times before that put sell flow has a lot of alpha in them versus straight call buying, which is why these two assets below interest me for a long. Let’s discuss…

JOBY

If you guys are long time readers of this publication, you know how bullish I have been for these aviation names for quite some time now. I also highlighted them in my year ahead write up, Jersace Juice List Vol. 2, that is pinned to our profile. Well, the trade just keeps providing opportunities.

JOBY just got handed a golden ticket by the Trump admin…

This isn't just hype - Trump literally signed an Executive Order in June mandating the FAA to fast-track eVTOL operations, and now Joby's in the pilot program. The eVTOL Integration Pilot Program (eIPP) lets mature aircraft like Joby's start operations before full FAA certification - that's huge.

Transportation Secretary Sean Duffy called it "the next great technological revolution in aviation" and they're targeting at least five pilot projects within 180 days. Joby's already positioning to operate in select markets ahead of full certification.

Yeah, Q2 earnings sucked, -$0.41 EPS vs -$0.19 expected and basically zero revenue. But here's what matters: they've got $991 million in cash with zero debt, so they're not going broke anytime soon.

The global eVTOL market is projected to hit $50+ billion, and Joby's targeting the sweet spots: urban air mobility, medical transport, and cargo delivery. They've already got partnerships with Delta Air Lines and deals in Saudi Arabia for up to 200 aircraft.

Bottom line:

The stock could easily retest the $20+ highs if they execute on the pilot program and maintain certification momentum. Just size your position for the volatility - this thing moves 10-15% daily.

AMPX

AMPX represents a rare combination of breakthrough technology, accelerating commercialization, and massive market opportunity. The company's silicon anode batteries deliver “industry-leading performance” that enables new applications in aviation, defense, and electric mobility.

With 350% revenue growth, first-time profitability, and strong analyst support averaging $11-13 price targets, AMPX offers solid upside from current levels around $8.32. The stock has already demonstrated significant momentum with gains over 300% since April lows, yet analysts see 40-135% additional upside as the company scales operations and captures market share.

For investors seeking exposure to next-generation battery technology with proven commercial traction, AMPX presents one of the most attractive opportunities in the clean energy space.

The Lottery

As you guys may be familiar with the previous letter, I’ve started to include a lottery section of these write-ups for fun cheap bets on highly speculative names with a ton of upside.

RR

Neat robotics name here - RR is a growing player in commercial and industrial robotics, focusing on automation solutions primarily for the service and hospitality industries. Trading around $3.73, the company is gaining attention as AI-driven robotics reshapes sectors like food delivery, cleaning, and logistics.

Interesting long idea here with a real presence in multiple growing service automation niches. Definitely a growth story name tied to evolving demand for autonomy agents across multiple sectors. If the robotics theme can remain hot, this could be a big winner. It remains in the lottery section as the moves can be quick and in either direction. Could play this name with just equity and make a nut versus degen calls as pictured above.

Some further dated calls below:

Full Flow Recap:

Great start to the week with some more outperformance to kick things off in the right direction heading into FOMC. I hope you guys enjoyed the read today as well as the dialogue in chat. As always, your feedback, likes, and shares mean the world and help push this community forward. Let’s keep this train rolling and see you all tomorrow.

Cheers,

Nice write up.