Unlocking Market Power: The Surprising Link Between Stock Trading Apps, Semiconductors, and Insurance Giants

Notable Flow 9/16

Good evening all - a few familiar names for you all to consider in today’s basket.

Notable Flow:

TER 0.00%↑ 105P STO 10/18 Exp.

MU 0.00%↑ 65P STO 11/01 Exp.

HOOD 0.00%↑ 29C 01/17/2025 Exp.

AIG 0.00%↑ 77.5C 11/15 Exp.

TER 0.00%↑ 105P STO 10/18 Exp.

Vol: 5,002 OI: 46 Avg: $0.97 Prem: $485,200

The stock had its highest options volume in the past 30 days. Almost all the volume came from this chain when this Whale traded 5k contracts at the Ask, causing a significant drop in the net put premium. With practically no OI, we assume the contracts are being opened, as not enough contracts are held for this to be a closing trade.

Teradyne is linked to the semi-conductor industry and trades with volatility due to the exposure during this cycle. The stock remains relatively range bound as of late but seems to have found support after a look below and fail of the 200DMA. Since then, Terdayne has based around this zone ready to reclaim recent highs. The 50DMA is notably the major resistance level overhead as it has failed to break the last few attempts currently trading slightly over 134.

MU 0.00%↑ 65P STO 11/01 Exp.

Vol: 7,531 OI: - Avg: $0.80 Prem: $602,613

This is another trade where puts are being sold to open (bullish). This trader did not hesitate to buy the dip after semi-conductor stocks declined today due to demand concerns. The Whale traded 7.5k contracts at the Bid and is betting that the stock will not go below 65 by 11/01.

Micron Technology Inc. will report its fiscal fourth quarter and full-year 2024 financial results on September 25, 2024. Investors expect an EPS of $1.112 and revenue of $7.675B for the fourth quarter.

Nearly ~50% from highs, we have another candidate in the semi-conductor arena with bullish put selling. The sector saw a sizable loss of interest and value the previous few months after an exhaustive run up. The whale is expecting the bottom to be in and ready for another run entering just above the 200-wk MA.

HOOD 0.00%↑ 29C 01/17/2025 Exp.

Vol: 2,020 OI: 416 Avg: $1.19 Prem: $240,308

$240k might not seem like a lot if we compare it to some other Whales, but the flow is clean and straightforward. Additionally, on Friday, 09/13, around 4k contracts of the 31C 12/20 Exp. were traded at the Ask, which now has an OI of 5.1k.

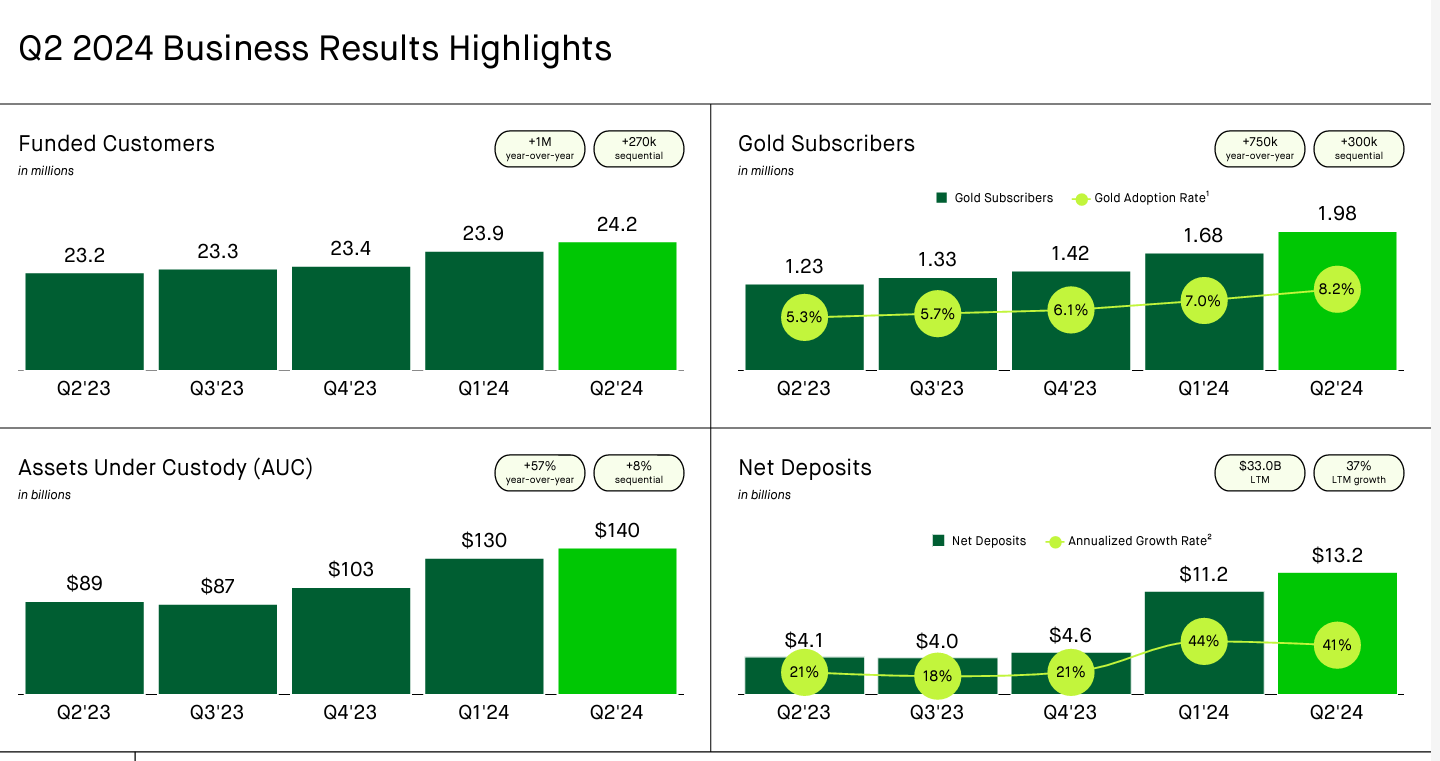

The charts below show that Robinhood’s business and financial health have improved considerably.

The stock is trading at 40.5x Forward EV/EBITDA, which makes it somehow overvalued but still lower than some of its peers, such as Goldman Sachs (49.1x), Jefferies (49.9x), and Schwab (54.9x).

The chart of the stock itself has been acting very well also, where we see a nice flag forming for potential upside out of the current channel it has resided in for quite some time. Primed for a breakout.

AIG 0.00%↑ 77.5C 11/15 Exp.

Vol: 2,079 OI: 793 Avg: $1.75 Prem: $363,774

This Whale placed 2 trades with over 1k contracts at the Ask on each for a total premium of $360k. The Net premium chart above (right) shows two spikes in the call net premium when the trades were placed. The Ask action and the positive inflow in the call net premium make us assume that these calls were being bought.

Pretty much risking the 200DMA here for a 6% bounce in equity with relatively close to the money calls with 2 months till expiry. We saw a similar reaction off the 200DMA back in mid-August. Could this whale have timed the same reaction?

Have a great rest of your night everyone. Try not to over-trade the choppy mess that is the broader market leading up to this weeks meeting. Some of these ideas can be interesting, but talking points can bring drastic moves regardless of the chart’s look. If you enjoyed today’s read, likes are greatly appreciated.

Cheers,

Kian, Jersace, & Jon