Unusual Flow Vol. 1

Notable flow from 8/5 - 8/9

Good Evening & welcome to Unusual Flow.

The goal of this substack is to highlight incoming options flow that we find interesting with additional analysis and thoughts. By no means is this information buy or sell recommendations, but rather a back pocket tool to consider.

We plan on posting a substack every Sunday with the prior weeks most notable flow as well as daily flow collected after each session.

Below we will be discussing the most notable flow collected from the previous week that make you wonder “what do they know?” Let’s dive in.

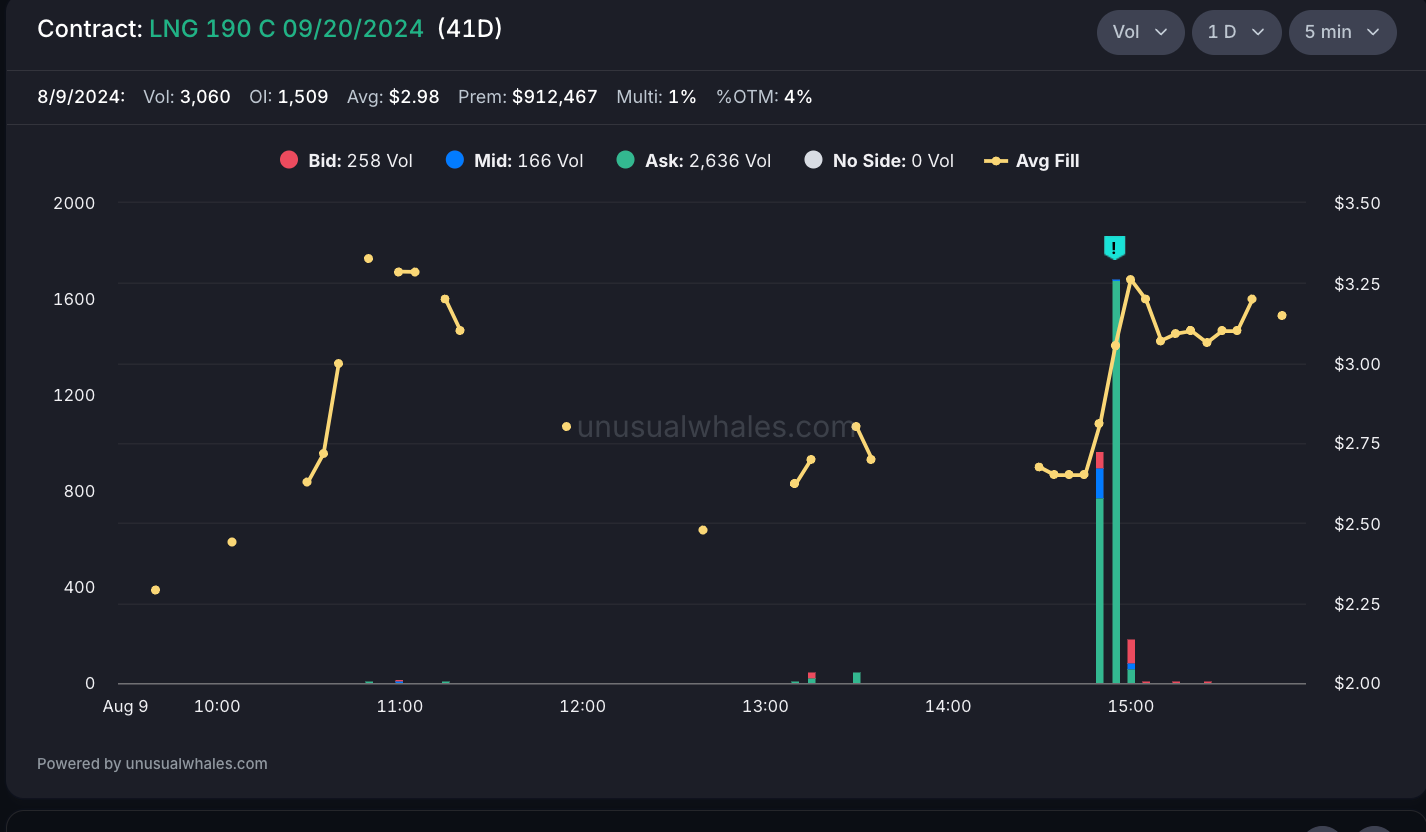

LNG 0.00%↑ 190C 9/20/24 Expiration

3060 in volume, 1500 in open interest (OI), totaling ~$912,000 in premium. A key note to consider on this one off the bat is that the flow for this name has not been getting too much premium (See charts below).

As you can see, just before power hour, a massive spike in options buying came in.

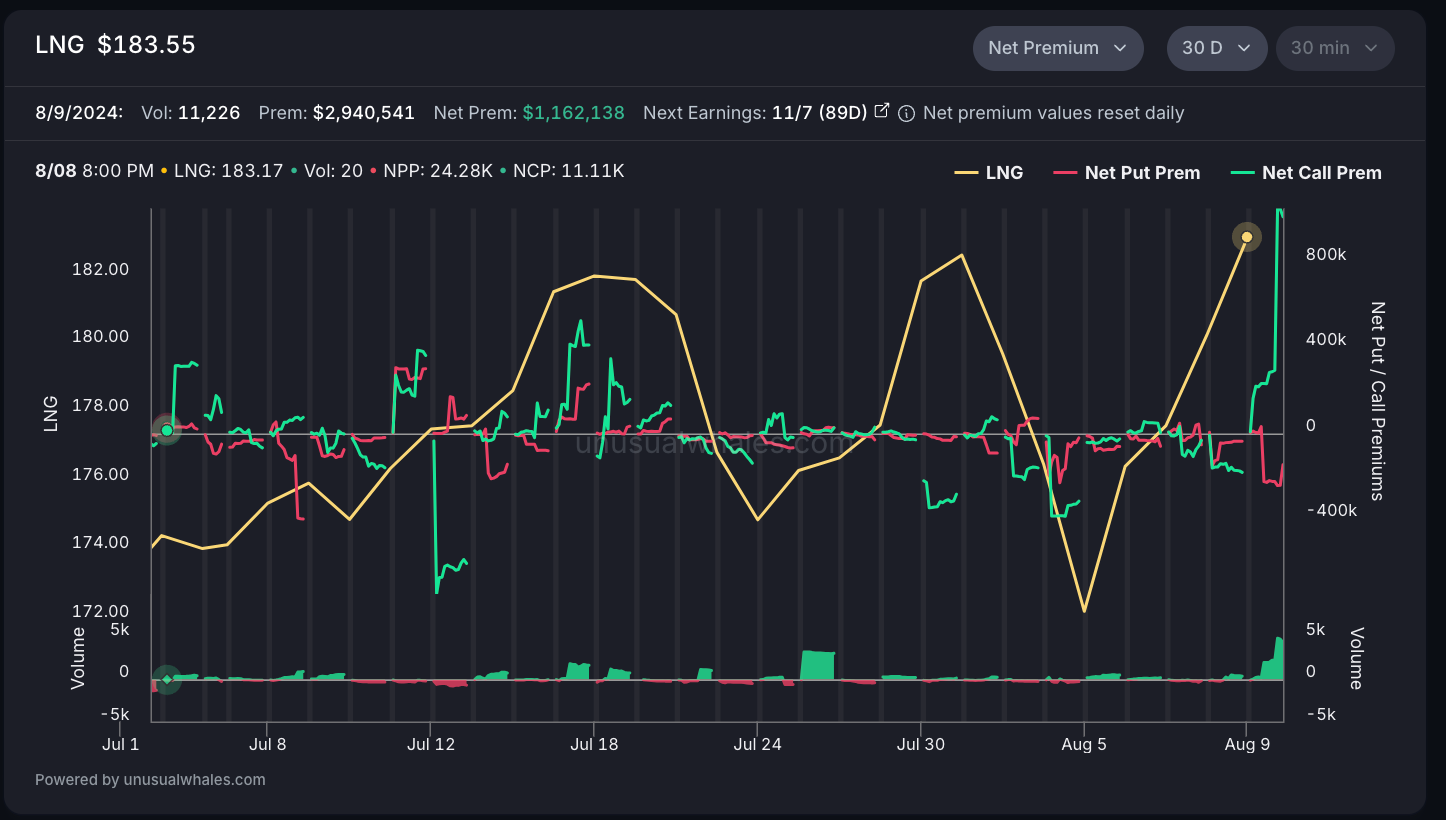

Here, we are displaying the stock price of LNG 0.00%↑ by the yellow line, call premium in green, and put premiums as red. Relatively flat before the flow hit the tape skewing to the upside.

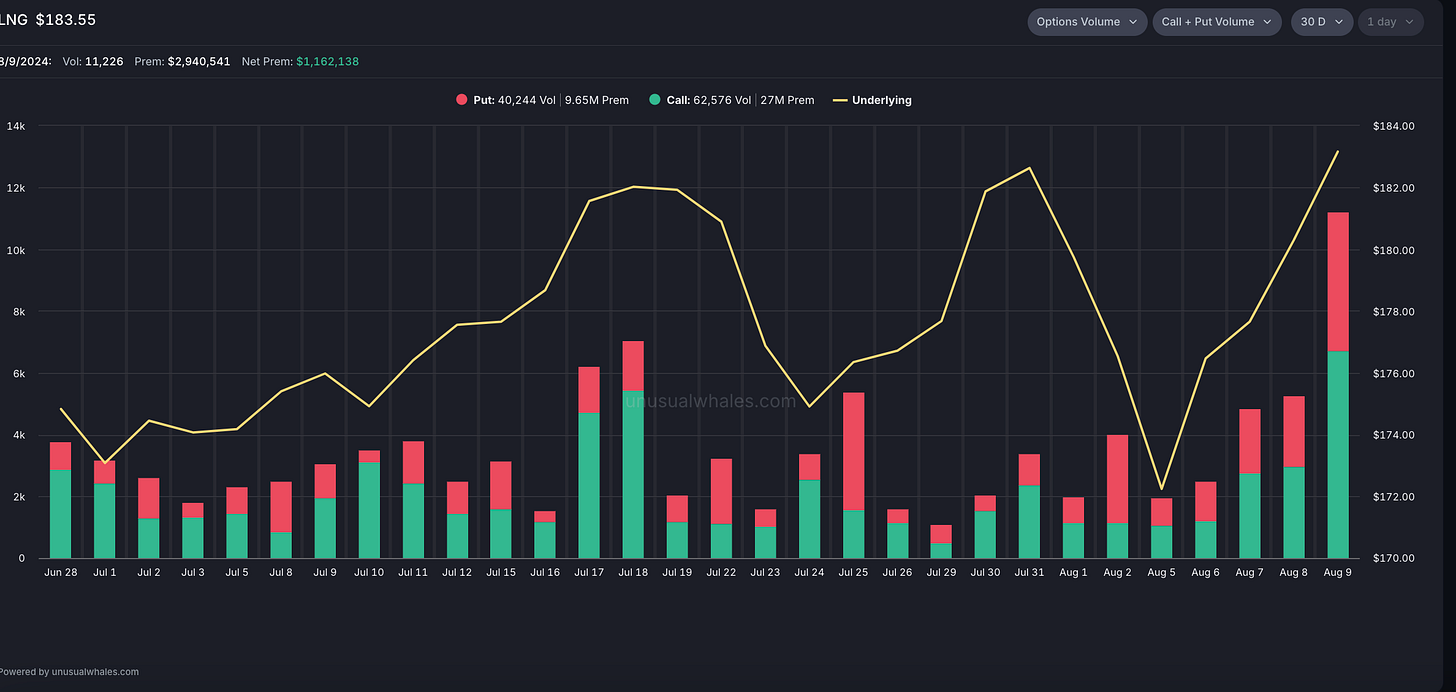

8/9 LNG 0.00%↑ saw the most amount of options flow since 7/18. LNG 0.00%↑ (Cheniere Energy) closed at the highest price in the stocks history of $183.17

Cheniere Energy, is one of the largest producers of liquified natural gas in the United States. As of August 2024, the stock is considered a strong buy by many analysts, with a 12-month price target of around $196.80, suggesting about a 7% upside from its current trading levels. The chart also seems to be in a good spot as previously mentioned closing at it’s highest price in company history whilst displaying somewhat of a cup and handle (shown below). Ideally you see a break above the current resistance of 184.50 and push towards the 190 mark for these options to go in the money (itm).

LPLA 0.00%↑ 195P STO 9/20 Expiration

Before we jump in on this, I wanted to point out “STO” - if you are not familiar with this terminology, STO simply means that these puts were sold to open. Essentially it is bullish / “bottoming flow”. Nice to see when bottom fishing for a perfect entry on a stock that has been crushed as of late. Anyways, I’m rambling. Let’s go.

1500 in volume, 85 OI totaling in ~$1.25 Million in premium, paying around 7.5/contract and only 1% OTM. As previously mentioned, this whale is betting that this stock is not going below 195 by expiration. I call this bottom fishing. Who’s not a fan of reeling in a massive fish off the bottom of the ocean floor?

A few things to note here from a moving average standpoint that caught my eye.

The monthly chart is sitting atop the 50MA, the weekly closed slightly above the 200MA (194.96) coinciding with the strike chosen by the whale to sell. Also shown on the monthly is a relatively large support zone into 195 with multiple wicks into this range yet closing above.

Overall, $LPLA appears to be well-positioned within the financial services sector, with strong growth potential and robust market sentiment despite some recent volatility.

CHKP 0.00%↑ 175P STO 10/18 Expiration

Another STO order here with 1938 volume to 7 OI totaling ~$581,000 in premium. The average price per contract filled here is 3.0 with the whale betting that this stock is not going to 175 or lower by expiration (5% OTM). This is the most amount of call-to-put premium since July 23rd.

Given the current market environment and abundance of “broken/weak” charts out there, CHKP 0.00%↑ looks incredibly strong sitting near all time highs increasing 7.56% from Monday lows after the infamous gap down and sell we witnessed. Seemingly positioned for a breakout above this level tested multiple times, this whale is swinging for the fences.

SERV 0.00%↑ 16C 9/20 Expiration

Relatively small bet in regards to the aforementioned flow in today’s post (~$338,000 in premium) however, we are noting it because the player is expecting a 16% move out of the money with just over a month left to expiry. 2000 volume, 35 OI, average contract fill of 1.68/contract.

This name is incredibly volatile with an average daily range of nearly ~28% (3.89 / day). The company specializes in autonomous sidewalk delivery robots. Initially a spin-off from Uber, Serve Robotics has quickly gained attention in the stock market, particularly after major investments from Nvidia and Uber. Nvidia’s stake in the company has played a key role in driving up SERV's stock price by nearly 600% since early July 2024.

Despite the impressive recent gains, SERV remains a volatile investment, with the possibility of a short squeeze adding to its speculative nature. The stock's small float and relatively high short interest contribute to this risk. Best of luck Mr. Whale.

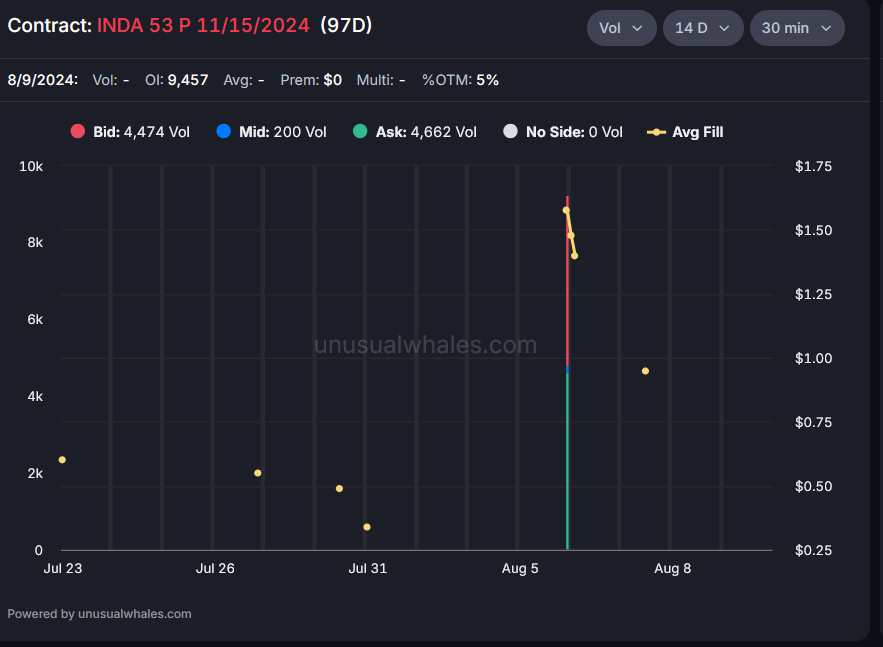

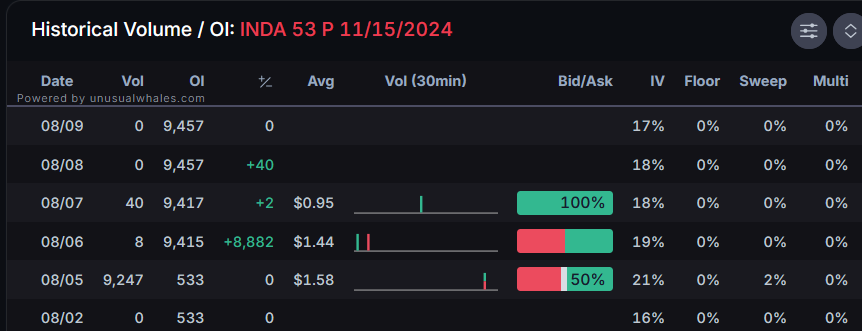

INDA 0.00%↑ 53P 11/15 Expiration

An interesting name here as many across the seas of Fintwit have been discussing the Nifty 50 otherwise known as the India ETF for best performing stocks similar to that of the S&P500 SPY 0.00%↑ for U.S. Equity markets. Contrary to CNBC’s pick as a hedge against a U.S. Recession, the flow we collected seems to think otherwise in the short term.

This flow was pulled from Monday, 8/5 where 9200 contracts were opened with 50% at the ask and 50% at the bid. Worth noting that 1200 of these were closed between now and then yet 8000 of the OI has stuck to this point meaning they are being held into Monday’s (8/12) open.

Not much to note from a technical standpoint on the chart outside of the clear resistance above here at 56 coinciding with the 10dma. As of Friday’s close, INDA 0.00%↑ has outperformed the SPY 0.00%↑ by surging 14.61% vs 13.91%.

Hope you all enjoyed Vol. 1 - look out for notable flow throughout the week as we will drop in for a thread update in regards to position updates. If there is anything additional that you would like to see from us, comment down below. If you enjoyed the article, likes are always appreciated.

Best Regards,

Excuse my French, but this first post is badass.