Unusual January

First Week of February

Good evening/morning all,

Hope you all had a solid weekend, because last week was a ride and this week isn’t going to slow down. Let’s dive in.

LAST WEEK IN REVIEW

January closed out on a positive note overall, but Friday reminded us that things can get ugly fast. For the month:

S&P 500 finished around 6,939, up 1.4% for January

Dow closed near 48,892, up 1.7% for the month

Nasdaq ended at 25,552, gaining about 1.27% for January

Russell 2000 was the quiet winner, jumping over 5% on the month as small caps caught a bid

But let’s be clear, Friday was brutal. The S&P dropped 0.43%, Dow fell 0.36%, and the Nasdaq got hit for nearly 1%. Tech led the selling, and risk assets across the board got whacked. VIX crept back up near 17.5.

Sector rotation was the story of January, and it wasn’t subtle.

Energy absolutely dominated, up over 13% for the period. Materials followed at nearly 11%. Industrials, Consumer Staples, and Comm Services all posted solid gains in the 6% range. Meanwhile, the laggards tell you everything about the rotation: Info Tech down 0.36%, Healthcare down 0.75%, and Financials bringing up the rear at negative 2.33%.

This is a clear “risk-on but not in mega cap tech” setup. Money rotated hard into cyclicals and commodity-sensitive names while the Mag 7 trade took a breather. Healthcare got wrecked by that Medicare Advantage news, and Financials never recovered from the early-month weakness.

Indices

- SPY Daily

Touched 7,000 briefly on Tuesday, which was a new intraday high, before pulling back. The index is sitting right above the 10/20d MA after Friday's action. Breadth has since faded from the January highs when many names were above their 50-day.

- QQQ Daily

Tech weakness dragged it down, especially on Friday. The Nasdaq underperformed all week as rate sensitivity weighed on growth names. Earlier in the week it appeared as though money had been rotating back into tech, yet we are left wondering if that was a head fake after the first half of earnings came around.

- DJI Daily

Held up relatively better thanks to some of the value and industrial names. Caterpillar gained over 3% on earnings. Verizon ripped 12% on guidance. But Visa and American Express weighed on the index.

- IWM Daily

Small caps had been quietly outperforming all month. The 5%+ January gain was notable, though Friday gave some of that back. Still worth watching if the ‘rotation’ trade continues.

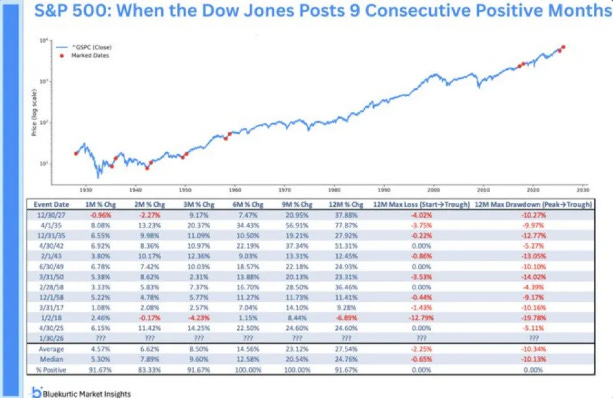

Here's something worth keeping in mind. The Dow just posted its 9th consecutive positive month. That's rare.

Going back to 1927, there have only been 12 instances of this happening. The forward returns are overwhelmingly positive. Average 1-month gain of 4.57%, 3-month gain of 8.50%, and 12-month gain of 27.54%. Over 91% of the time, the market was higher one month later.

Now, past performance isn’t a guarantee, and we’re dealing with a different macro backdrop than most of these historical periods. But the takeaway is clear, momentum tends to beget momentum. Extended winning streaks historically don’t just suddenly reverse. Something has to break the trend, and right now, the data isn’t showing that.