Volatility Presents Opportunity

Whipsaw Action...

Good evening everyone - hope this week’s treating you well so far. The tape’s been choppy, sentiment’s swinging, and we’re entering the part of the week where positioning and flow is a mixed bag due to nonstop headlines. One fresh data point: the Fed’s Beige Book dropped earlier, and it painted a picture of cooling momentum across most districts - fewer expansions, some flat or contracting zones, and signs that consumer spending and hiring are softening. Add on the IMF flagging possible overheating in AI-investment valuations and markets starting to get jittery on the narrow concentration of gains, and you’ve got the perfect recipe for selective trade setups, not broad bullish conviction. I’ve been harping on this in the subscriber chat now for the last couple weeks in regards to pulling back some risk and getting a bit picky where we put our cash to work.

Today, tech is trying to hold the line. Nvidia and AI-adjacent names are still propping sentiment, though volatility and rotation are never far behind. Stocks that are over-baked will need discipline, names that are tired or broken need to prove they can hold. The intermediate backdrop feels ‘noodly’ not a crash, not a mega breakout… just accumulation, tests, and traps.

Trade war playbook from Q1 seems to be reoccurring here in Q3 so it’s best to be vigilant and selective as I previously mentioned. Getting chopped up in longer dated swings is never fun but there are plenty of opportunities for quick news hits, or hedges across the board in these sessions. Any headline or positive notion of resolve between Trump and Xi would absolutely trigger this market to surge back to highs. A general market correction was indeed needed to fix some of these charts however, amid this process, some have become ‘broken’ and / or unattractive. On the flip side, this is typically where the bigger gains are made when you bid troughs and bottoms on unattractive names with certain looming upside on the heels of positive resolve.

Let’s talk about where SPY / QQQ / IWM sit in this mess:

SPY Weekly

Yes we are below the 10 / 20D SMA’s… However, SPY’s dancing in that resistance band just above its recent highs. The strength is there when buyers show up, but the follow-through’s been weak. It’s stuck in a range until volume backs a clean breakout. If price can reclaim and hold above that resistance zone with conviction, we may see a leg higher - but if not, this could rollover. It’s a classic “watch the edges” game right now. While we are below the easy momentum average’s of 10/20D, we’ve maintained the 10wk to this point and are already reaching extreme fear territory on the fear/greed index ticking to 20.

QQQ Weekly

QQQ’s been doing the heavy lifting. Tech and AI still driving it, and relative strength is giving it more say in where the broader market goes. When QQQ leads, setups in semis, AI plays, and high-growth rerating names become more valid. But risk is that QQQ overextends and the rest of the market can’t keep up. If it pulls back, tech will need support (flow / institutional bids) to re-anchor. Also holding the 10wk here but simultaneously below 10/20D as mentioned on SPY.

IWM Weekly

Small caps continue to lag the party. IWM’s showing more volatility - it will move quick when liquidity or macro relief hits, but until then it’s getting clipped on weakness more often. The chart is weaker, participation is sparser, and without a catalyst, IWM will be reactive, not leading. If macro or policy surprises line up, though, it could be a sharp catch-up… which is what many have practically begged for now for the last four years. As it stands now is actually pretty important in regards to the weekly candle close. We’ve only closed above this 244.59 level shown once in the past four years (two weeks ago) before ultimately failing the breakout. IWM actually still holds the 20D SMA still but in a way a moot point given the lack of returns here.

From here, the trick is being nimble: flow, volume, and confirmation > ideology. I’m watching for high-conviction setups, clean breakouts, and names that refuse to roll. The broader indices are your map - but today, it’s about picking direction off internals, not macro hope.

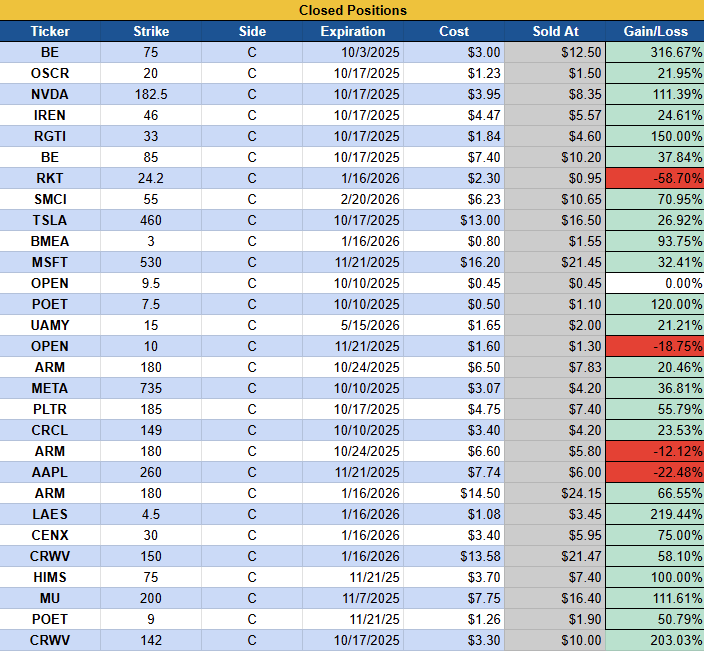

Amid the chop and whippy action of the intraday sessions, I’ve provided consistent value for subscribers in the daily chat with live trading / alerts to help outperform consistently whether that be quick scalps, news trades, or quick hit swing trades to capitalize on the volatility while we let longer term trades do their work on their own time. I’ve started tracking trades placed in the subscriber chat the past few weeks and I’ll let the numbers speak for themselves.

The main reason for this is not to gloat, but rather display that trades we take are not solely mentioned in the letters posted & that they are being called out actively in our chat as many have been quite time sensitive and headline driven the previous couple weeks. I apologize if you suffer from OCD / ADHD or whatever alphabet diagnosis that makes you cringe at the unorganized structure of expiration sorting displayed above .. LOL.

Not a big flow grab today as I mentioned in the intro that it’s been pretty mixed as of late. Nonetheless, some interesting ideas I have that I’d like to share with you all today below for our subs.