When AI Strikes Oil: Navigating the Pipeline Between Black Gold and Green Energy

Labor Day Weekend Pull

Good afternoon, all. We hope your extended weekend was great and that you enjoyed your time away from the screens. Nevertheless, the market is open tomorrow, and we must prepare accordingly. Let’s cut to it and dive in.

Notable Flow:

NBR 0.00%↑ 80C STO 12/20 Exp

AMRC 0.00%↑ 40C STO 1/17/2025 Exp

APLD 0.00%↑ 5.5C 1/17/2025 Exp

PLTR 0.00%↑ 49C 1/17/2025 Exp

ASTS 0.00%↑ 47C 9/20 Exp

NBR 0.00%↑ 80C STO 12/20 Exp

Vol: 1,000 OI: 163 Avg: $10.10 Prem: $1,010,000

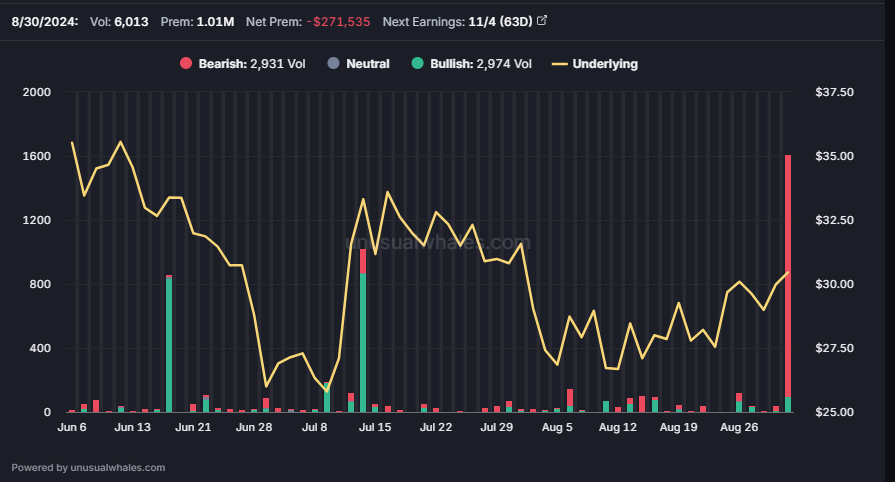

This Whale is bearish in the stock by selling 1,000 contracts of these calls. This name has had a lot of options bearish activity in the past 30 days, as can be seen in the Net premiums chart below.

Maintaining the downtrend from April ‘22 and rejecting the test of the 50-week MA, it’s safe to assume this action will continue outside of pending news or earnings reports triggering upside movement. As of Friday’s close, NBR has closed below each of the significant moving averages shown on the chart below. The company reported a significant loss in its most recent quarterly earnings, with an earnings per share (EPS) of -$4.29, missing analyst expectations. Nabors' high debt levels and negative profit margins are key risks, but the company's resilience and strategic positioning in the energy sector could offer some upside if market conditions improve.

AMRC 0.00%↑ 40C STO 1/17/2025 Exp

Vol: 1,567 OI: 15 Avg: $1.96 Prem: $307,021

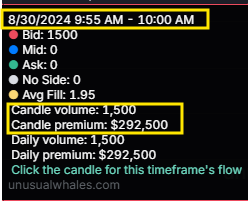

1500 contracts were traded at the Bid on 08/30 within 30 minutes of the market opening. At the same time the trade took place, the call Net premium turned negative by -$293k, which makes us assume that the calls were STO.

The chart below shows us the highest options volume in the past 60 days.

A long-term downtrend from November ‘21 and continuing to bleed off bad news is not ideal for a buy-and-hold. That’s what we have here. Below are a few reasons highlighted for a possible thesis why the Whale would consider selling call-side premiums with some time out to January.

Earnings Misses: Ameresco's recent earnings reports have been underwhelming. In Q2 2024, the company reported an EPS of $0.10, significantly missing the consensus estimate of $0.25. This marked the second consecutive quarter where the company failed to meet earnings expectations, which can undermine investor confidence.

Guidance Concerns: The company’s full-year 2024 guidance also raised some concerns. While Ameresco expects earnings per share (EPS) between $1.15 and $1.35, the lower end of this range is below the consensus estimate of $1.36. This conservative outlook suggests potential challenges in the near term.

Valuation Pressure: Ameresco's valuation multiples, such as a forward P/E ratio of around 24.5x for 2024, suggest that the stock may be priced high relative to its earnings growth, particularly given the recent earnings disappointments. Such high valuations can put pressure on the stock if the company continues to underperform expectations.

Stock Performance: The stock has seen significant declines recently, dropping by over 16% in the past month alone. This downward trend reflects broader market concerns about the company’s future performance.

APLD 0.00%↑ 5.5C 1/17/2025 Exp

Vol: 5,296 OI: 132 Avg: $0.50 Prem: $265,426

This Whale is “Buying The Dip” after the stock dropped over 30% this week during its post-earnings reaction. The company announced its Fiscal 2024 Q4 and Fiscal 2024 Year results on 08/28, giving mixed results, with Fiscal 2024 revenue of $165.6 million versus $55.4 million in 2023, Net loss of $149.7 million versus $45.6 million in 2023, and Fiscal 2024 adjusted net loss of $77.5 million versus $7.9 million in 2023. Fiscal 2024 adjusted net loss was negatively impacted by $38.5 million of expenses associated with facilities and equipment that were not yet generating revenue.

On Friday, 08/30, the stock saw its highest options volume for the month of August. Additionally, there was activity for the 4C 10/18 Exp. with 922 contracts traded at the Ask and a total premium of $47.7k.

Applied Digital has transitioned from its original cryptocurrency mining focus to more diverse AI and HPC applications. This pivot allows the company to tap into the rapidly growing AI market, providing computing power for tasks like natural language processing and machine learning. This strategic shift positions the company in a high-demand sector, which could drive future growth.

Overall, while Applied Digital presents a compelling growth story in the AI and HPC markets, it also carries significant risks that investors should be aware of before considering it a bullish play.

The chart speaks for itself regarding risks. Last quarter, there was very volatile movement and an offering, which caused the market to react negatively, with a nearly 20% drop in one trading session.

PLTR 0.00%↑ 49C 1/17/2025 Exp

Vol: 5,426 OI: 2,511 Avg: $0.48 Prem: $262,826

The Whale is speculating that the stock will continue its upward movement by buying calls 56% OTM with 137 days to expiration. A total of 4,044 contracts were traded at the Ask within the first hour of the market on Friday, 08/30. The OI in this chain was already 2.5k, which makes us assume that on Tuesday 09/03 OI on this chain will update to somewhere between 6.5k-7k.

Palantir has recently been seen as a strong, bullish opportunity, primarily due to its rapid AI sector growth and expanding commercial and governmental customer base. Palantir's AI Platform (AIP) is gaining significant traction, particularly in the U.S. commercial sector, where revenue surged by 47%. The company's total addressable market for AI infrastructure has also tripled, indicating strong potential for future growth.

Palantir's expanded partnership with Microsoft to integrate AI solutions for the U.S. Defense and Intelligence Community is a critical move. This partnership enhances Palantir’s position in the government sector, which is seeing increasing demand for advanced AI and analytics capabilities.

The chart itself is extremely strong, looking out of a rounded base and continuously breaking higher as of late. Many know this name back from the IPO and have waited patiently for the days we have had recently. They continue to maintain this hopeful hype as it nears all-time highs. The strike chosen here is also well above all-time highs, so the whale is expecting a full-scale breakout.

ASTS 0.00%↑ 47C 9/20 Exp

Vol: 3,798 OI: 42 Avg: $0.70 Prem: $267,426

These Whales didn’t hesitate to open their options contracts as soon as the market opened on 08/30, placing two big trades, each with around 1.7k contracts, which made up almost all of the daily volume on this chain.

The 9/20 expiration in these calls will cover 2 events in which the AST SpaceMobile will participate:

B. Riley 7th Annual Consumer & TMT Conference on 09/12

WSBW Panel: Direct to Phone and More - The Future of Mobile Satellite Services from 09/16 to 09/20

A very popular name years ago has risen once again, and with the move we all expected/anticipated in recent days. Those who held through it all or even got back in, are appreciative and bountiful of the gifts received. ASTS has increased by over 1,600% at its peak since May 2024, warranting one of the larger moves we have seen YTD. This action has been experiencing a bullish trend primarily due to its unique and ambitious project: developing the world's first space-based cellular broadband network. This network aims to provide global mobile coverage directly to standard smartphones without needing ground-based towers.

AST SpaceMobile's upcoming satellite launches and recent FCC approvals have further fueled investor optimism. While the chart shows a sizable pullback of ~25% this previous week, some would say that’s healthy and expected. With all this in consideration, the stock held the 20DMA over the course of the last three sessions, proving its strength going forward. Mr. Whale looks for a hold of this 27.50 spot for continued upside with the upcoming launch plans.

That’s all for today folks. We all hope you enjoyed today’s read and look forward to the action provided to us tomorrow. As always, likes are greatly appreciated.

Cheers,