From Cargo Ships to Cargo Pants: Trader Goes Long on Fashion and Freight!

Notable Flow 10/7

Good afternoon folks and welcome back to your favorite 5 minute read about Unusual Option Activity. Let’s see what the whale’s are purchasing today.

Notable Flow:

FRO 0.00%↑ 28C 11/15 Exp

FLR 0.00%↑ 60C 06/20/2025 Exp

SRRK 0.00%↑ 30P 04/17/2025 Exp

ROST 0.00%↑ 130P 11/22 Exp

FRO 0.00%↑ 28C 11/15 Exp

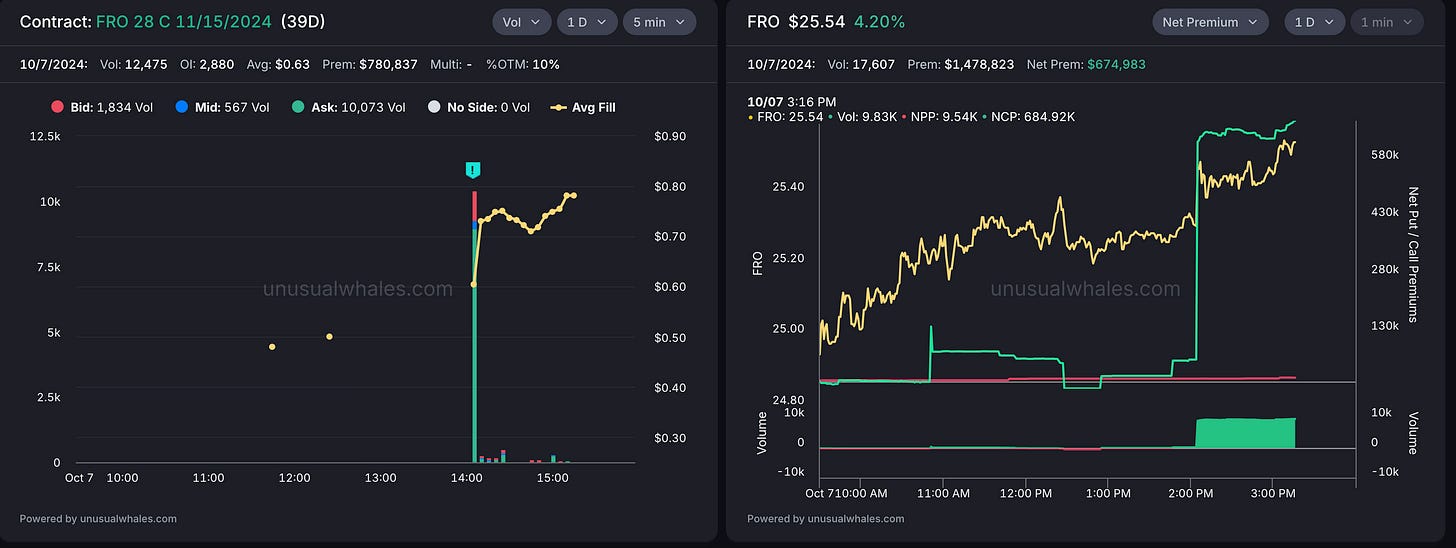

Volume: 12,475 OI: 2,880 Premium: $780k Fill: 0.63

Flow: Trader here is betting a 10% OTM move by 11/15exp paying over $780k in total premium, mainly all contracts trading at the ask. You can see on the right side of the chart, net call premiums sky rocketing and put premiums flat. Today, this ticker had the most amount of options volume in the last 14 days. Only way to know if this whale is confident about this trade is by checking the open interest before market opens tomorrow.

Frontline Ltd. (ticker symbol: $FRO) is a shipping company that primarily focuses on the transportation of crude oil. It is one of the largest oil tanker operators in the world, providing services for the seaborne transportation of oil and oil products. This popular theme remains active as we start off the new week with war headlines still prevalent each hour. In regards to the chart, we see a nice break of a weekly downtrend last week with continued strength during today’s session. Now above all relative moving average’s, the support remains strong for this name in a technical sense paired with theme & momentum.

FLR 0.00%↑ 60C 06/20/2025 Exp

Volume: 743 OI: 34 Premium: $267k Fill: 3.60

Flow: Trader placing a pretty bullish bet here. Paying over $268k in premium, not a lot but all contracts are bought at the ask, expecting a 18% OTM move by expiration. Highest amount of options volume in the last 14 days, something to note. This position, we would like to see if the open interest does carry over and if any more volume comes in the next couple days.

Fluor provides engineering, procurement, construction, maintenance, and project management services. The company has a global presence, serving clients in a wide range of industries like oil & gas, petrochemicals, power, mining, and infrastructure.

The company has been riding several notable trends that reflect changes in its core industries and global market dynamics such as:

Energy Transition and Clean Energy Projects

Infrastructure Spending Boom

Restructuring and Streamlining

Government and Defense Contracts

Increased Focus on Digital Transformation

The chart also looks good for longer term investors as it has broken above a monthly downtrend dating back to 2008 (lol). As you can see it is quite a slow moving stock in regards to it’s ADR however boasts long term growth.

SRRK 0.00%↑ 30P 04/17/2025 Exp

Volume: 2,608 OI: — Premium: $1.6M Fill: 6.13

Flow: To be honest, not much to say about this stock, except for the fact that this whale thinks there is much more upside after being up over 350% on the day. Trader is selling the 30 put strike for 4/17exp for over 2,608 in size, total premium of $1.6M. 12% OTM cushion. Whale’s goal is to buy this contract for much cheaper or even better, contract goes worthless.

Scholar Rock's stock ($SRRK) saw a significant surge of over 350% during today's session due to “highly positive results from its Phase 3 clinical trial for apitegromab, a treatment for spinal muscular atrophy (SMA). The trial, known as the SAPPHIRE study, achieved its primary endpoint, showing substantial improvement in motor function for SMA patients.” This breakthrough heightened investor optimism regarding the potential approval and commercialization of the drug, driving the stock price higher.

Perhaps a mean reversion idea from the whale, as he looks to capitalize on extended upside movement.

ROST 0.00%↑ 130P 11/22 Exp

Volume: 3,701 OI: — Premium: $688k Fill: 1.86

Flow: Right out the gate after the stock being down 4.4%, this whale is selling the 130 puts for 11/22 expiration for over $688,000 in premium. All these contracts were traded at the bid. Net put premium significantly declined and net call premium stayed relatively flat throughout the day. No open interest since this was a new trade that was placed.

Alternate headline: ROSS Invest for Less, More Downside!

All jokes aside, the asset is down over 15% in the last 30 sessions losing all significant moving average’s most recently being the 200-day. Previous quarterly support can be found at 135 which could put up some fight before ultimately reaching the strike chosen by this whale of 130.

While Ross has an established business model that usually is able to combat uncertain times, macroeconomic pressures are becoming quite the talking point amongst consumers. With inflationary pressures and high interest rates, consumers have been prioritizing essential spending over discretionary things such as apparel and home goods which would affect their sales. The company has their next earnings report the first week of November.

Alrighty folks - we hope you enjoyed this strange basket of information and perhaps find it helpful. Thanks for joining us and supporting us each day, we really do appreciate it. As always, if you enjoyed the read likes are greatly appreciated.

Cheers,

Kian, Jersace, & Jon