Jackson Hole Eve

Notable Flow 8/22

Tomorrow is the most important day of your trading career until the next data event which will then be the most important day of your trading career. Do you understand?

I’d like to note that in yesterday’s letter we had quite a sizable bet placed on MSFT 0.00%↑ which is working well in the whale’s favor. The resistance and thought processes we assumed has played out thus far rejecting 426 and losing 2% in value at the time of writing.

Enough gloating, let’s get into today’s basket.

Notable Flow:

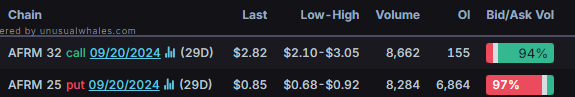

AFRM 0.00%↑ Bullish Risk Reversal 25P STO & 32C BTO 9/20 Exp.

TPG 0.00%↑ 47.5P STO 10/18 Exp.

DKNG 0.00%↑ 38C 08/30 rolled to 38C 09/06

BTDR 0.00%↑ 10C 03/21/2025 Exp.

PSTG 0.00%↑ 70C 12/20 Exp.

AFRM 0.00%↑ Bullish Risk Reversal 25P STO & 32C BTO 9/20 Exp.

Selling the 25P for $713k and buying the 32C for $2 million

This trader speculates that the stock price will go up and volatility will remain the same or go up as the company reports Earnings for its 2024 Q2 on 08/28. The company is expected to post a quarterly loss of $0.45 per share (+34.8% YoY), and Revenues are expected to be $599.5 million (up 34.5% from 2023 Q2). The trader received credit for selling about 8k contracts of the 25P and used that credit to open about 8k contracts of 32C. For this Whale to have a positive PnL, the stock must trade above 32 by 9/20.

Affirm is one of those stocks that continuously pushes you away but you keep coming back hoping for the day we all anticipate of lucrative upside. Displayed is cup and handle yet the handle is leaking lower and lower within the shown range. Plenty of overhead resistance from previous breakdown zones and overhead moving averages. This risk reversal trade does give us some cushion however and confidence of giving it a chance as one of the most popular small cap names out there. With “buy now pay later” becoming more prevalent, you can imagine this will have its moment eventually…

TPG 0.00%↑ 47.5P STO 10/18 Exp.

Vol: 4,200 OI: - Avg: $1.25 Prem: $525,605

This is a Floor Trade, which means it was placed on the floor of an exchange. The trader is bullish on this stock and is selling puts. This is the first time the stock has had any sort of options volume in the past 14 days and its highest options volume in the past 90 days.

TPG Inc. is a leading global alternative asset management firm with a significant presence across various investment strategies, including private equity, credit, real estate, and market solutions.

The chart shown below encapsulates all action since inception dating back to Jan 2022 as you can see how strong and resilient it has been YTD gaining over 25% in equity. Supportive moving averages, defined risk, and put selling at previous resistance levels give us a good feel for future/near-term price action to the upside. A break of this flat top around 50.00 could give this the potential for more growth as analyst targets range towards 52 with a “hold” or “buy” rating across the board.

DKNG 0.00%↑ 38C 08/30 rolled to 38C 09/06

Closing 3.5k contracts of the 08/30 for $88k and opening 3.5k of the 09/06 for $183k

Instead of closing the contract for a loss, this trader has decided to add an extra week to the position. It seems like a risky bet since the decay on contracts with short expiration is high, as shown in the chart below. Maybe our Whale friend knows something that we don’t?

Being the gambling man that I am, I am extremely excited for the upcoming football season. That is, American Football, for you Futbol (ahem soccer) fans out there. Quite possibly as simple thinking as that for DraftKings bulls in a season where their user base is at it’s highest with MLB nearing playoffs and NFL/CFB seasons beginning. Another fun seasonality bet in that regards.

Pretty constructive chart with supportive moving averages aside from the 50D which it reacted to poorly today couple with the trendline from ATH’s, these levels need to crack for any continued momentum.

BTDR 0.00%↑ 10C 03/21/2025 Exp.

Vol: 2,512 OI: 543 Avg: $0.85 Prem: $213,430

Our Whale friend is paying over $200k for these long-dated calls, 45% OTM (out-the-money). The stock has seen an increase in options volume since its 2024 Q2 Earnings on 08/12, when it announced a 5.75% growth in Revenue and a 33% growth in its adjusted EBITDA compared to 2023 Q2. However, the stock sold off 25% on 08/25 after a $150 million Convertible Notes offering.

The convertible notes offering however might indicate plans for further expansion or investments. Assuming this is the whale’s stance on the matter, it could be worth a punt here as the stock is seemingly just a range trade as it nears the recent lows of said range. Shown below is also a falling wedge that could ideally propel the stock higher with a break to the upside of this wedge.

PSTG 0.00%↑ 70C 12/20 Exp.

Vol: 830 OI: 687 Avg: $4.40 Prem: $365,157

820 Contracts were traded at the Ask between 11:40 AM and 11:45 AM ET, accounting for almost all the daily volume in this specific chain.

The company is set to report its 2024 Q2 Earnings on 08/28. Investors expect a revenue of $755 million and an EPS of $0.3.

The Call Net Premium is seeing a considerable spike today, making it the highest in the past 30 days with a total of $623k in positive Call Net Premium.

As previously stated, they do have an upcoming earnings report which this flow obviously covers. Surprising estimates the last few reports, Mr. Whale is hoping the report and market reaction is similar in the fact that it bodes well for him. From a technical stance we can also see that it’s pushing into the top of a bull-flag into this report. Supportive moving averages with providing a cushion for defined risk as well with the 20D resting slightly below current value ~59 and the 10D at current levels.

That’s everything for today. Place your bets for Jackson Hole tomorrow. Long/Short/Nothing-Burger, what will ya have, ser? Let’s hope today’s action was favorable for all in some sort of manner as we gear into the end of this week and speculate on tomorrow’s data. I assume everyone will suddenly become macro experts on FinTwit tonight. Anyhow, we appreciate your time, support, and likes as always.

Thanks for reading,

Thank you! Could you add your opinion on these flows if you agree or disagree. Your explanations are helping me understand these flows so much more. Thank you

These little articles are awesome!