Just Do It?

Notable Flow 9/24

Good afternoon all - last week we had Eliant Capital join us to include his thoughts on FOMC and the Fed’s decision. Ultimately he had also noted that it is likely China receives a stimmy… fast forward to today, and bing bong.

If you missed that read, you can find it here, certainly worth the time.

Notable Flow:

NKE 0.00%↑ 100P STO 12/20 Exp.

EEM 0.00%↑ 50C 12/20 Exp.

KMB 0.00%↑ 143C 11/01 Exp.

TCOM 0.00%↑ 55C 12/20 Exp.

NKE 0.00%↑ 100P STO 12/20 Exp.

Vol: 229 OI: 125 Avg: $13.41 Prem: $307,060

This trader is placing a bullish bet by writing puts. By trading 215 contracts at the Bid, this Whale speculates that Nike shares will trade above $100 by the expiration date, which is riskier because the stock price is currently at $87, which makes these puts ITM, meaning they will need to go OTM for the trader to profit. Nike will report its fiscal Q1 results on 10/01/2024. Investors expect an EPS of $0.522 and revenues of $11.645 billion.

A catalyst such as the upcoming earnings report could trigger this trade to work quicker rather than later as this report comes in a week. Down nearly -20% YTD, Nike seems due for regression to the mean and trending back upwards. Having beat their previous four reports, there is surrounding optimism in regards to the upcoming report this following week. When looking at the chart, Nike currently tests the downtrend from December highs with curling MA’s on the weekly time frame.

EEM 0.00%↑ 50C 12/20 Exp.

Vol: 132K OI: 276 Avg: $0.21 Prem: $2,746,862

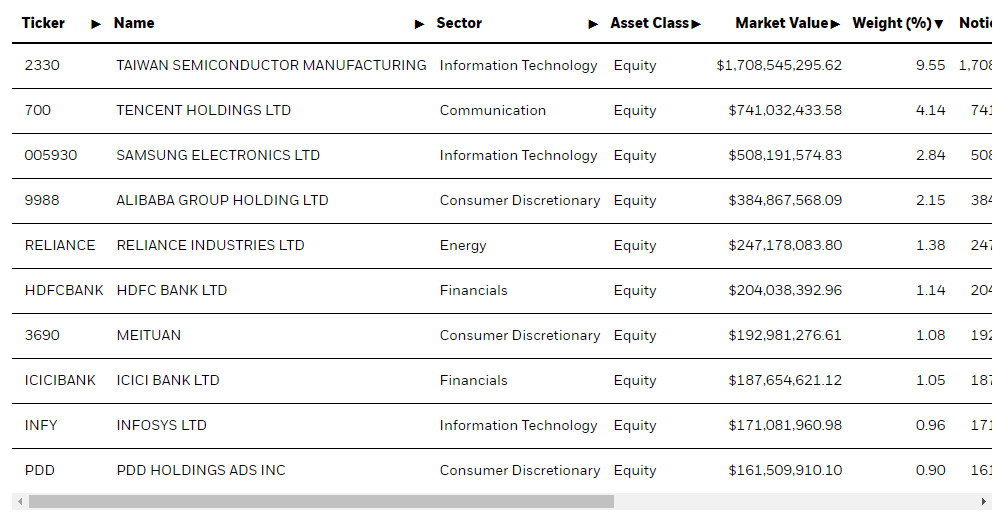

These Whales are placing a bullish bet on this ETF, which focuses on small and mid-caps from emerging markets. The total volume on this chain was around 132k contracts, with 107k traded at the Ask side and 25k traded at the bid. The current spike in the Hang Seng index is probably motivating these traders. As you can see in the chart below, they have some good exposure to Chinese companies.

EEM aims to provide exposure to a broad range of companies in emerging markets such as China, India, Taiwan, South Korea, and Brazil as shown above.

To boot with this information, EEM finds itself breaking out of a massive downtrend and investors are hopeful for continued upside as we have mounted the 200-week moving average. A lot of times we see these China names run, it typically ends up being a momentum trade rather than just a one day pop. As volume picks up, we will monitor the situation closely as we track this whale’s position.

KMB 0.00%↑ 143C 11/01 Exp.

Vol: 1,524 OI: 3 Avg: $3.27 Prem: $497,653

This Whale is opening a position in a chain that only had 3 contracts in OI by trading 1.5k contracts at the Ask, which caused the net call premium to reach its highest levels in the past 30 days.

Nice bounce off the 200-day moving average and breaking out of a falling wedge pattern, the household name of KMB seems poised for further upside momentum after trending down the previous few weeks since the start of September. Overhead we have the 10 & 50 day moving average’s. Acting as short-term resistance levels, a reclaim of these can be supportive towards the whales position.

TCOM 0.00%↑ 55C 12/20 Exp.

Vol: 2,755 OI: 1,485 Avg: $2.71 Prem: $747,312

Another stock that has benefited from the China Central Bank stimulus package. These Whales expect more upside by adding calls that are 5% OTM. Initially, the chain had unusual activity, with 800 contracts traded at the Ask. More large trades followed this one, totaling 2.7k contracts in volume 1.49k at the Ask. Since the chain got crowded and there was already a high OI, we must check the OI tomorrow during the pre-market session to see how many contracts were held overnight.

These China names are getting pounded today across the board. Pure momentum and breakout buyers seemingly. Breaking above two notable trendlines in recent weeks, we feel as though this move has more momentum present as the asset is up 8% in today’s session. Don’t want to beat the same drum over and over again as we have talked about China multiple times already in this letter so will let the chart speak for itself with supporting moving average’s.

Thanks for joining us today. If you enjoyed the read, likes are greatly appreciated as well as feedback in the subscriber chat or by reaching out to any of us individually.

All the best,